Is There Still Opportunity in Chemtrade After Its Strong 129% Three-Year Rally?

Reviewed by Bailey Pemberton

Trying to decide what to do with Chemtrade Logistics Income Fund stock? You are definitely not alone. Investors across the market are eyeing this name as its recent performance continues to turn heads. Chemtrade’s shares closed at $13.34 most recently, after notching a 0.6% gain for the week and 3.1% over the last month. If you zoom out, the picture gets even more compelling: up 23.3% since the start of the year, 29.0% over the past twelve months, and a substantial 129.3% gain over the past three years. Looking at the five-year chart, you are looking at a total return of 303.5%. That kind of growth tends to make investors wonder if there is still value left or if most of the gains are already in the rearview mirror.

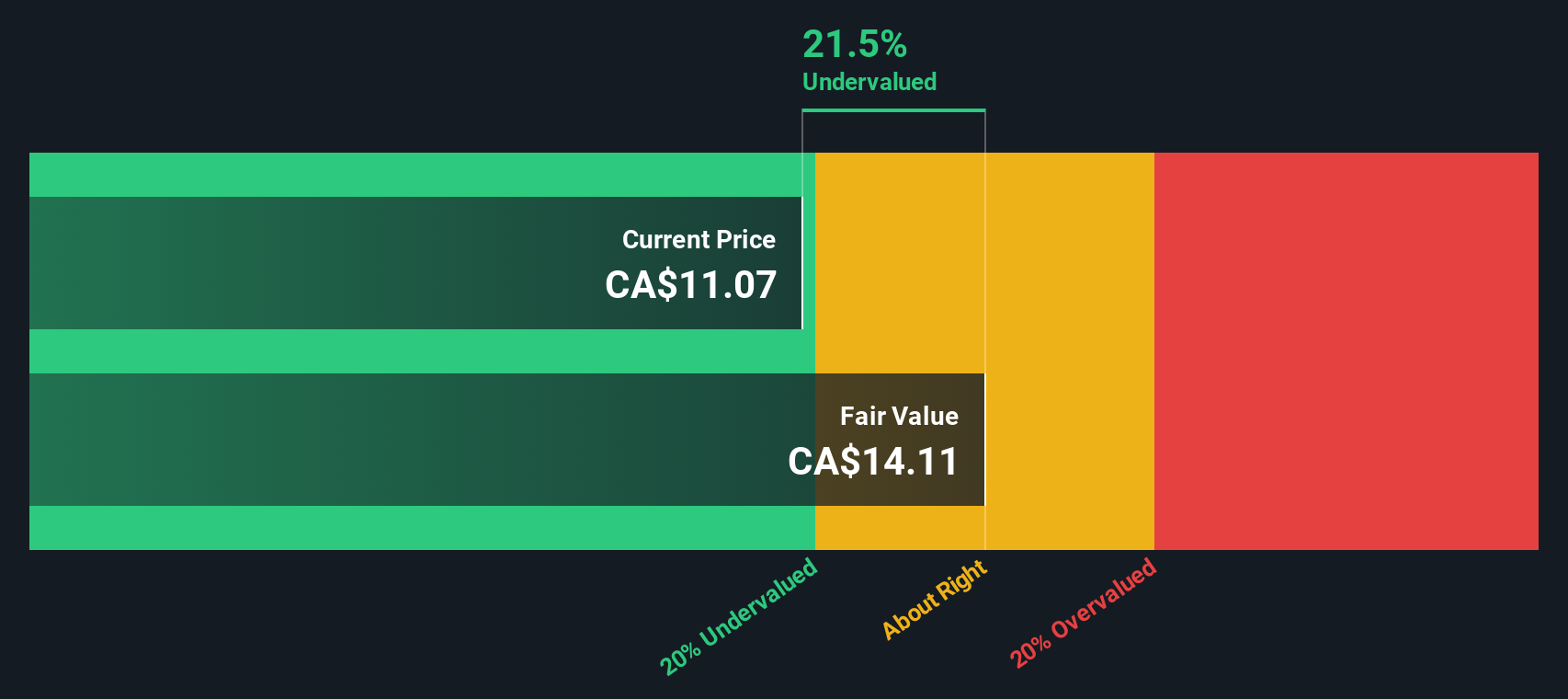

Market factors like commodity pricing and shifting industry sentiment have played a part in the recent moves, making Chemtrade a stock that stands out even as market conditions ebb and flow. Its recent value score is particularly interesting: on a six-point undervaluation checklist, Chemtrade scores a 5, which puts it firmly in undervalued territory. This begs the question: What is everyone missing, and is there still room to run?

Let’s break down what’s under the hood by looking at different valuation methods to see what sets Chemtrade apart. Stay with me, because at the end we will also look at an even better way to understand its value, so you can decide if the next move should be yours.

Why Chemtrade Logistics Income Fund is lagging behind its peers

Approach 1: Chemtrade Logistics Income Fund Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular approach for estimating the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value. This method gives investors a way to gauge what Chemtrade Logistics Income Fund might be worth based on its expected ability to generate cash over time.

For Chemtrade, the most recent free cash flow (FCF) reported stands at CA$174 million. Analyst estimates extend to 2027, projecting FCF to reach CA$194 million. Projections for the following years are extrapolated beyond analyst coverage, resulting in an expected FCF of approximately CA$267 million by 2035. These assumptions use a two-stage free cash flow to equity model, balancing both near-term analyst insight and longer-term trend estimates.

After discounting all future cash flows to their present value, the DCF model estimates Chemtrade’s fair value at CA$36.58 per unit. With shares currently trading at CA$13.34, this implies the stock is trading at a steep 63.5 percent discount to its estimated intrinsic value. In plain terms, according to this valuation, Chemtrade appears to be significantly undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chemtrade Logistics Income Fund is undervalued by 63.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Chemtrade Logistics Income Fund Price vs Earnings

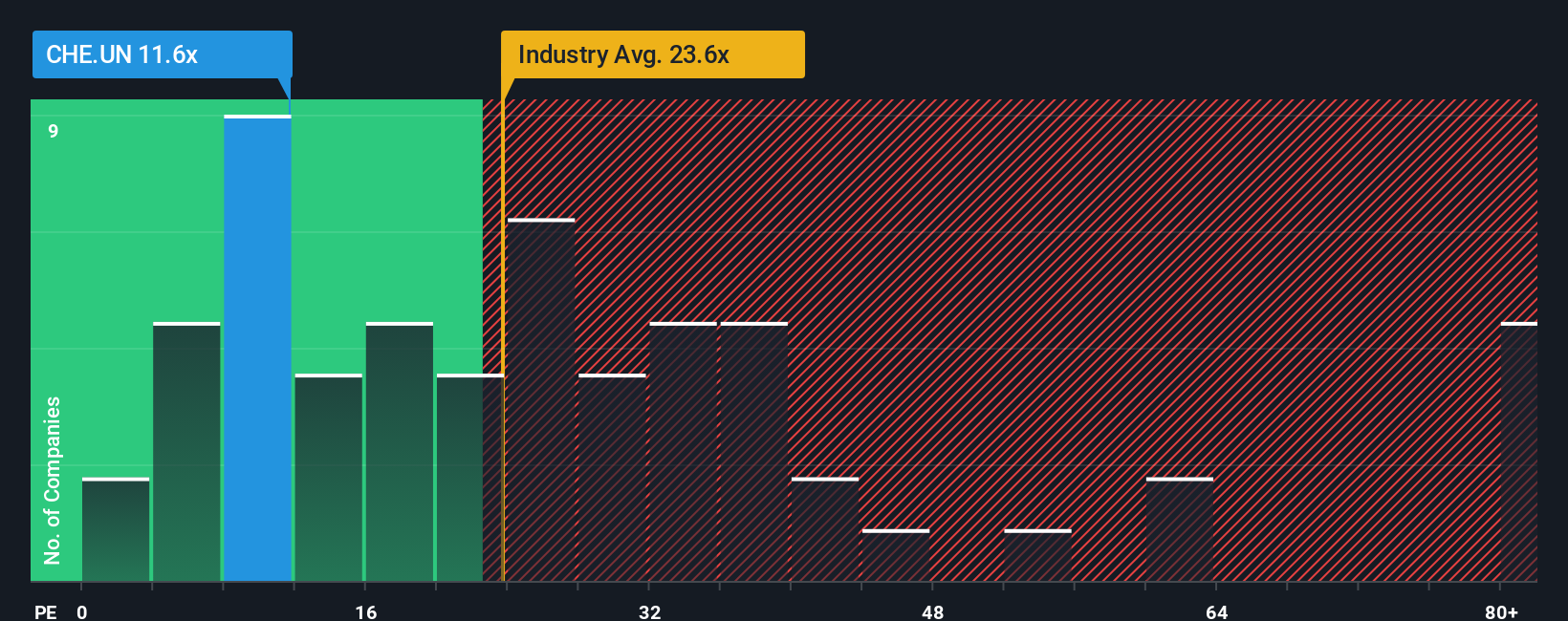

The Price-to-Earnings (PE) ratio is a widely recognized tool for valuing profitable companies, as it relates a company’s current share price to its per-share earnings. This makes it a helpful metric for investors because it shows how much the market is willing to pay for a dollar of Chemtrade’s profits. It also reflects both growth expectations and perceived risk. Companies with strong growth prospects or lower risk profiles often trade at higher PE ratios. In contrast, slower-growth or higher-risk companies trade at a discount.

Chemtrade currently trades at a PE ratio of 11.65x. For comparison, the industry average PE for chemicals stands at 22.59x, and the average among its closest peers is 16.32x. These comparisons suggest that Chemtrade is trading at a noticeable discount relative to its sector and peer group.

This is where the “Fair Ratio” comes in. Developed by Simply Wall St, the Fair Ratio takes into account factors such as Chemtrade’s earnings growth, profit margins, market cap, risk profile, and its industry. This delivers a valuation benchmark tailored to the company’s unique characteristics. This approach is more nuanced and accurate than simply comparing with industry or peer averages because it reflects the actual business quality and outlook.

Chemtrade’s Fair Ratio is calculated at 14.74x. Comparing this to the current PE of 11.65x, the stock is trading below its Fair Ratio, suggesting that it remains undervalued even after accounting for company-specific risks and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chemtrade Logistics Income Fund Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story for a company. It is your own perspective that ties together Chemtrade’s business outlook, your assumptions for future revenue, earnings, and margins, and turns them into a fair value estimate. Narratives connect the dots between the company’s journey, its financial forecasts, and a personalized fair value, helping you see how your expectations stack up against the current market price.

Available on Simply Wall St’s Community page, which is used by millions of investors, Narratives are an accessible, hands-on tool for making smarter investment decisions. By comparing your Narrative’s Fair Value to Chemtrade’s current price, you can clearly see whether you think it is the right time to buy, hold, or sell. Narratives also update dynamically with new developments, like earnings releases or market news, so your story and fair value always stay fresh.

For example, some investors are optimistic, highlighting Chemtrade’s water treatment expansion and expect a fair value as high as CA$17.50, while others are more cautious about acquisition risks, estimating fair value at just CA$14.00. Your Narrative will reflect your own view, making you part of the decision-making process.

Do you think there's more to the story for Chemtrade Logistics Income Fund? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CHE.UN

Chemtrade Logistics Income Fund

Offers industrial chemicals and services in Canada, the United States, and South America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives