- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Avino Silver & Gold Mines (TSX:ASM) Reports Q2 Sales Up To US$22 Million

Reviewed by Simply Wall St

In the latest quarter, Avino Silver & Gold Mines (TSX:ASM) announced substantial growth with Q2 sales climbing to USD 21.81 million, up from USD 14.79 million year-over-year. The company also reported promising drill results from its La Preciosa project, potentially boosting investor confidence. Over the same period, the market has shown an upward trend with a 1.3% increase in the last week alone. Avino's 35.94% price rise appears consistent with its positive developments, aligning well with broader market performance without strongly deviating from it.

We've identified 1 possible red flag for Avino Silver & Gold Mines that you should be aware of.

The recent developments at Avino Silver & Gold Mines, including the strong Q2 sales growth and positive drill results from La Preciosa, indicate potential for increased future production and profitability. This aligns with the company's narrative of leveraging La Preciosa to drive revenue and earnings. With significant underground development and enhanced mill throughput, Avino aims to capitalize on higher metal prices and operational efficiency. However, reliance on volatile metal markets and potential cost fluctuations remain risks to consider.

Over a longer period, Avino's shares have seen substantial gains, with a total return of over 742% in three years. This performance far outpaces both the Canadian market and the wider Canadian Metals and Mining industry over a one-year timeframe, where Avino shares exceeded respective market returns. Such longer-term success underscores the company's ability to capitalize on its strategic initiatives and market conditions.

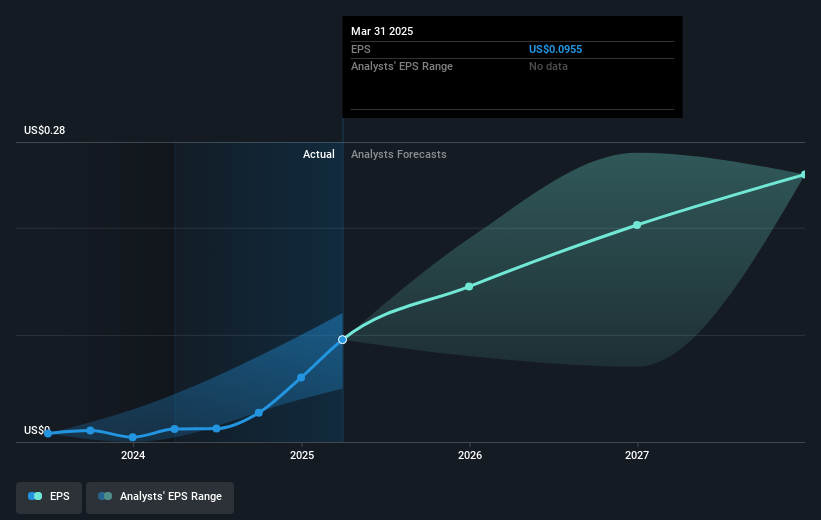

Analysts' forecasts already reflect optimism with anticipated growth in revenue and earnings due to improved production and cost efficiencies. The current share price of CA$5.90 places the stock above the consensus price target of CA$5.23, indicating a potential overvaluation in market expectations relative to these forecasts. Investors should consider the company's execution risks and revenue dependency on fluctuating metal prices amidst these price movements. The news around La Preciosa could have a profound impact on sustaining growth, contingent on effective implementation and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)