- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Franco-Nevada (TSX:FNV): Assessing Valuation After Expansion Plans in Australia and Gold Price Surge

Reviewed by Kshitija Bhandaru

Franco-Nevada (TSX:FNV) recently announced its intention to expand its royalty and streaming business in Australia. The company is focusing on Western Australia as gold prices reach new highs and mining activity accelerates across the sector.

See our latest analysis for Franco-Nevada.

Franco-Nevada’s announcement comes as gold stocks continue to catch investors’ attention, with miners and royalty companies rallying alongside record-high precious metal prices. The company’s share price has surged 64% year-to-date, and its one-year total shareholder return of nearly 70% shows that momentum is firmly building. This reflects renewed optimism about growth prospects and strong sector tailwinds.

If this wave of mining interest has you wanting to spot the next standout, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With such a strong run in both its share price and fundamentals, investors have to ask whether Franco-Nevada still has room to climb or if all the good news is already reflected in its valuation. Is this a fresh buying opportunity, or is the market pricing in all future growth?

Most Popular Narrative: 5.8% Undervalued

Compared to the last close at CA$286.16, the most popular narrative values Franco-Nevada above today’s trading price, suggesting an upward path if projections hold. This valuation uses an analyst consensus fair value based on robust growth and margin expectations for the coming years.

Robust, record-level gold prices combined with ongoing global inflation concerns and monetary debasement are driving record royalty revenues and expanding margins for Franco-Nevada. This strengthens top-line revenue growth and leads to higher operating and net margins.

Want to know the growth blueprint driving this premium? The key elements are explosive margin expansion and significant increases in both revenue and earnings. Curious what financial assumptions push this narrative so high? Dive in and see the surprising projections at the heart of this fair value call.

Result: Fair Value of $303.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, gold price swings and revenue concentration in several key assets remain potential risks. These factors could quickly challenge this otherwise bullish case.

Find out about the key risks to this Franco-Nevada narrative.

Another View: Trading at a Premium?

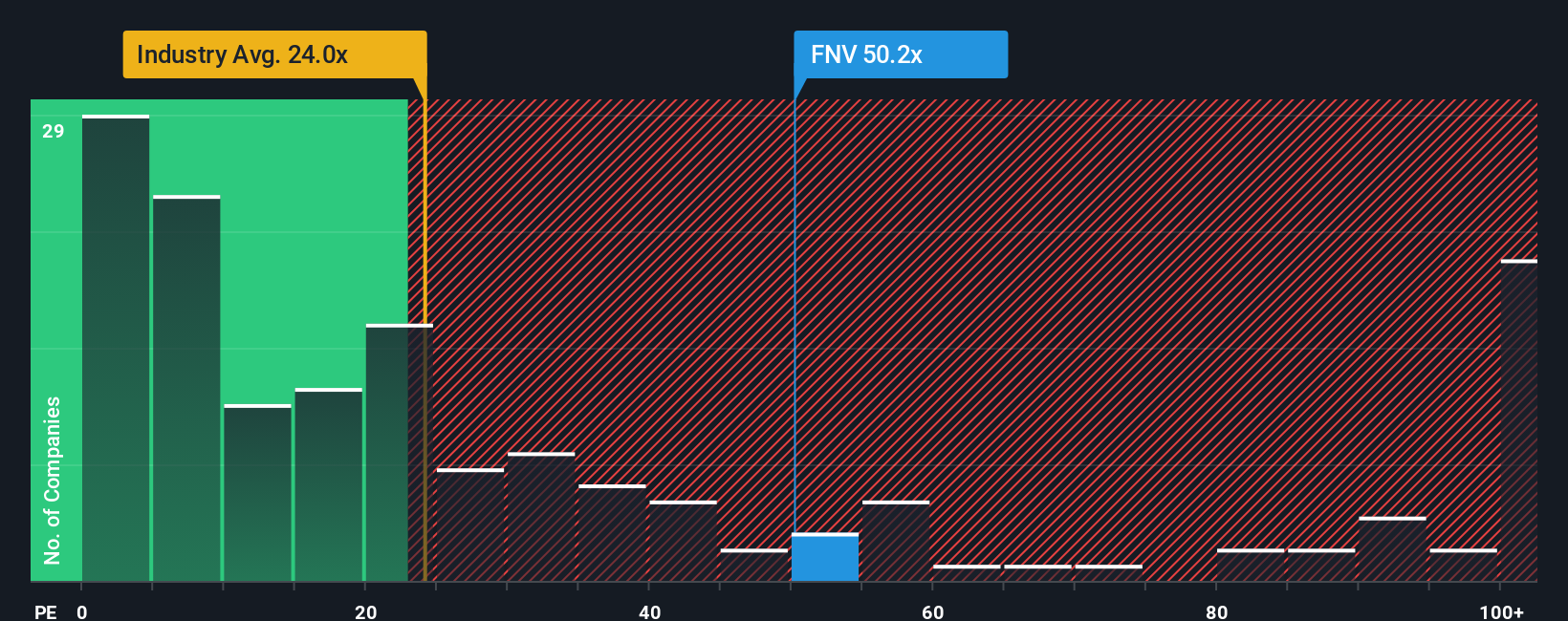

Looking through the lens of earnings ratios, Franco-Nevada appears pricey with a price-to-earnings ratio of 50.2x. That stands well above both the Canadian industry average of 23.6x and the peer average of 31.6x. Even when compared to the fair ratio of 24.2x, there is a significant premium attached. Does this gap signal future upside, or is it a caution flag for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franco-Nevada Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own take in just a few minutes. Do it your way

A great starting point for your Franco-Nevada research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their radar on for the next big move. Let Simply Wall St’s screeners point you toward compelling opportunities in high-potential sectors now.

- Supercharge your search for top-yield potential with these 19 dividend stocks with yields > 3% offering greater than 3% returns.

- Tap into booming trends by checking out these 899 undervalued stocks based on cash flows sourced from real cash flow analysis.

- Capitalize on market shifts and cutting-edge technology through these 24 AI penny stocks powering innovation across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives