- Canada

- /

- Metals and Mining

- /

- TSX:ARG

Amerigo Resources (TSX:ARG): Assessing Valuation After Announced Special Dividend for January 2026

Reviewed by Simply Wall St

Amerigo Resources (TSX:ARG) just declared a special dividend of CAD 0.05 per share, payable January 15, 2026, with both the ex dividend and record dates set for December 17, adding an extra cash kicker for shareholders.

See our latest analysis for Amerigo Resources.

The special dividend lands on top of a powerful run, with Amerigo’s 30 day share price return of 32.21 percent feeding into a 169.38 percent year to date surge and a standout 183.23 percent one year total shareholder return that signals strong, building momentum.

If this kind of move has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With the share price already rocketing and analysts seeing only modest upside from here, the key question now is whether Amerigo still trades below its true worth or if the market is already pricing in future growth.

Price to earnings of 25.4x: Is it justified?

Amerigo Resources trades on a price to earnings ratio of 25.4 times at its last close of CA$4.31, sitting below peers but above the wider industry.

The price to earnings multiple compares the current share price with the company’s per share earnings. It is a direct barometer of how much investors are paying for each dollar of profit in a capital intensive sector like metals and mining.

Against a peer average multiple of 43.6 times, Amerigo looks inexpensive on earnings, suggesting the market is assigning a lower premium to its current profit base despite strong recent share price performance.

However, compared with the broader Canadian metals and mining industry average of 21.4 times, its 25.4 times multiple represents a richer valuation, implying investors are still paying a noticeable premium for Amerigo’s earnings relative to many other miners.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 25.4x (ABOUT RIGHT)

However, investors still face risks, including potential volatility in copper prices and operational challenges in Chile that could quickly cool sentiment around Amerigo’s growth story.

Find out about the key risks to this Amerigo Resources narrative.

Another view on value

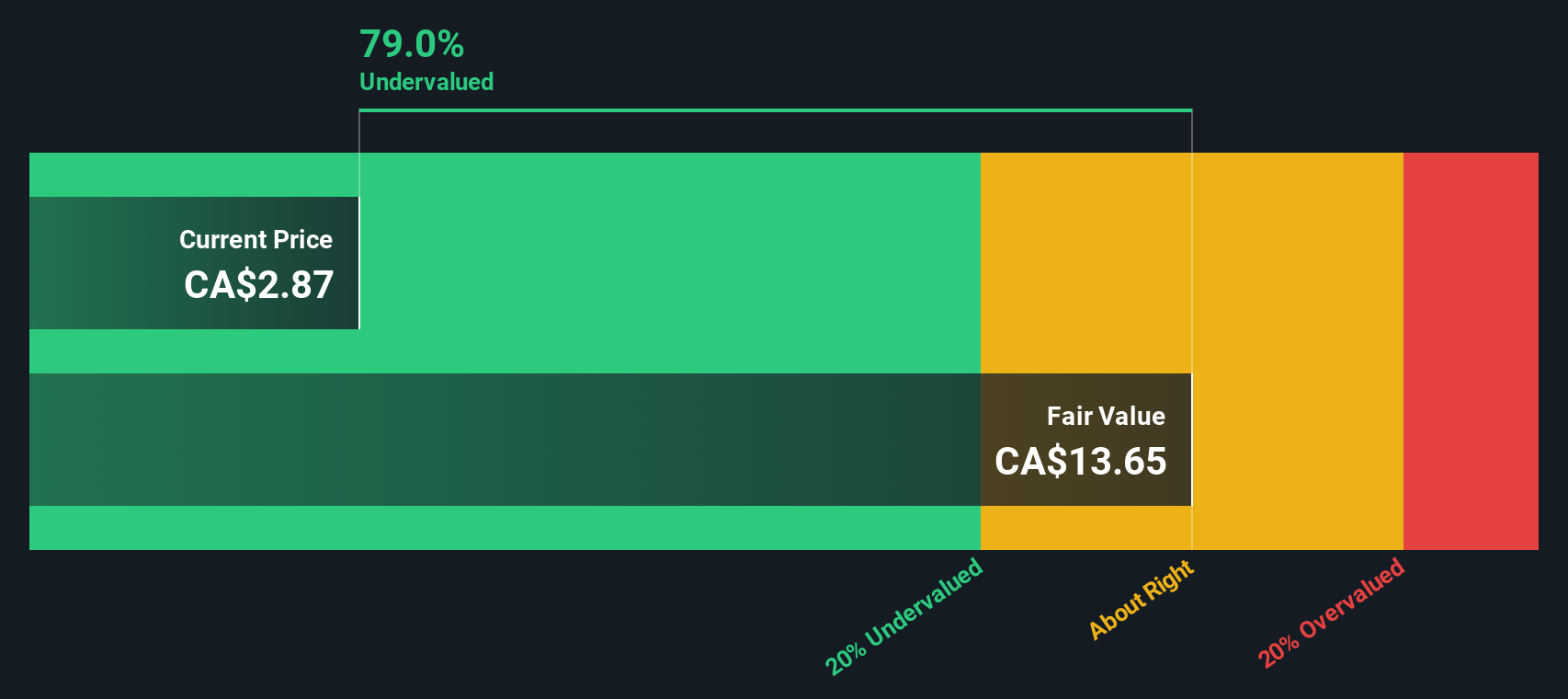

Our DCF model presents a much more aggressive outlook, with Amerigo’s fair value estimated at around CA$14.65 per share. This implies the stock could be about 70.6 percent undervalued compared with its CA$4.31 price. If that gap is even half right, how long can it remain?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amerigo Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amerigo Resources Narrative

If you see things differently or would rather dig into the numbers yourself, you can shape a complete narrative in just a few minutes: Do it your way.

A great starting point for your Amerigo Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

If you stop with Amerigo, you could miss out on other powerful setups. Keep your edge sharp using Simply Wall St’s screened opportunities.

- Capture mispriced opportunities by targeting companies trading below intrinsic value through these 911 undervalued stocks based on cash flows that spotlight compelling cash flow potential.

- Ride structural tailwinds in next generation medicine by zeroing in on innovators tapping intelligent diagnostics and treatment breakthroughs with these 30 healthcare AI stocks.

- Position yourself early in the digital asset ecosystem by focusing on listed businesses building real world blockchain infrastructure using these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., produces copper and molybdenum concentrates in Chile.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)