As the broader market sentiment remains optimistic with a continuing bull market that began in October 2022, small-cap stocks in Canada may present unique opportunities for investors looking to diversify their portfolios. Amidst this environment, identifying undervalued small caps with insider buying can be particularly compelling, as these actions often signal confidence from those who know the company best.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Martinrea International | 6.2x | 0.2x | 44.66% | ★★★★★★ |

| Dundee Precious Metals | 8.6x | 3.0x | 42.18% | ★★★★★★ |

| CI Financial | NA | 0.7x | 33.20% | ★★★★★★ |

| Guardian Capital Group | 10.8x | 4.2x | 30.00% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.2x | 2.9x | 37.33% | ★★★★★☆ |

| Rogers Sugar | 13.6x | 0.6x | 41.43% | ★★★★☆☆ |

| Nexus Industrial REIT | 2.4x | 3.0x | 19.95% | ★★★★☆☆ |

| Gear Energy | 21.3x | 1.5x | 22.84% | ★★★☆☆☆ |

| Calfrac Well Services | 2.3x | 0.2x | -1.07% | ★★★☆☆☆ |

| Freehold Royalties | 15.7x | 6.8x | 45.93% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

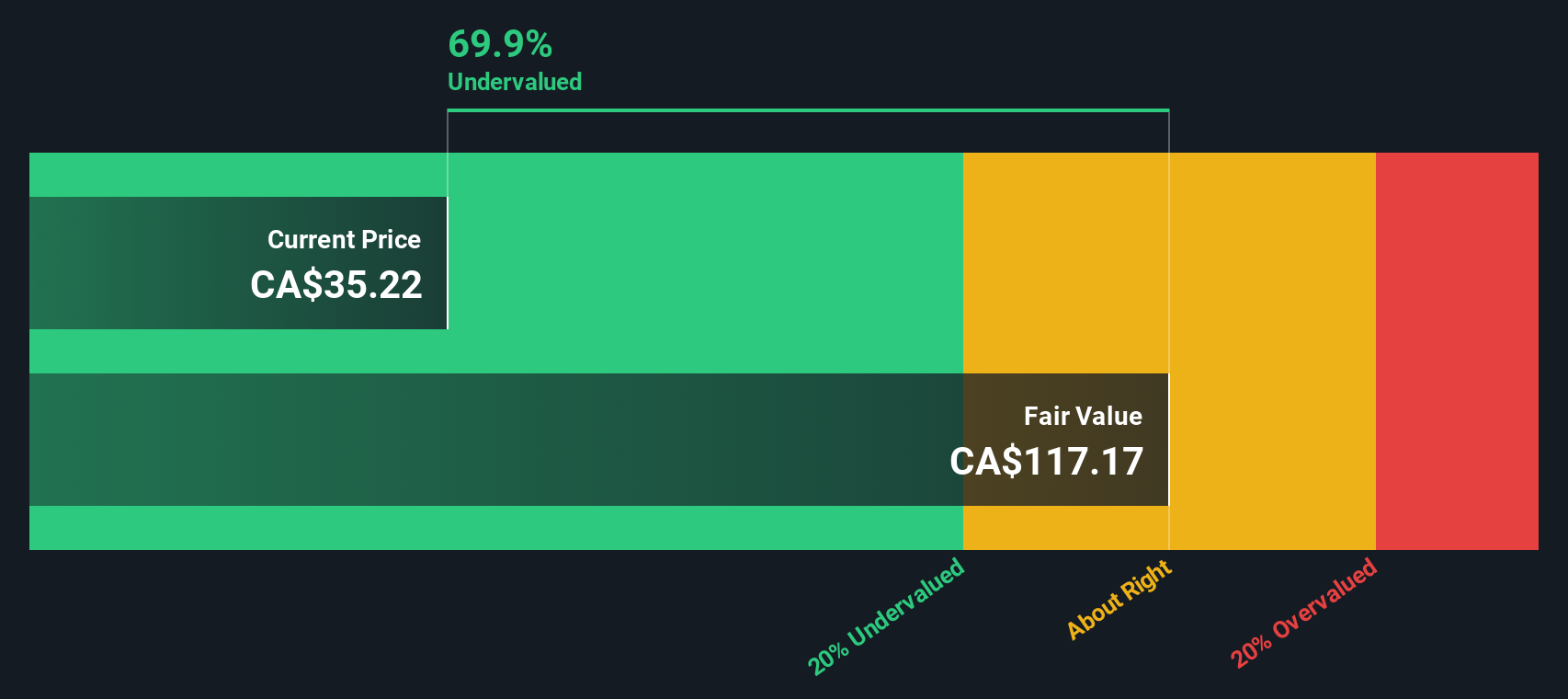

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals Inc., a gold mining company with a market capitalization of CA$2.07 billion, operates primarily through its two main revenue segments: Ada Tepe and Chelopech.

Operations: Ada Tepe and Chelopech are the primary revenue-generating operations for this entity, contributing significantly to its financial performance with respective revenues of $243.33 million and $274.18 million. The company's gross profit margin has shown a notable increase over the years, reaching 53.34% in the latest quarter, reflecting its ability to manage production costs effectively while maintaining profitability.

PE: 8.6x

Dundee Precious Metals, reflecting a strategic focus on growth, recently showcased its robust Coka Rakita project in Serbia at a global mining conference. With an anticipated high-margin production profile and strong economic projections including a 33% IRR, the project underscores Dundee's adeptness in leveraging regional synergies and mining expertise. Despite recent insider purchases signaling confidence, projected earnings suggest an 8.6% decline annually over the next three years. The company reaffirmed its full-year production guidance while maintaining dividend payouts, emphasizing operational consistency amidst strategic expansions.

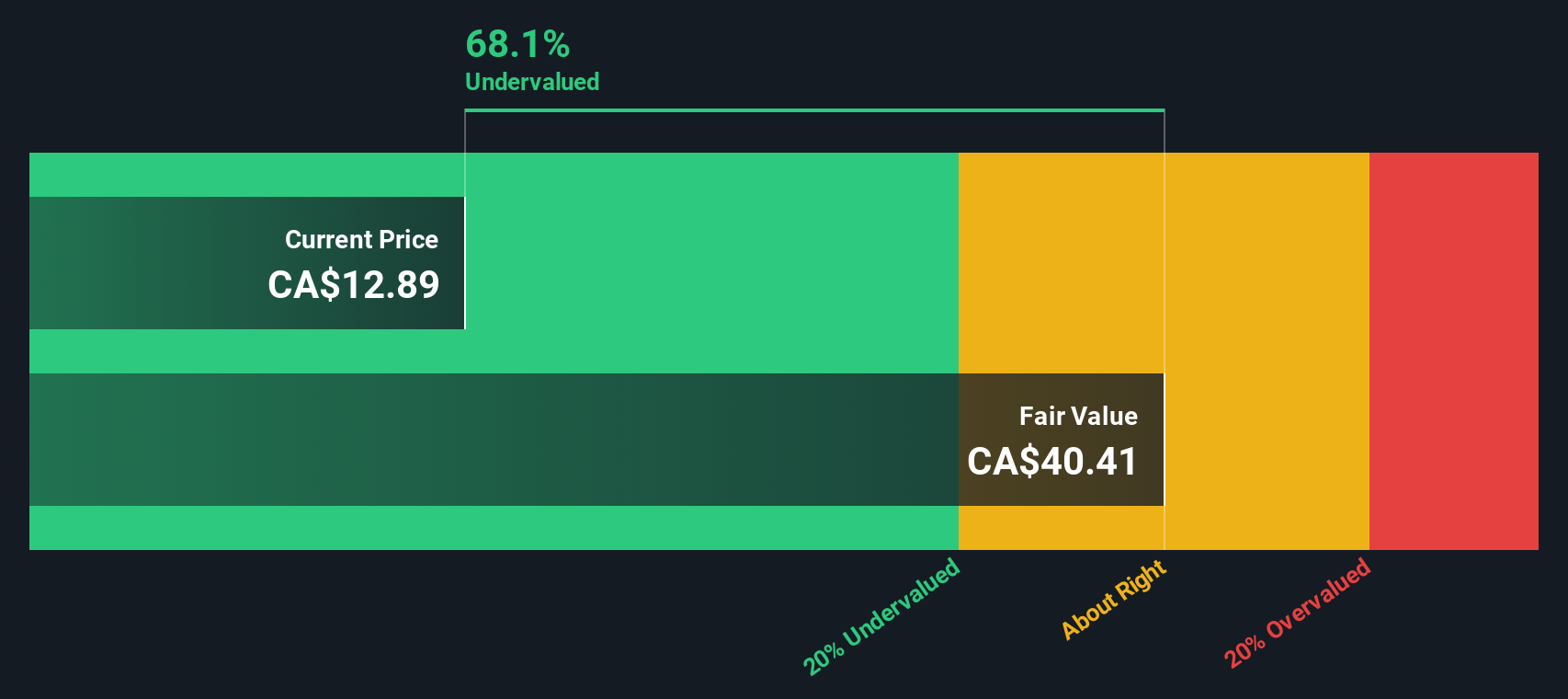

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Freehold Royalties Ltd. operates primarily in Western Canada and the United States, focusing on acquiring and managing royalty interests across a diverse portfolio of oil, gas, natural gas liquids, and potash properties, with a market capitalization of approximately CA$2.06 billion.

Operations: The company generates revenue primarily through oil and gas exploration and production, with a notable gross profit margin of 96.74% as of the latest reporting period. Net income stood at CA$134.87 million, translating to a net income margin of 43.19%.

PE: 15.7x

Recently, David Spyker demonstrated his confidence in Freehold Royalties by acquiring 20,000 shares for CA$276,000. This insider activity suggests a bullish outlook from within the company itself. In operational terms, Freehold has maintained steady production with Q1 results showing an average output nearly matching the previous year's figures at around 14,714 boe/d. Financially robust too, they've reported a net income rise to CA$34 million this quarter from CA$31 million last year. With consistent dividends and reaffirmed production guidance for 2024, Freehold presents as a compelling consideration amidst undervalued entities in Canada’s energy sector.

- Delve into the full analysis valuation report here for a deeper understanding of Freehold Royalties.

-

Explore historical data to track Freehold Royalties' performance over time in our Past section.

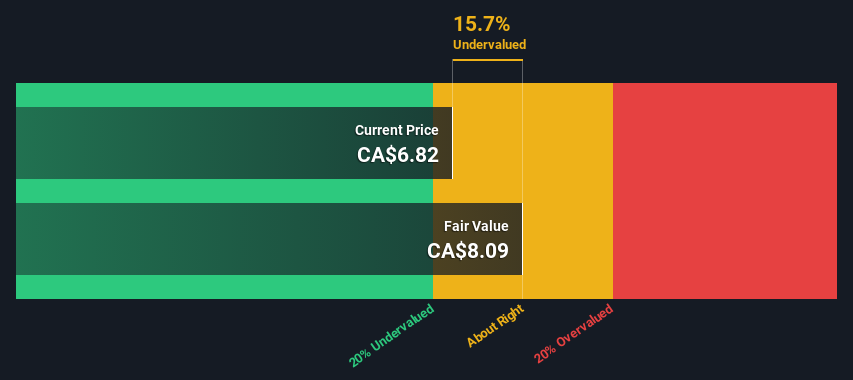

5N Plus (TSX:VNP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: 5N Plus Inc. specializes in the production and sale of specialty metals and chemicals, serving markets in North America, Europe, and Asia with a market cap of CA$537.18 million.

Operations: Specializing in performance materials and specialty semiconductors, the company generates its revenue through these two key segments, with specialty semiconductors contributing significantly more to the total income. The business has experienced a gross profit margin of 24.30% as of the latest reporting period, indicating a notable portion of revenue retained after accounting for the cost of goods sold.

PE: 23.6x

Recently, Jean-Marie Bourassa, a director at 5N Plus, demonstrated his confidence in the firm by acquiring 60,100 shares for CA$272K. This insider activity coincides with the company's robust first-quarter performance, where sales surged to US$65 million and net income doubled to US$2.51 million compared to last year. Additionally, 5N Plus secured a significant US$14.4 million contract from the U.S. Department of Defense for space-qualified materials, underscoring its strategic position in high-tech industries and hinting at future growth prospects.

- Click to explore a detailed breakdown of our findings in 5N Plus' valuation report.

-

Review our historical performance report to gain insights into 5N Plus''s past performance.

Next Steps

- Access the full spectrum of 35 Undervalued Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dundee Precious Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DPM

Dundee Precious Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives