- Canada

- /

- Metals and Mining

- /

- TSX:PRYM

Top 3 TSX Penny Stocks With Market Caps Under CA$300M

Reviewed by Simply Wall St

As the Canadian market navigates a period of economic strength and fluctuating bond yields, investors are closely watching how these factors influence stock valuations. In this context, penny stocks—often smaller or newer companies—can still offer significant value when backed by solid financials. Despite their somewhat outdated name, these stocks can present unique opportunities for growth and affordability, making them intriguing options for those seeking under-the-radar investments with potential long-term benefits.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$968.15M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.44 | CA$122.52M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.43 | CA$392.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$641.85M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$29.82M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$177.67M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.21 | CA$232.09M | ★★★★☆☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$158.26 million.

Operations: The company generates revenue from its mining services segment, which amounts to CA$1.73 million.

Market Cap: CA$158.26M

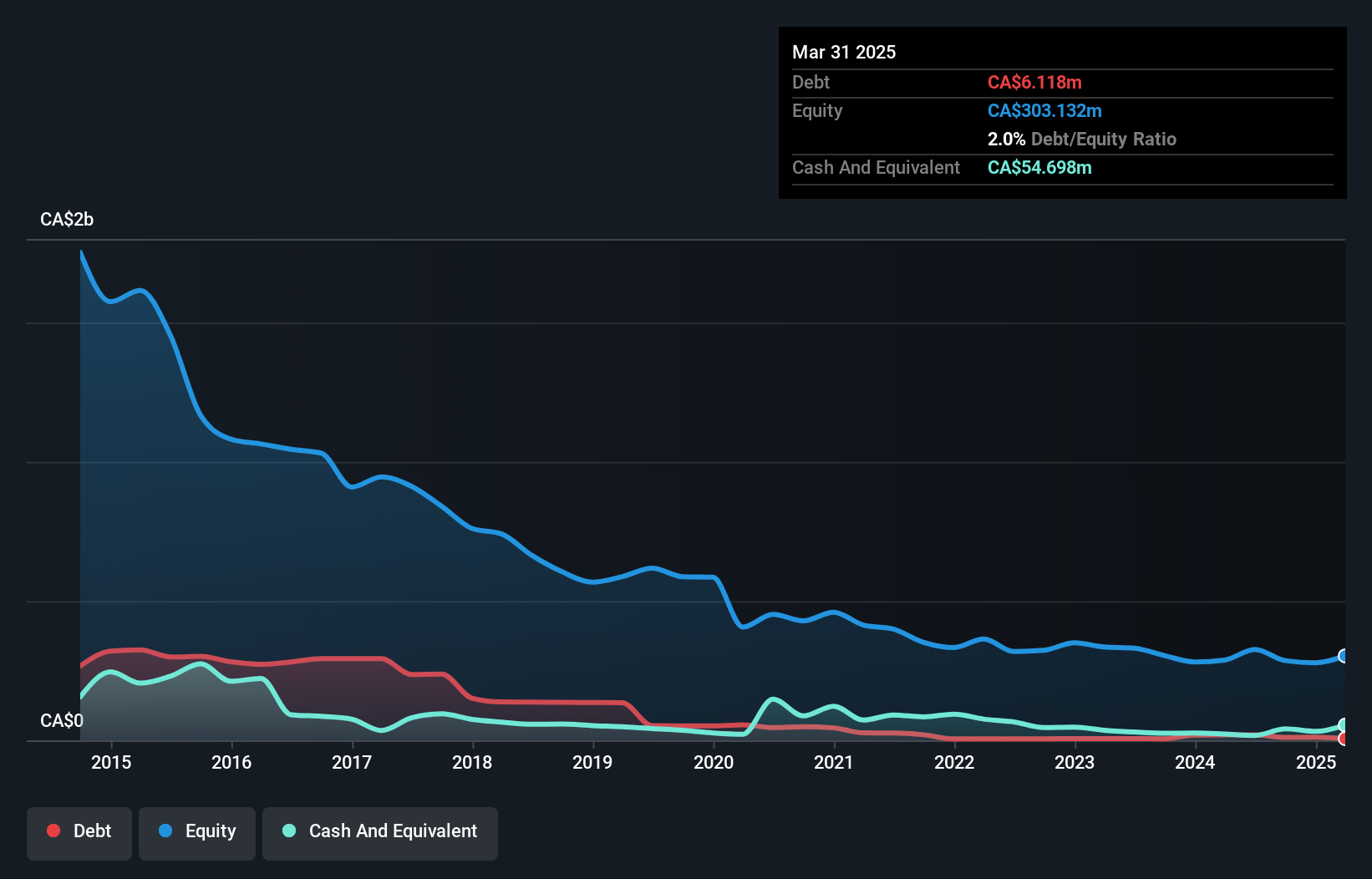

Dundee Corporation, with a market cap of CA$158.26 million, has recently turned profitable, reporting net income of CA$67.33 million for the first nine months of 2024. Despite limited revenue from its mining services segment (CA$3.86 million), Dundee benefits from having more cash than total debt and a high return on equity at 22.2%. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating strong financial positioning. The company’s price-to-earnings ratio is low at 2.4x compared to the Canadian market average, suggesting potential value for investors seeking opportunities in penny stocks.

- Get an in-depth perspective on Dundee's performance by reading our balance sheet health report here.

- Gain insights into Dundee's past trends and performance with our report on the company's historical track record.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, with a market cap of CA$151.87 million, offers mineral exploration drilling services to mining companies in West Africa, Egypt, Chile, and Peru.

Operations: The company generates revenue of $140.00 million from its business services segment, focusing on mineral exploration drilling.

Market Cap: CA$151.87M

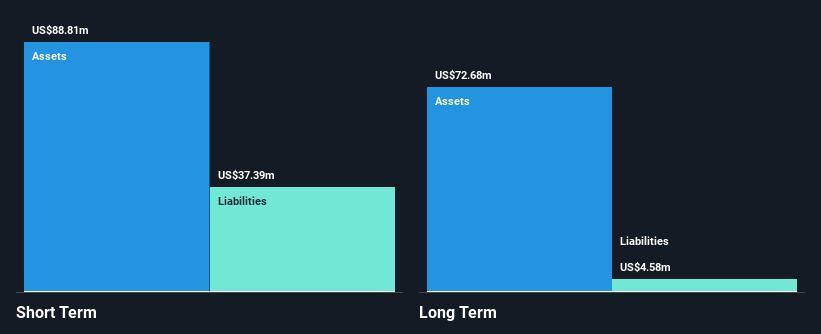

Geodrill Limited, with a market cap of CA$151.87 million, has shown financial stability and growth potential in the penny stock category. The company reported third-quarter sales of US$34.09 million and a net income turnaround to US$2.68 million from a loss last year. Despite negative earnings growth over the past year, Geodrill's short-term assets significantly exceed liabilities, and its cash position surpasses total debt, indicating solid financial health. The management team is experienced with an average tenure of 12.4 years, contributing to stable operations amidst industry challenges in mineral exploration drilling services across multiple regions.

- Click here to discover the nuances of Geodrill with our detailed analytical financial health report.

- Assess Geodrill's future earnings estimates with our detailed growth reports.

Prime Mining (TSX:PRYM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prime Mining Corp. focuses on the acquisition, exploration, and development of mineral resource properties in Mexico, with a market cap of CA$247.98 million.

Operations: Prime Mining Corp. has not reported any revenue segments.

Market Cap: CA$247.98M

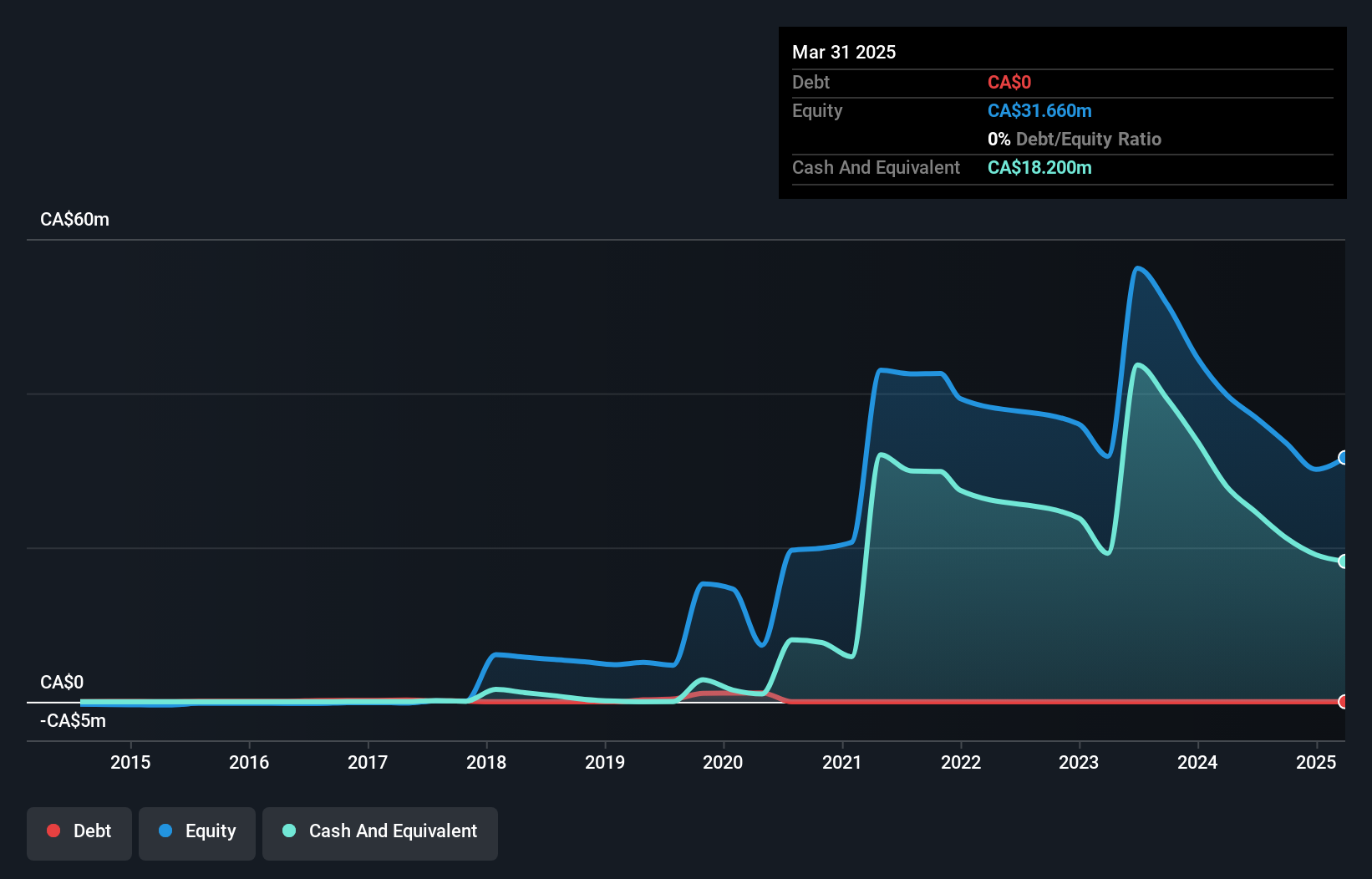

Prime Mining Corp., with a market cap of CA$247.98 million, is pre-revenue and debt-free, focusing on mineral exploration at its Los Reyes project in Mexico. Recent expansion drilling has revealed promising high-grade gold-silver intersections, suggesting potential for resource development. Despite being unprofitable with losses increasing annually by 23.2%, Prime Mining maintains sufficient short-term assets to cover liabilities and plans further exploratory drilling in 2025. Analysts expect significant stock price appreciation, although insider selling has been noted recently. The management team is relatively experienced with an average tenure of 3.3 years, supporting strategic exploration efforts.

- Take a closer look at Prime Mining's potential here in our financial health report.

- Explore historical data to track Prime Mining's performance over time in our past results report.

Summing It All Up

- Take a closer look at our TSX Penny Stocks list of 935 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRYM

Prime Mining

Engages in the acquisition, exploration, and development of mineral resource properties in Mexico.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)