- Canada

- /

- Metals and Mining

- /

- TSX:FM

Assessing First Quantum After Copper Price Surge and 66.8% YTD Share Rally in 2025

Reviewed by Bailey Pemberton

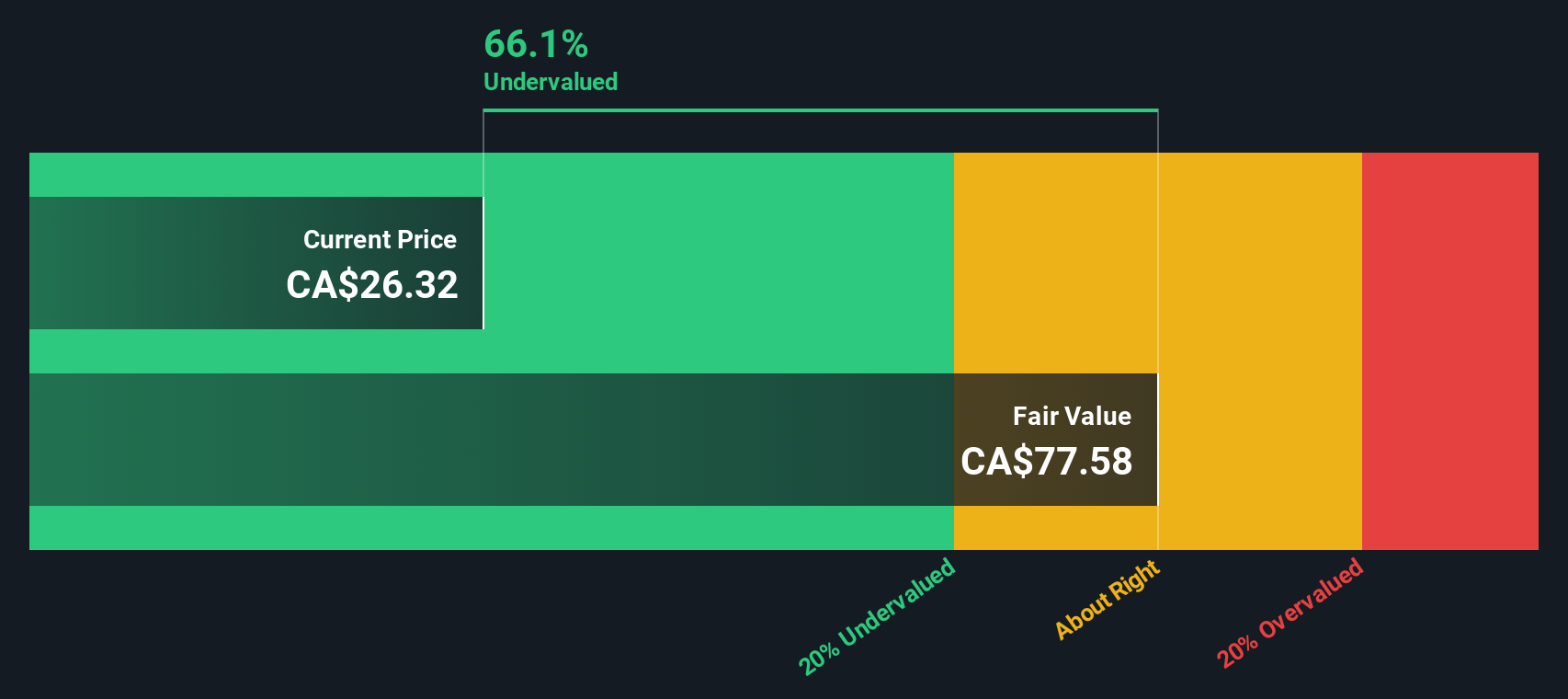

If you are trying to figure out what to do with First Quantum Minerals stock, you are in good company. Investors have witnessed a remarkable journey in share price, with a 33.2% jump over the last month and a year-to-date climb of 66.8%. Even over the past five years, the stock has surged by 166.4%. This upswing is catching attention, especially as the global minerals landscape shifts and the company's prospects are being evaluated in a new light. Some positive market developments around copper demand and evolving regulatory environments have provided additional tailwinds, fueling optimism about future growth potential.

Of course, price movement is only half of the story. When it comes to valuation, First Quantum Minerals currently earns a value score of 2 out of 6. This means the stock is considered undervalued in two different areas by traditional metrics, which could be intriguing or maybe concerning depending on your outlook. As we step through the main approaches to valuation next, let’s see what these numbers really mean. Be sure to stick around for a smarter way to judge whether First Quantum is truly undervalued, overvalued or just right.

First Quantum Minerals scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: First Quantum Minerals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s value. This approach aims to show what the business is worth, based on how much cash it can generate over time, adjusted for the risk and time value of money.

For First Quantum Minerals, the latest reported Free Cash Flow stands at $647.6 Million. Analyst estimates suggest these cash flows will increase significantly. In fact, within five years, annual free cash flow is projected to reach $2.58 Billion. Further growth is extrapolated by modelers for the next decade. These projections are built using a 2 Stage Free Cash Flow to Equity model, which considers both detailed analyst forecasts and longer-term growth assumptions beyond that period.

Applying this DCF approach, the estimated fair value per share for First Quantum Minerals is $79.74, calculated in US dollars. When compared to the current market price, this represents a 60.4% discount. According to this model, the stock appears substantially undervalued based on cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests First Quantum Minerals is undervalued by 60.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: First Quantum Minerals Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it gives investors a quick sense of how much they are paying for each dollar of a company’s earnings. For businesses that are generating solid profits, like First Quantum Minerals, the PE ratio helps highlight whether the stock is priced for growth, stability, or carries more risk.

Growth expectations and risk profile both factor into what investors consider a “normal” or “fair” PE ratio. High growth prospects or a less risky business often justify a higher PE, while low growth or higher risk demand a lower PE. For First Quantum Minerals, the current PE stands at 92.7x, which is noticeably higher than the Metals and Mining industry average of 23.1x and also above peers, who trade at an average of 82.3x. At first glance, this could suggest the stock is expensive. However, relying solely on these comparisons can be misleading. Different companies face unique growth rates and risk factors, so a simple comparison can overlook important context.

This is where Simply Wall St's “Fair Ratio” comes into play. It estimates what an appropriate PE multiple would be for First Quantum Minerals, considering its earnings growth, profit margins, industry, company size, and risk factors. This delivers a more tailored benchmark for fair value. For First Quantum, the Fair Ratio is 48.5x. By comparing this to the current PE (92.7x), it is evident the stock trades well above its Fair Ratio, meaning it carries a significant premium relative to what would be reasonable based on these fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Quantum Minerals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your unique perspective on a company, connecting its story, financial estimates, and the fair value you believe it deserves. Instead of relying solely on standard metrics, Narratives allow you to build a personal forecast based on your assumptions about First Quantum Minerals’ future revenue, earnings, and margins, and instantly see how your story translates into a fair value.

Narratives, available on Simply Wall St’s Community page, are a powerful yet accessible tool used by millions of investors to make more informed decisions. They help you decide when to buy or sell by comparing your Fair Value against the current market price, putting you in control. What makes Narratives even more useful is their dynamic nature, as they update automatically when new information, such as earnings announcements or important news, becomes available.

For example, one investor’s optimistic Narrative for First Quantum Minerals results in a much higher fair value, while another’s more cautious view leads to a lower estimate. Narratives help you see, share, and refine your outlook alongside the community, so your investment decisions always reflect your true view of the company’s future.

Do you think there's more to the story for First Quantum Minerals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FM

First Quantum Minerals

Engages in the exploration, development, and production of mineral properties.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives