- Canada

- /

- Metals and Mining

- /

- TSX:CS

Capstone Copper (TSX:CS) Is Up 12.6% After Higher Than Expected Copper Grades at Mantoverde

Reviewed by Sasha Jovanovic

- Capstone Copper recently announced initial exploration results from its Phase 1 drill program at the Mantoverde project in Chile, revealing higher than expected copper grades in several sectors and resource growth potential north of the existing pit.

- This outcome underscores the technical success of ongoing exploration, with indications that new mineralization could improve future resource conversion and enhance overall mine economics.

- We'll explore how these strong exploration results at Mantoverde could meaningfully reinforce Capstone Copper's investment narrative centered on production growth and resource expansion.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Capstone Copper Investment Narrative Recap

For Capstone Copper shareholders, the key investment belief is that the company’s production growth and resource expansion, particularly from projects like Mantoverde and Santo Domingo, will drive margin expansion and long-term value. The recent Mantoverde drill results are promising and could enhance resource conversion, but they do not meaningfully shift the short-term focus away from the Mantoverde Optimized project’s execution or the ongoing risk from operational concentration at a few large assets.

Among recent developments, the August 2025 approval for Mantoverde Optimized stands out as highly relevant. This project’s successful ramp-up remains a central short-term catalyst for higher output, and the encouraging drilling results reinforce overall confidence in Mantoverde’s production and future reserve base.

In contrast, investors should also be aware of the persistent water constraints at Pinto Valley, which...

Read the full narrative on Capstone Copper (it's free!)

Capstone Copper's outlook anticipates $3.0 billion in revenue and $413.5 million in earnings by 2028. This scenario relies on 15.2% annual revenue growth and a $337.9 million increase in earnings from the current $75.6 million level.

Uncover how Capstone Copper's forecasts yield a CA$12.09 fair value, a 12% downside to its current price.

Exploring Other Perspectives

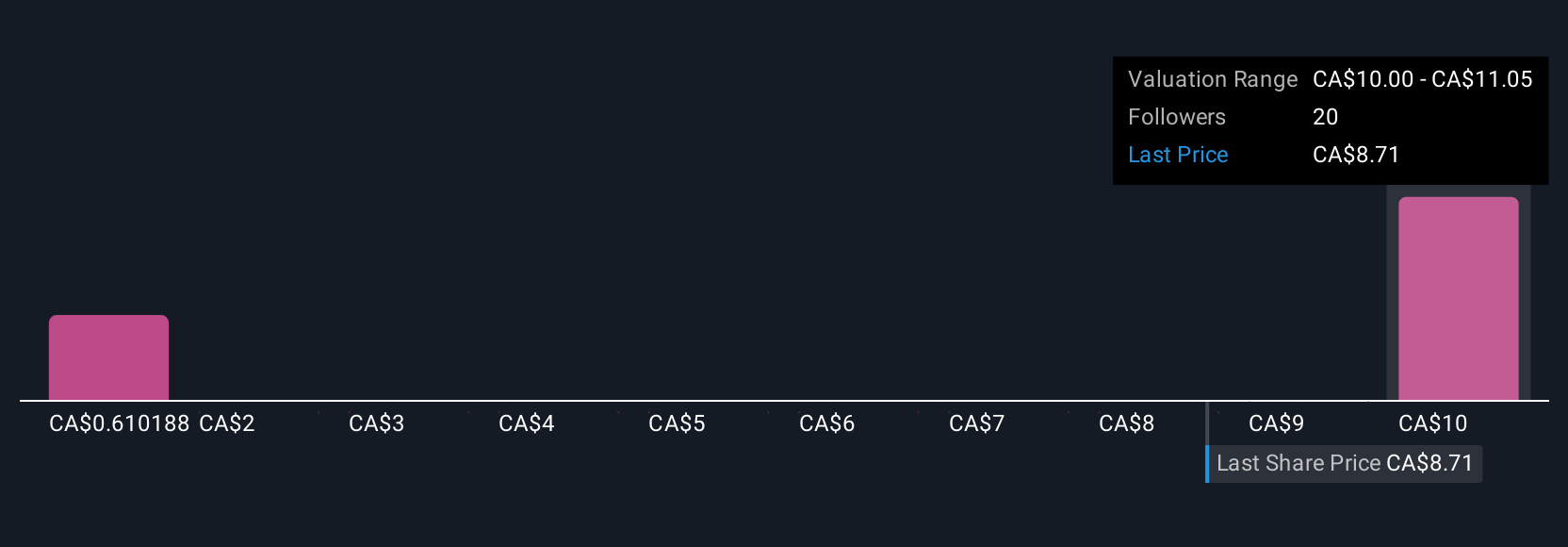

Simply Wall St Community members estimate Capstone Copper’s fair value between CA$0.48 and CA$13 across five views, reflecting significantly different outlooks. With Mantoverde’s drill results pointing to resource growth, the company’s reliance on a handful of large mines could have broader consequences if any face disruption.

Explore 5 other fair value estimates on Capstone Copper - why the stock might be worth as much as CA$13.00!

Build Your Own Capstone Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capstone Copper research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Capstone Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capstone Copper's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives