- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

Discover 3 Undervalued Small Caps In Canada With Insider Buying

Reviewed by Simply Wall St

With the Canadian TSX index rebounding over 5% and a potential rate-cutting cycle on the horizon from both the Federal Reserve and Bank of Canada, market sentiment has turned more positive. This environment creates opportunities to explore small-cap stocks that may be undervalued, especially those showing insider buying activity as a sign of confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Calfrac Well Services | 2.6x | 0.2x | 34.00% | ★★★★★★ |

| Nexus Industrial REIT | 3.3x | 3.3x | 27.23% | ★★★★★☆ |

| Obsidian Energy | 6.7x | 1.1x | 47.37% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.2x | 18.28% | ★★★★★☆ |

| Trican Well Service | 8.0x | 1.0x | 6.98% | ★★★★☆☆ |

| Hemisphere Energy | 6.6x | 2.4x | 15.88% | ★★★★☆☆ |

| Information Services | 24.0x | 2.1x | -66.79% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 10.9x | 2.9x | 45.86% | ★★★★☆☆ |

| ADENTRA | 16.8x | 0.3x | 8.40% | ★★★☆☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -33.34% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centerra Gold is a Canadian-based gold mining and exploration company with operations in Turkey, North America, and other regions, and has a market cap of approximately CAD $2.37 billion.

Operations: Centerra Gold's revenue streams are primarily derived from Öksüt ($603.31 million), Mount Milligan ($429.08 million), and Molybdenum ($239.65 million). The company's cost of goods sold (COGS) significantly impacts its gross profit, which has shown variability with a recent gross profit margin of 44.22%. Operating expenses and non-operating expenses also play crucial roles in determining net income outcomes, which have fluctuated over time.

PE: 11.2x

Centerra Gold, a smaller Canadian mining firm, recently reported significant financial improvements. For Q2 2024, sales surged to US$282.31 million from US$184.52 million year-over-year, while net income swung to US$37.67 million from a loss of US$39.68 million previously. Insider confidence is evident with recent share purchases in the past six months, reflecting optimism despite forecasted earnings declines averaging 13.7% annually over the next three years. The company also declared a quarterly dividend of CAD 0.07 per share for August 29, 2024.

- Navigate through the intricacies of Centerra Gold with our comprehensive valuation report here.

Gain insights into Centerra Gold's historical performance by reviewing our past performance report.

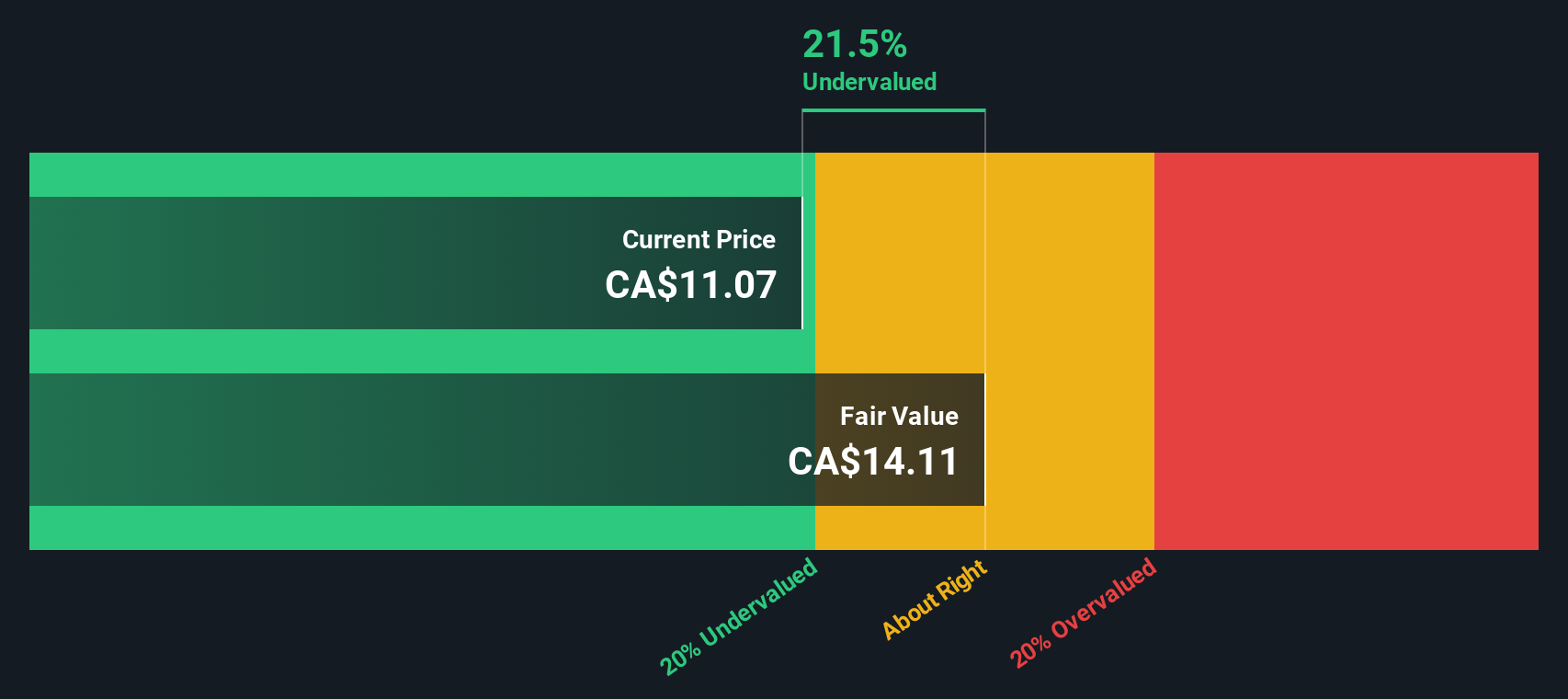

Chemtrade Logistics Income Fund (TSX:CHE.UN)

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund operates in the chemical industry, providing industrial chemicals and services with a market cap of approximately CA$0.86 billion.

Operations: The company generates revenue primarily from its EC and SWC segments, with recent quarterly revenues reaching CA$1.77 billion. Gross profit margin has shown an upward trend, reaching 23.63% in the latest quarter. Operating expenses and non-operating expenses are significant cost components impacting net income margins, which have varied over time but recently reached 13.50%.

PE: 8.4x

Chemtrade Logistics Income Fund, a small cap in Canada, has recently reported a dip in sales and net income for Q2 2024, with sales at C$448.1 million and net income at C$14.6 million compared to last year's figures of C$469.97 million and C$87.33 million respectively. Despite these declines, insider confidence remains high with recent share purchases by executives over the past three months. The company continues to pay steady dividends of $0.055 per unit monthly, indicating consistent shareholder returns amidst financial challenges.

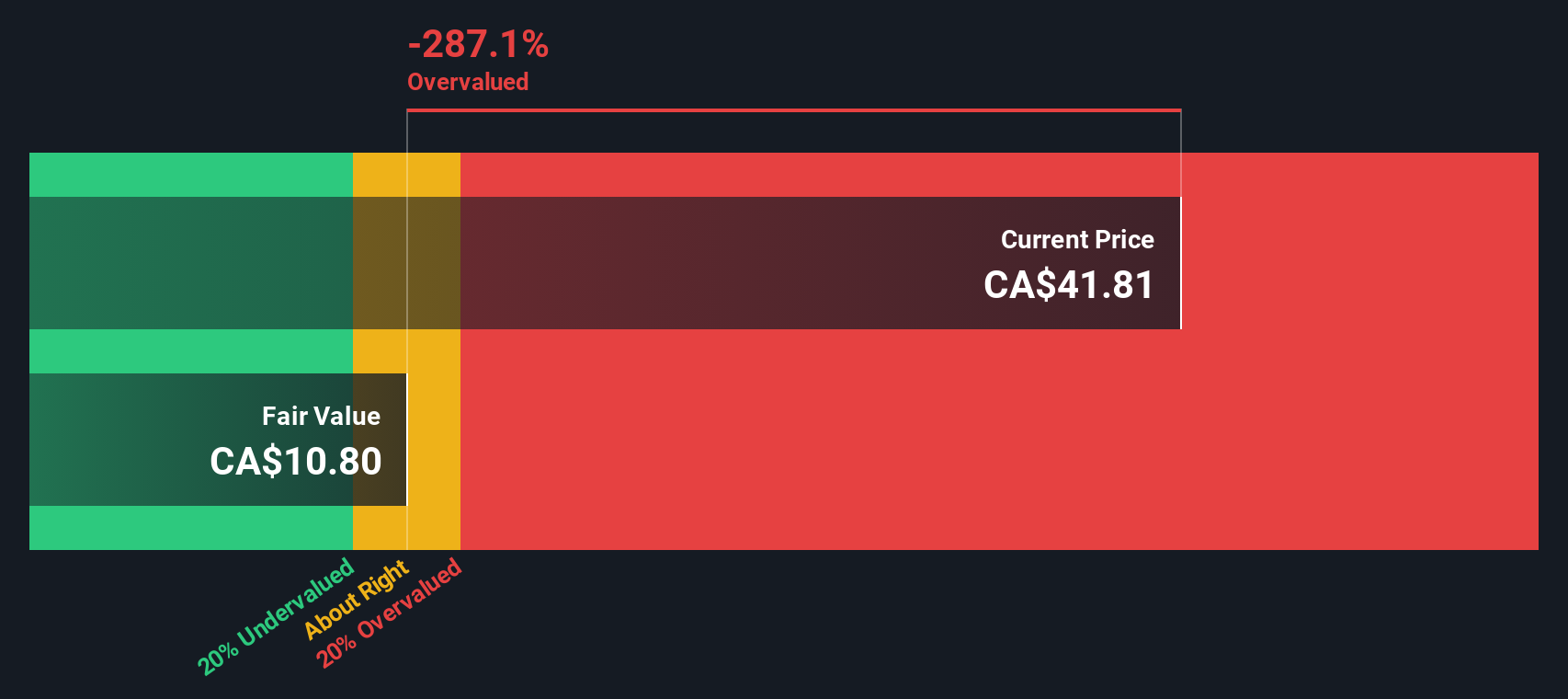

MDA Space (TSX:MDA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MDA Space is a Canadian company specializing in geointelligence, robotics and space operations, and satellite systems with a market cap of CA$1.34 billion.

Operations: MDA Space generates revenue from three primary segments: Geointelligence, Robotics & Space Operations, and Satellite Systems. As of the latest period ending 2024-08-18, the company reported CA$860.80 million in revenue with a net income of CA$47.6 million and a gross profit margin of 32.41%. Operating expenses include significant allocations to R&D and general administrative costs. The company's net income margin for this period was 5.53%.

PE: 37.8x

MDA Space appears to be a promising candidate in the Canadian small-cap sector. The company reported strong earnings for Q2 2024, with sales of C$242 million, up from C$196 million the previous year. Net income also rose to C$11 million from C$9.9 million. Future revenue guidance for Q3 2024 is set between $270-$280 million, and full-year projections have been raised to $1.02-$1.06 billion. Notably, insider confidence is high as Independent Chairman Brendan Paddick acquired 85,000 shares worth approximately C$1 million recently, indicating potential growth prospects ahead.

- Click to explore a detailed breakdown of our findings in MDA Space's valuation report.

Examine MDA Space's past performance report to understand how it has performed in the past.

Taking Advantage

- Delve into our full catalog of 26 Undervalued TSX Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives