- Canada

- /

- Metals and Mining

- /

- TSXV:LCE

Geodrill Leads 3 TSX Penny Stocks To Consider

Reviewed by Simply Wall St

In 2025, diversification has emerged as a crucial theme for investors, especially as the Canadian market faces volatility and softened growth outlooks. Penny stocks, while an older term, still represent intriguing opportunities for those looking to explore beyond the mainstream. These smaller or newer companies can offer substantial growth potential when supported by solid financials and strong fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| NTG Clarity Networks (TSXV:NCI) | CA$1.83 | CA$81.36M | ✅ 4 ⚠️ 2 View Analysis > |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$29.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Madoro Metals (TSXV:MDM) | CA$0.04 | CA$3.58M | ✅ 2 ⚠️ 5 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.98 | CA$420.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.90 | CA$314.55M | ✅ 2 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.60 | CA$167.62M | ✅ 3 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.68 | CA$632.31M | ✅ 2 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.87 | CA$78.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.485 | CA$14.32M | ✅ 2 ⚠️ 4 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.07 | CA$36.92M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, with a market cap of CA$137.24 million, offers mineral exploration drilling services to mining companies across West Africa, Egypt, Chile, and Peru.

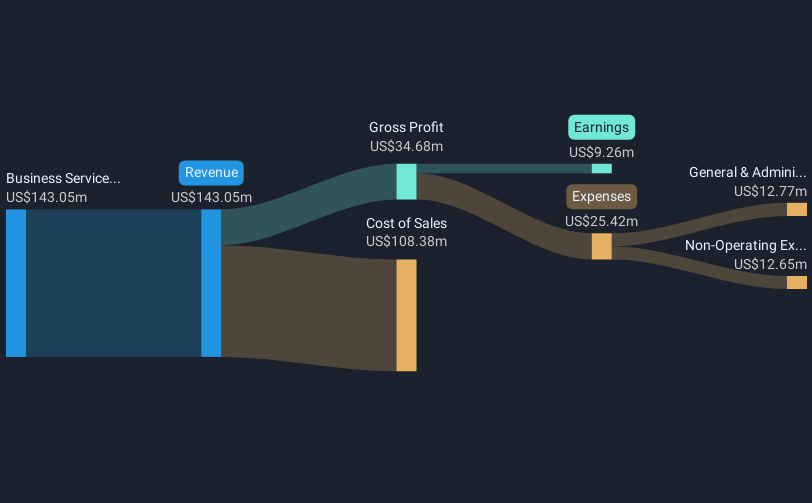

Operations: The company generates revenue of $143.05 million from its mineral exploration drilling services.

Market Cap: CA$137.24M

Geodrill Limited, with a market cap of CA$137.24 million, has demonstrated robust financial health and growth potential. The company reported revenue of US$143.05 million for 2024, marking an increase from the previous year. Its net income rose to US$9.26 million, reflecting improved profit margins and earnings quality. Geodrill's short-term assets comfortably cover both its short- and long-term liabilities, while its debt is well covered by operating cash flow. Despite low return on equity at 7.6%, the company's seasoned management and board contribute to its stability in the penny stock landscape in Canada.

- Click here to discover the nuances of Geodrill with our detailed analytical financial health report.

- Learn about Geodrill's future growth trajectory here.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$122.01 million.

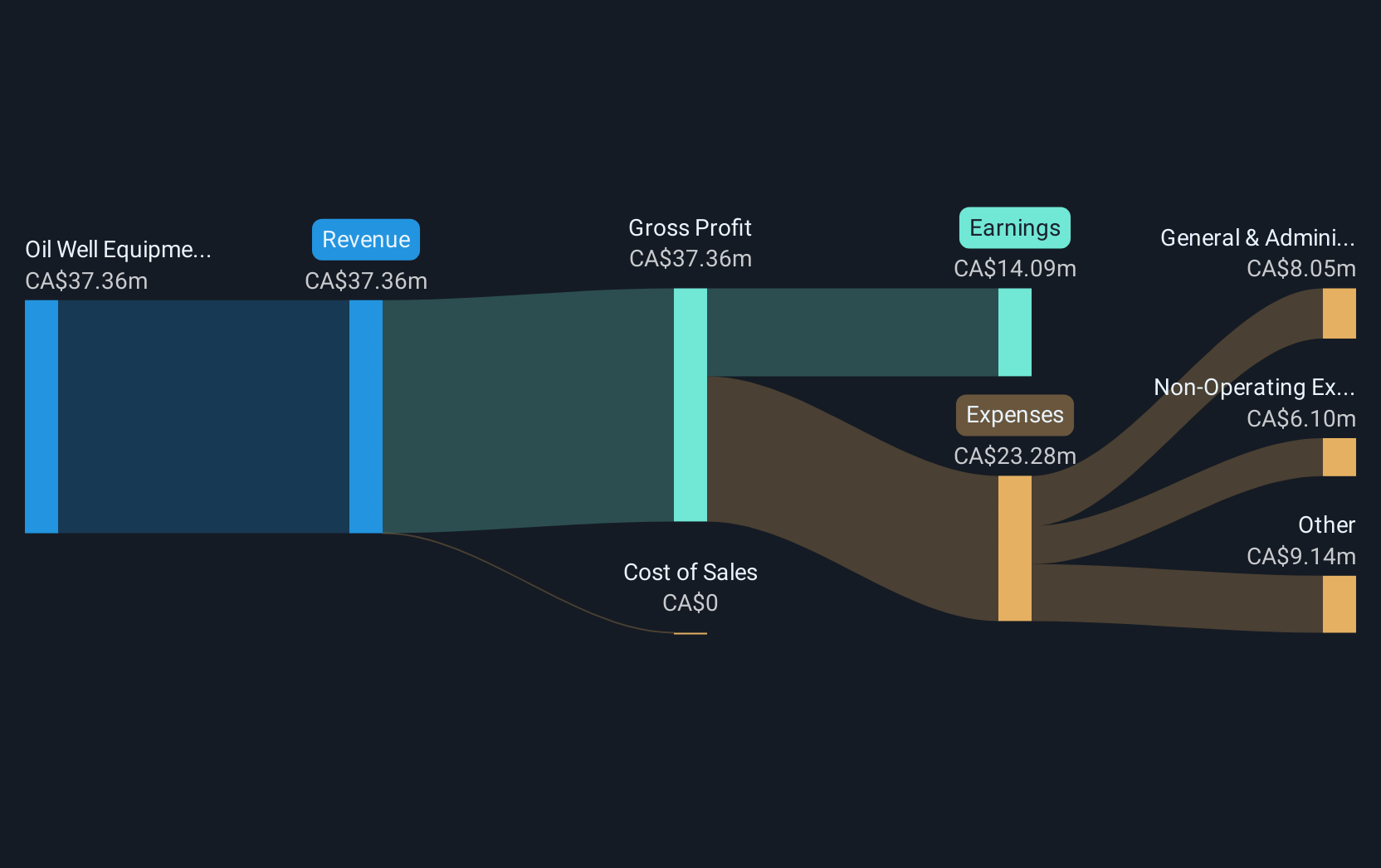

Operations: The company's revenue segment includes Oil Well Equipment & Services, generating CA$23.38 million.

Market Cap: CA$122.01M

Pulse Seismic Inc., with a market cap of CA$122.01 million, offers a mixed picture for investors in the penny stock arena. The company reported revenues of CA$23.38 million and net income of CA$3.39 million for 2024, down from the previous year, indicating challenges in profit growth despite having high-quality earnings and no debt burden. Its recent share buyback program reflects confidence in its financial position, supported by short-term assets exceeding liabilities and an experienced management team with an average tenure of 13.7 years. However, declining profit margins and unstable dividend history may concern potential investors seeking stability.

- Get an in-depth perspective on Pulse Seismic's performance by reading our balance sheet health report here.

- Evaluate Pulse Seismic's historical performance by accessing our past performance report.

Century Lithium (TSXV:LCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Century Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, evaluating, and developing mineral resource properties in the United States with a market cap of CA$43.35 million.

Operations: Century Lithium Corp. does not currently report any revenue segments, as it is in the exploration and development phase of its mineral resource projects in the United States.

Market Cap: CA$43.35M

Century Lithium Corp., with a market cap of CA$43.35 million, is pre-revenue and focused on developing its Angel Island lithium project in Nevada. Recent optimization studies suggest potential CAPEX reductions of up to 25%, enhancing the project's economic viability. The company has successfully implemented process improvements at its Pilot Plant, shifting focus from R&D to demonstration mode, which could attract strategic partners and reduce operating costs. Despite having no debt and experienced management, Century Lithium faces challenges with high volatility and limited cash runway under a year, while earnings are forecasted to decline over the next three years.

- Unlock comprehensive insights into our analysis of Century Lithium stock in this financial health report.

- Evaluate Century Lithium's prospects by accessing our earnings growth report.

Make It Happen

- Gain an insight into the universe of 935 TSX Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LCE

Century Lithium

An exploration and development stage company, engages in the acquisition, exploration, evaluation, and development of mineral resource properties in the United States.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives