- Canada

- /

- Metals and Mining

- /

- TSX:CS

Capstone Copper (TSX:CS): Assessing Valuation After Mantoverde Production Recovery Restores Operational Momentum

Reviewed by Kshitija Bhandaru

Capstone Copper (TSX:CS) just flipped a major switch at its Mantoverde mine in Chile, restoring full sulphide copper production after resolving the ball mill motor failure that had slowed things down since late August. For investors who track operational risks, this kind of quick recovery is more than just a status update. It signals steady hands at the controls and a renewed sense of stability at a site critical to Capstone’s growth story. While a short five-day maintenance shutdown is still on the calendar for the end of September, confidence in the company’s ability to deliver on its production targets appears to be on firmer ground today.

Big picture, Capstone has weathered a year of ups and downs, but momentum is building, especially over the past three months, as shares have climbed 32%. Even over the past month, the stock held up with a 7% gain, suggesting markets are responding to operational improvements and the company’s push to boost output. Longer term, Capstone’s three-year return north of 260% puts it among the sector’s standouts. The latest operational update looks like another step toward balancing near-term execution challenges with long-term supply ambitions in a rapidly evolving copper market.

So after this latest bounce in performance and production, is Capstone Copper trading at a bargain, or is the market already factoring in next year’s growth story?

Most Popular Narrative: 6% Undervalued

According to the most widely followed narrative, Capstone Copper is currently undervalued by around 6% compared to its fair value estimate. This perspective is based on a detailed analysis of the company’s growth prospects and operational outlook in the evolving copper market, factoring in expectations about future revenue, profit margins, and major expansion projects.

The imminent execution of the Mantoverde Optimized project, following recent permit approval, is expected to materially increase throughput and sustain higher copper production at lower incremental cost. This development would likely have a positive impact on both revenue and net margins as expanded volumes are realized.

Capstone’s valuation is drawing fresh attention. There is an ambitious set of growth and profit assumptions behind that premium, including some bold forecasts about just how far earnings and revenues can rise over the next few years. How high could margins and cash flows go? The full narrative breaks down the pivotal financial leap that supports this fair value assessment.

Result: Fair Value of $11.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, climate-driven water shortages and operational hiccups at Capstone’s largest mines remain real risks. These factors could derail these optimistic forecasts and pressure margins.

Find out about the key risks to this Capstone Copper narrative.Another View: Multiples Paint a Pricier Picture

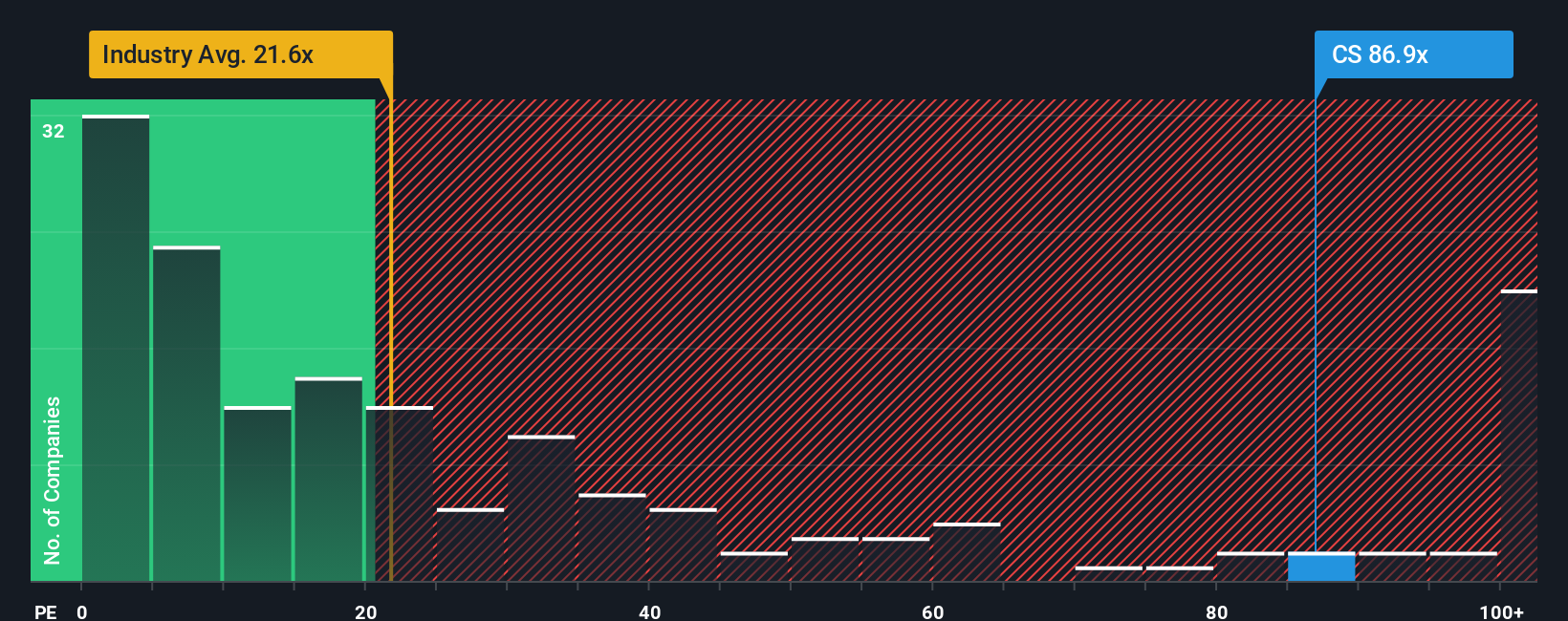

Looking from a different angle, the standard price-to-earnings approach suggests Capstone Copper may not be the bargain indicated by the first method. When compared to the broader industry, its valuation appears more stretched. So, what is the real story behind this price?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Capstone Copper to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Capstone Copper Narrative

If you see the numbers differently or want to dig into the details yourself, you can craft a personalized narrative from scratch in just minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Capstone Copper.

Looking for More Smart Investment Opportunities?

Expand your watchlist with ideas that could boost your portfolio’s future performance. Use these tailored stock screens to discover potential opportunities before they become widely recognized.

- Discover the potential for rapid returns by scanning for penny stocks with strong financials using penny stocks with strong financials.

- Explore the next wave of digital transformation by identifying companies leading in artificial intelligence innovation with AI penny stocks.

- Find stable income streams by reviewing opportunities among dividend stocks with yields above 3% through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives