Centerra Gold Inc. (TSE:CG) will pay a dividend of $0.07 on the 12th of June. This means the annual payment is 3.9% of the current stock price, which is above the average for the industry.

See our latest analysis for Centerra Gold

Centerra Gold Might Find It Hard To Continue The Dividend

If the payments aren't sustainable, a high yield for a few years won't matter that much. Even in the absence of profits, Centerra Gold is paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Looking forward, earnings per share is forecast to rise by 37.6% over the next year. The company seems to be going down the right path, but it will take a little bit longer than a year to cross over into profitability. Unfortunately, for the dividend to continue at current levels the company definitely needs to get there sooner rather than later.

Dividend Volatility

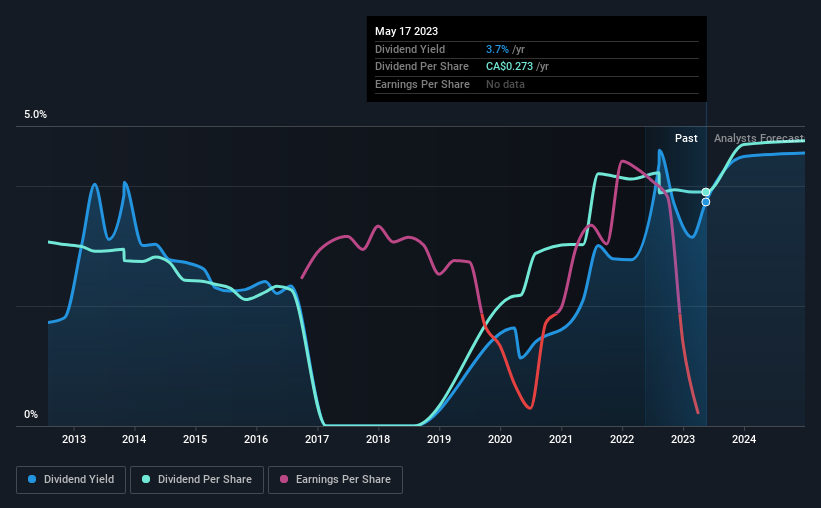

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of $0.159 in 2013 to the most recent total annual payment of $0.202. This works out to be a compound annual growth rate (CAGR) of approximately 2.4% a year over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been crawling upwards at 3.6% per year. Earnings growth isn't particularly strong, and if the company isn't able to become profitable fairly soon, the dividend could come under pressure.

Centerra Gold's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The track record isn't great, and the payments are a bit high to be considered sustainable. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Centerra Gold that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives