- Canada

- /

- Metals and Mining

- /

- TSX:FOM

Will Foran Mining’s (TSX:FOM) Board Addition Refocus Its Global Project Growth Ambitions?

Reviewed by Simply Wall St

- Foran Mining Corporation recently appointed John Munro as an Independent Director to its Board, adding over 30 years of global metals and mining experience including executive leadership at Cupric Canyon Capital, Gold Fields Limited, and First Reserve Corporation.

- Munro’s involvement in successfully delivering and monetizing large-scale mining projects, such as the US$2.1 billion Khoemacau copper-silver transaction, highlights his depth in project financing and international resource business growth.

- We’ll examine how Munro’s expertise in global mining leadership and project development could influence Foran Mining’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Foran Mining's Investment Narrative?

To believe in Foran Mining as a shareholder today is to focus on its ambitious transition from a developer to a producer, underpinned by rapid progress at McIlvenna Bay and expectations of strong revenue growth in the years ahead. The company’s recent board appointments, most recently John Munro, bring rare depth in global project leadership and financing, qualities that could directly shape upcoming milestones like commercialization and capital raising. In the short term, Munro’s track record could help address one of the company’s immediate catalysts and risks: managing construction delivery and financing as the equity offering proceeds amid ongoing losses and recent share dilution. If Munro’s experience accelerates project execution or improves financing terms, it could change the risk profile; if not, many challenges remain, including execution, profitability timing, and board stability after several rapid director changes. Share price moves since the news have not indicated a strong immediate impact, but the potential for reduced project risk is worth watching. Yet even with board expertise, ongoing share dilution is something investors should not ignore.

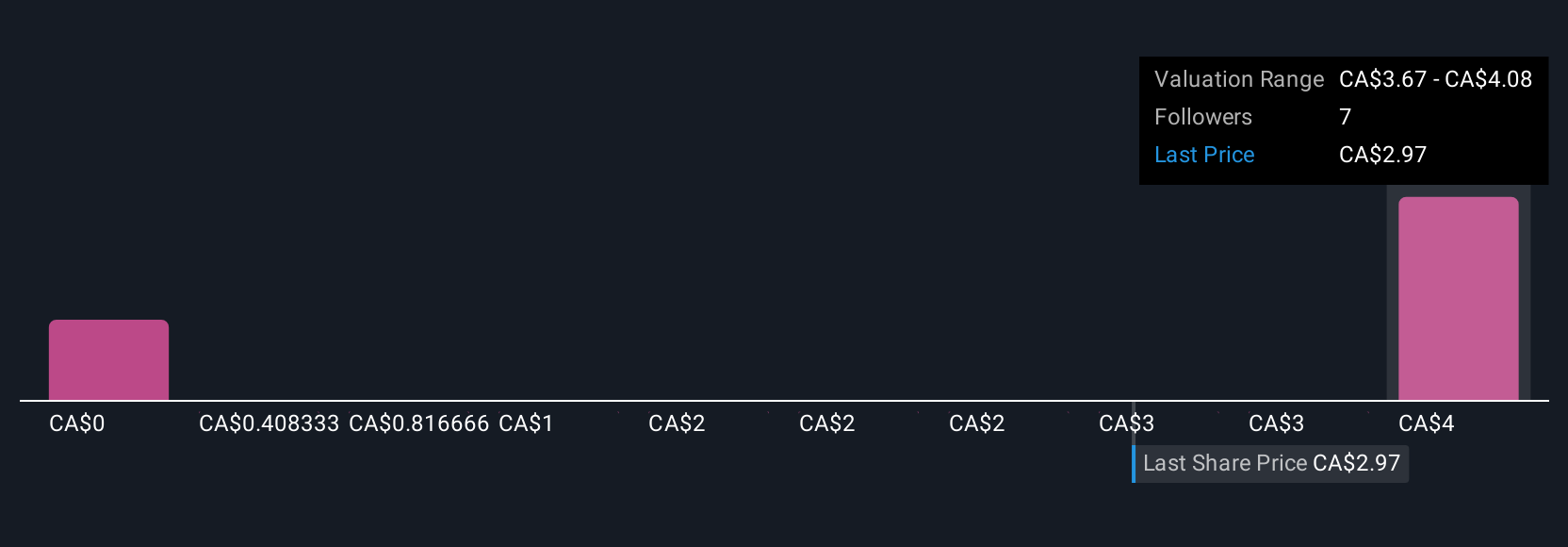

Foran Mining's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on Foran Mining - why the stock might be worth less than half the current price!

Build Your Own Foran Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Foran Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Foran Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Foran Mining's overall financial health at a glance.

No Opportunity In Foran Mining?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FOM

Foran Mining

Engages in the acquisition, exploration, and development of mineral properties.

High growth potential and fair value.

Market Insights

Community Narratives