- Canada

- /

- Real Estate

- /

- TSX:CIGI

TSX Growth Companies With High Insider Ownership For January 2025

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a landscape shaped by new U.S. policy directions under President Trump, with particular attention on energy and tariffs. Despite uncertainties, the TSX index has shown resilience, supported by a strong consumer base and positive economic growth projections. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities as insiders often have confidence in their business's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Robex Resources (TSXV:RBX) | 28.2% | 130.7% |

| Allied Gold (TSX:AAUC) | 17.7% | 79.2% |

| West Red Lake Gold Mines (TSXV:WRLG) | 13.4% | 77.6% |

| Almonty Industries (TSX:AII) | 17.2% | 43.9% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 33.2% |

| Aritzia (TSX:ATZ) | 18.6% | 45.1% |

| Enterprise Group (TSX:E) | 32.2% | 56.3% |

| Colliers International Group (TSX:CIGI) | 14.1% | 24.1% |

| CHAR Technologies (TSXV:YES) | 10.8% | 60.5% |

Here's a peek at a few of the choices from the screener.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. is involved in the exploration, evaluation, and development of precious metals projects in Morocco and has a market cap of CA$1.48 billion.

Operations: Aya Gold & Silver's revenue primarily comes from its production activities at the Zgounder Silver Mine in Morocco, generating $40.85 million.

Insider Ownership: 10.2%

Aya Gold & Silver demonstrates significant growth potential, with forecasted revenue and earnings expected to grow substantially above market averages. The company has achieved commercial production at its Zgounder Mine, showcasing rapid ramp-up capabilities and high-grade exploration results. Despite a recent delay in commissioning affecting production guidance, the company is progressing towards stabilizing operations. Although there has been notable insider selling recently, Aya remains undervalued compared to its estimated fair value, highlighting investment interest in its growth trajectory.

- Take a closer look at Aya Gold & Silver's potential here in our earnings growth report.

- Our valuation report here indicates Aya Gold & Silver may be overvalued.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★★☆

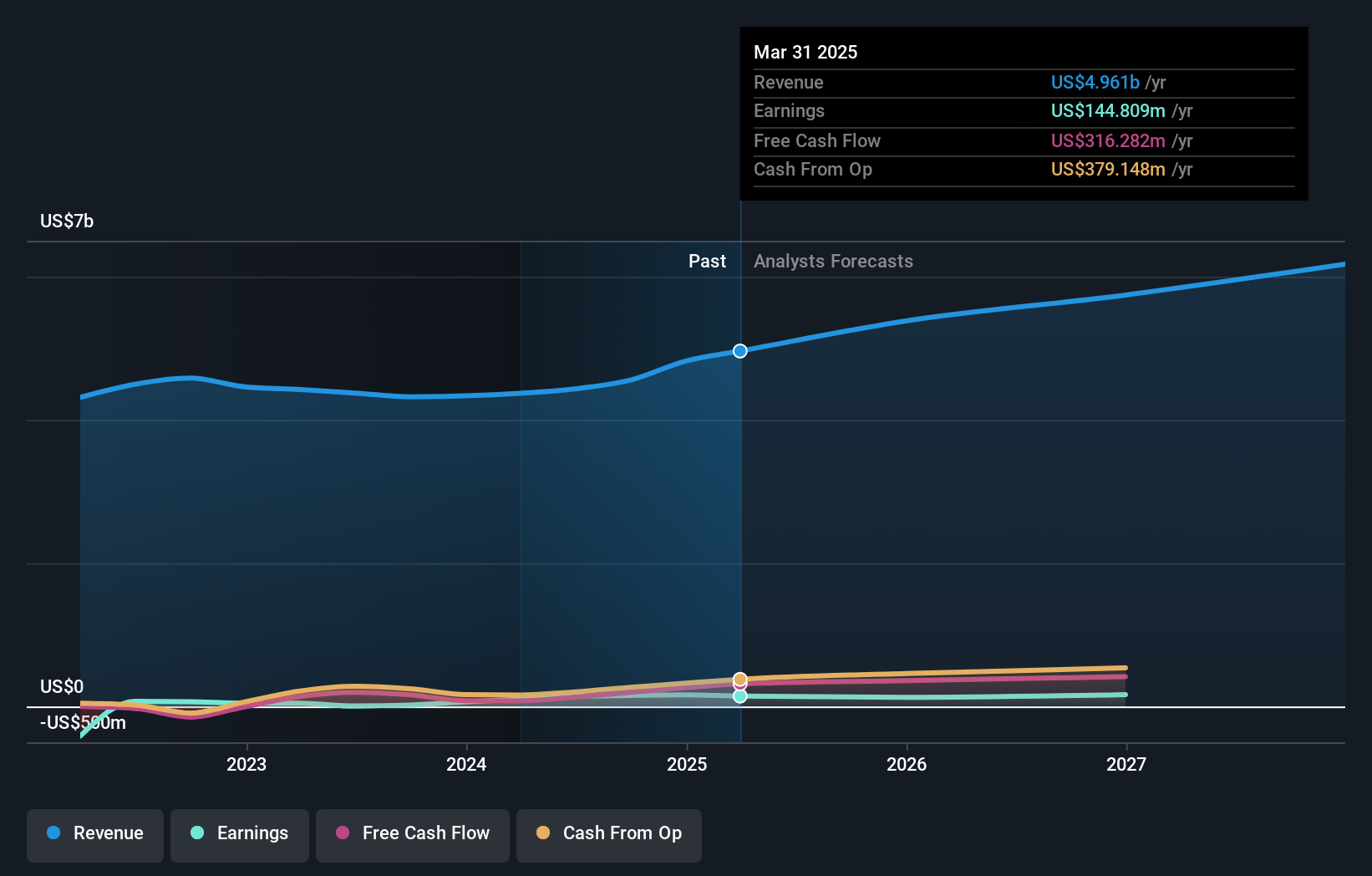

Overview: Colliers International Group Inc. offers commercial real estate and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of CA$10.26 billion.

Operations: The company generates revenue from investment management services amounting to $505.11 million.

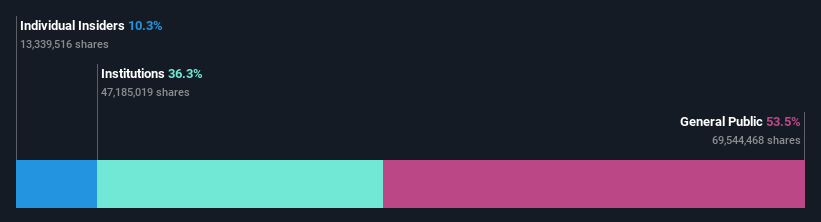

Insider Ownership: 14.1%

Colliers International Group is positioned for growth, with earnings forecast to rise 24.1% annually, outpacing the Canadian market. Despite substantial insider selling recently, the company trades at a significant discount to its estimated fair value. Colliers' recent expansion of its credit facility to $2.25 billion provides over $1 billion for growth investments, reinforcing its financial strategy. The appointment of John Sullivan to the board adds valuable real estate expertise amid these strategic developments.

- Get an in-depth perspective on Colliers International Group's performance by reading our analyst estimates report here.

- The analysis detailed in our Colliers International Group valuation report hints at an inflated share price compared to its estimated value.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.39 billion.

Operations: The company generates revenue from its Patient Care segment, which amounts to CA$184.01 million.

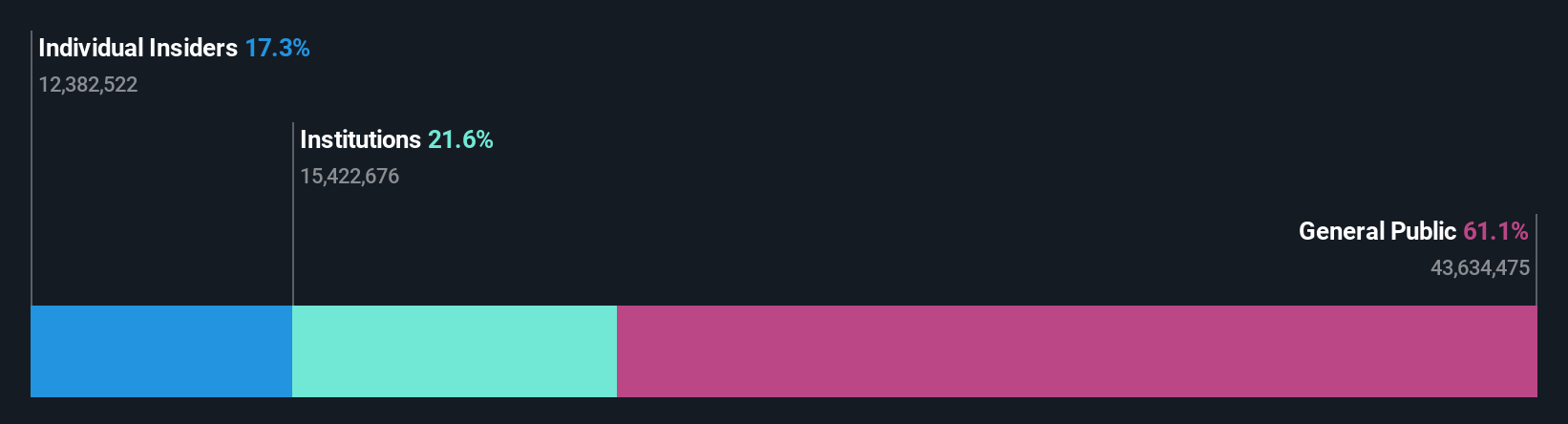

Insider Ownership: 17.2%

Savaria Corporation demonstrates growth potential, with earnings forecast to increase significantly at 31.4% annually, surpassing the Canadian market's average. Despite revenue growth projections of 7.1% per year being modest, they still exceed market expectations. The company trades below its fair value estimate by 29.5%, indicating potential upside. Insider activity reflects confidence, with substantial buying over the past three months and no significant selling noted recently, supporting positive sentiment towards future performance.

- Click here to discover the nuances of Savaria with our detailed analytical future growth report.

- Our valuation report here indicates Savaria may be undervalued.

Key Takeaways

- Reveal the 44 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives