- Canada

- /

- Metals and Mining

- /

- TSX:CGG

China Gold International Resources (TSX:CGG) Is Up 7.4% After Posting a Major Profit Turnaround for H1 2025

Reviewed by Simply Wall St

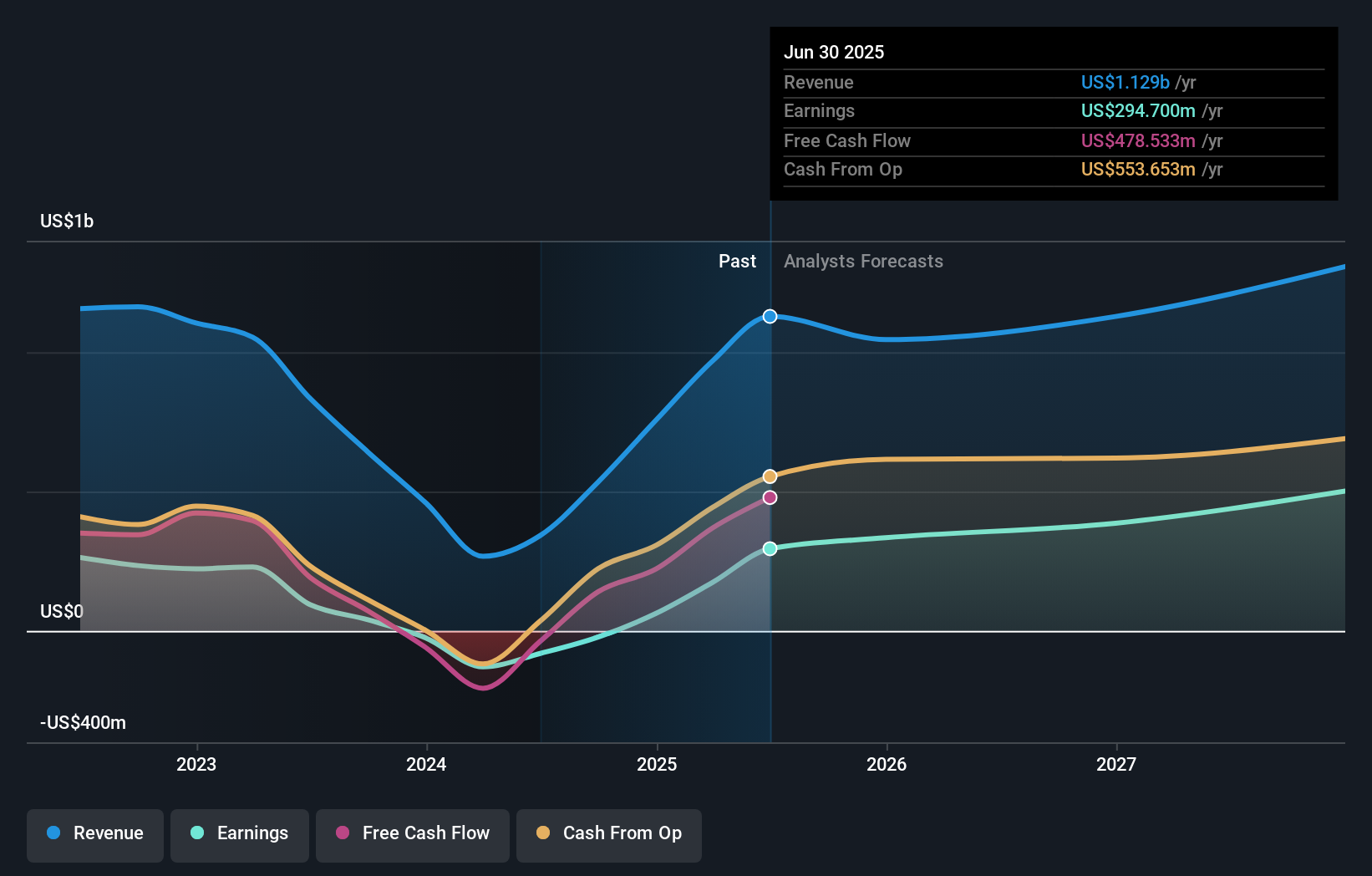

- China Gold International Resources reported a strong turnaround for the second quarter and first half of 2025, with sales for the half reaching US$580.37 million and net income growing to US$200.29 million compared to net losses during the same period last year.

- This marked shift from losses to significant profit highlights a period of exceptional operational and financial improvement for the company.

- We’ll explore how this surge in sales and profitability enhances China Gold International Resources’ investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is China Gold International Resources' Investment Narrative?

To hold China Gold International Resources stock, you have to believe in a continued operational recovery, disciplined expansion, and the company’s ability to weather both industry cycles and internal change. The recent surge in sales and profits changes the company’s short term outlook in a material way. Where prior analysis identified operational reliability and leadership turnover as pressing concerns, the new earnings result shows an improvement in both performance and momentum, at least for now. This could mean that risks related to production setbacks and execution are less severe heading into the remainder of the year, temporarily shifting attention instead to whether the earnings rebound can last and how management deploys these profits for future growth. However, the market has quickly reflected optimism, and there is still the matter of how sustainable these profit levels prove to be once expectations normalize. On the flip side, ongoing concerns about operational reliability and management consistency remain key points for investors to track.

China Gold International Resources' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on China Gold International Resources - why the stock might be worth just CA$136.86!

Build Your Own China Gold International Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Gold International Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free China Gold International Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Gold International Resources' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGG

China Gold International Resources

A gold and base metal mining company, acquires, explores, develops, and mines mineral resources in the People’s Republic of China and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives