- Canada

- /

- Metals and Mining

- /

- TSX:AYA

### 3 TSX Growth Stocks With High Insider Ownership Expecting Up To 71% Earnings Growth ###

Reviewed by Simply Wall St

The recent rate cuts by the Federal Reserve and the Bank of Canada have set a positive tone for equity markets, with both the S&P 500 and TSX reaching new highs. In this favorable environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong internal confidence in future performance.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.3% | 70.7% |

| Allied Gold (TSX:AAUC) | 21.9% | 73.5% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Amerigo Resources (TSX:ARG) | 12% | 36.8% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Here we highlight a subset of our preferred stocks from the screener.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., with a market cap of CA$5.70 billion, designs, develops, and sells apparel and accessories for women in the United States and Canada.

Operations: The company generates revenue primarily from the sale of apparel, amounting to CA$2.37 billion.

Insider Ownership: 18.9%

Earnings Growth Forecast: 60.4% p.a.

Aritzia, a Canadian growth company with high insider ownership, is forecast to achieve significant annual earnings growth of 60.4% over the next three years, outpacing the Canadian market's 15%. Despite a recent dip in profit margins from 7.5% to 3.3%, its revenue is expected to grow by 12.2% annually. Recent earnings showed sales increasing to C$498.63 million, though net income slightly decreased year-over-year to C$15.83 million.

- Dive into the specifics of Aritzia here with our thorough growth forecast report.

- Our valuation report unveils the possibility Aritzia's shares may be trading at a premium.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc., with a market cap of CA$2.42 billion, engages in the exploration, evaluation, and development of precious metals projects in Morocco.

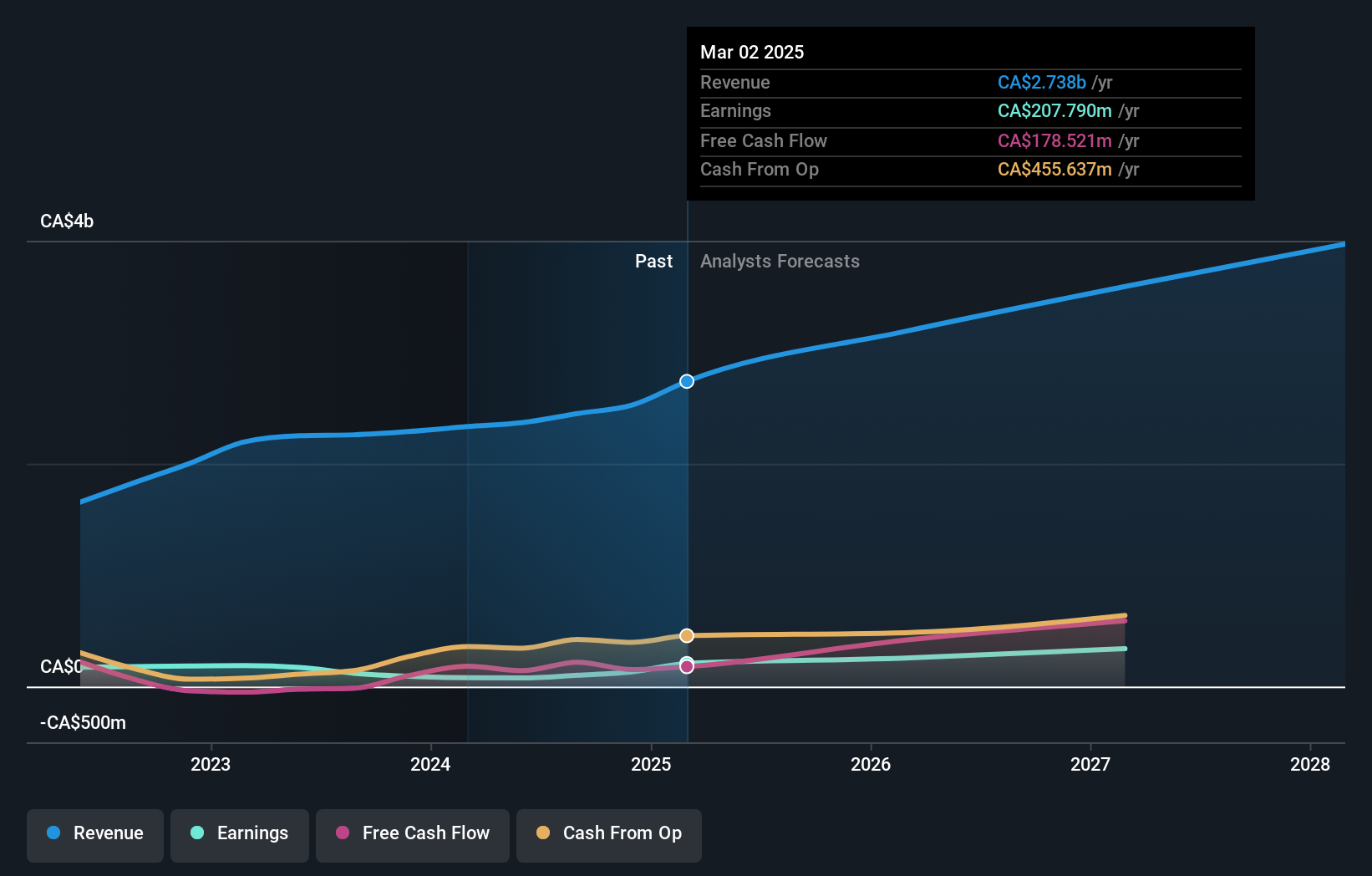

Operations: Revenue from the Zgounder Silver Mine in Morocco amounted to $41.54 million.

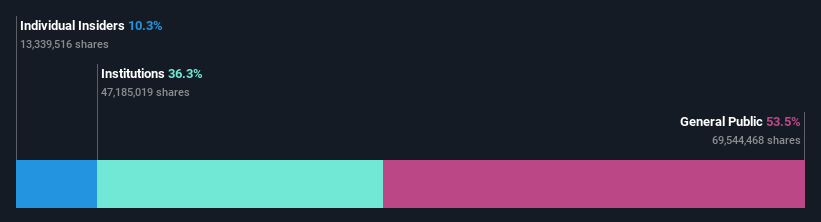

Insider Ownership: 10.2%

Earnings Growth Forecast: 71.4% p.a.

Aya Gold & Silver, a Canadian growth company with substantial insider ownership, is experiencing significant developments. Recent high-grade drill results from its Boumadine and Zgounder projects in Morocco highlight the company's exploration success. Aya's earnings have grown by 220.3% over the past year, with revenue forecast to grow at 46.7% annually, outpacing the Canadian market's 6.9%. However, shareholders have faced dilution recently despite strong operational progress and expansion efforts in North Africa.

- Navigate through the intricacies of Aya Gold & Silver with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Aya Gold & Silver is priced higher than what may be justified by its financials.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. engages in the mining, development, and exploration of minerals and precious metals primarily in Africa and has a market cap of CA$25.95 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities focused on minerals and precious metals in Africa.

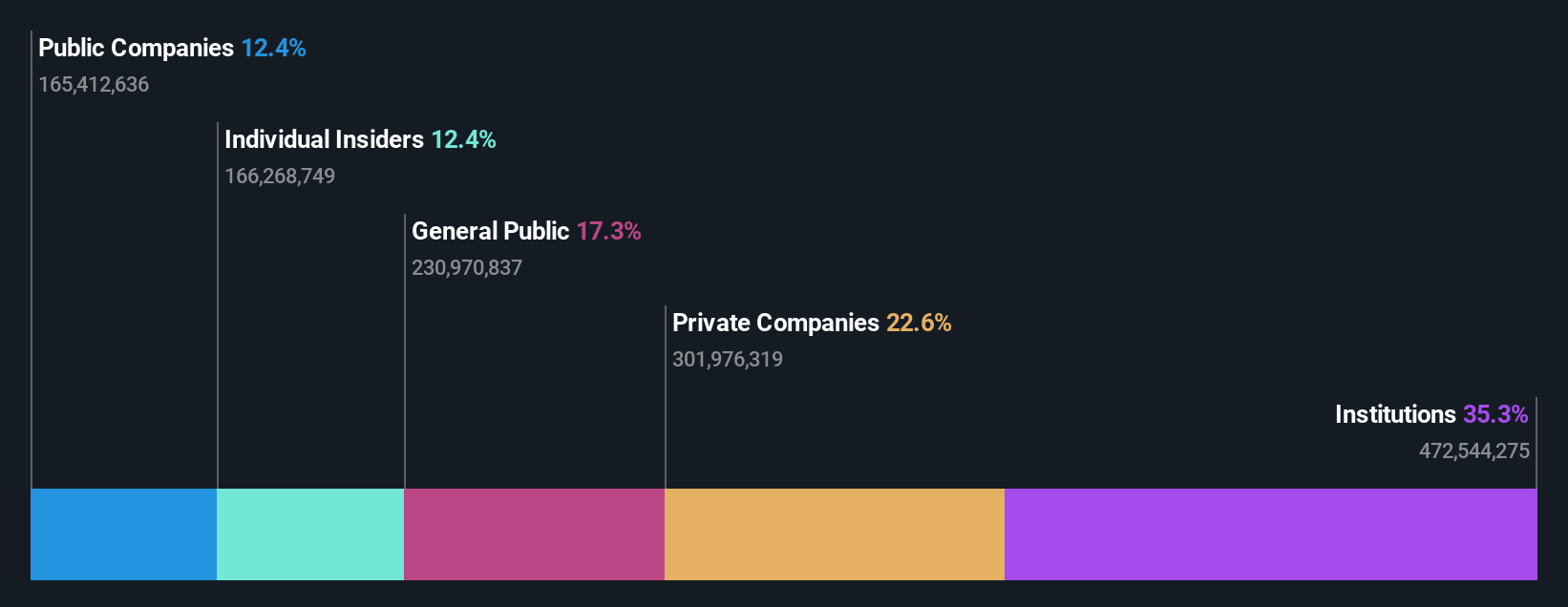

Insider Ownership: 12.3%

Earnings Growth Forecast: 68.3% p.a.

Ivanhoe Mines, a Canadian growth company with high insider ownership, recently signed an MOU with Zambia's Ministry of Mines to commence exploration activities. The Kamoa-Kakula Copper Complex in the DRC achieved record production levels in August, producing 40,347 tonnes of copper concentrate. Despite past shareholder dilution and lower recent earnings ($76.4 million Q2 2024), Ivanhoe's revenue is forecast to grow at 83.5% annually, significantly outpacing the Canadian market's average growth rate.

- Delve into the full analysis future growth report here for a deeper understanding of Ivanhoe Mines.

- The valuation report we've compiled suggests that Ivanhoe Mines' current price could be inflated.

Key Takeaways

- Explore the 36 names from our Fast Growing TSX Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with proven track record.