- Canada

- /

- Metals and Mining

- /

- TSX:CGG

China Gold International Resources Corp. Ltd.'s (TSE:CGG) Share Price Is Still Matching Investor Opinion Despite 28% Slump

To the annoyance of some shareholders, China Gold International Resources Corp. Ltd. (TSE:CGG) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Longer-term shareholders would now have taken a real hit with the stock declining 8.3% in the last year.

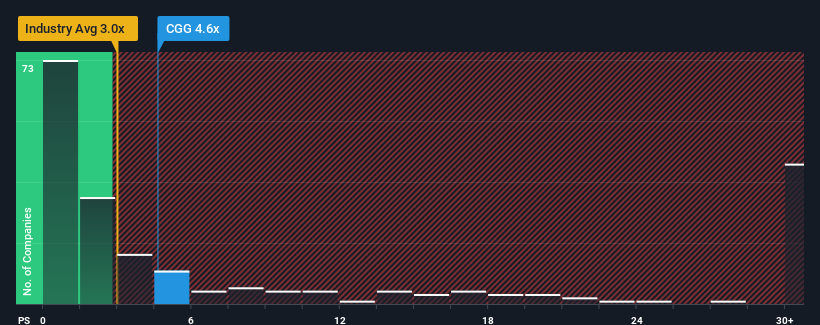

In spite of the heavy fall in price, you could still be forgiven for thinking China Gold International Resources is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.6x, considering almost half the companies in Canada's Metals and Mining industry have P/S ratios below 3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for China Gold International Resources

How China Gold International Resources Has Been Performing

China Gold International Resources hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China Gold International Resources.How Is China Gold International Resources' Revenue Growth Trending?

China Gold International Resources' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 59%. As a result, revenue from three years ago have also fallen 68% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 169% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 32% growth forecast for the broader industry.

With this in mind, it's not hard to understand why China Gold International Resources' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On China Gold International Resources' P/S

China Gold International Resources' P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Gold International Resources maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Metals and Mining industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for China Gold International Resources with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CGG

China Gold International Resources

A gold and base metal mining company, acquires, explores, develops, and mines mineral resources in the People’s Republic of China and Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives