- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

TSX Growth Stocks With High Insider Ownership In July 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape marked by trade negotiations and potential economic cooling, investors are keenly observing growth sectors that have shown resilience amid volatility. In this context, companies with high insider ownership often attract attention for their potential alignment of interests between management and shareholders, making them noteworthy candidates in an environment where strategic positioning is key.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| VersaBank (TSX:VBNK) | 10.4% | 61.8% |

| Tenaz Energy (TSX:TNZ) | 10.3% | 151.2% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.3% |

| Propel Holdings (TSX:PRL) | 36.2% | 33% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Enterprise Group (TSX:E) | 32.2% | 24.8% |

| Discovery Silver (TSX:DSV) | 15.1% | 39.3% |

| Burcon NutraScience (TSX:BU) | 15.1% | 125.9% |

| Aritzia (TSX:ATZ) | 17.4% | 24.7% |

| Almonty Industries (TSX:AII) | 11.2% | 56.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allied Gold Corporation, along with its subsidiaries, is engaged in the exploration and production of mineral deposits in Africa and has a market cap of CA$2.11 billion.

Operations: The company's revenue is derived from three main segments: Agbaou Mine generating $201.54 million, Bonikro Mine contributing $224.17 million, and Sadiola Mine accounting for $476.02 million.

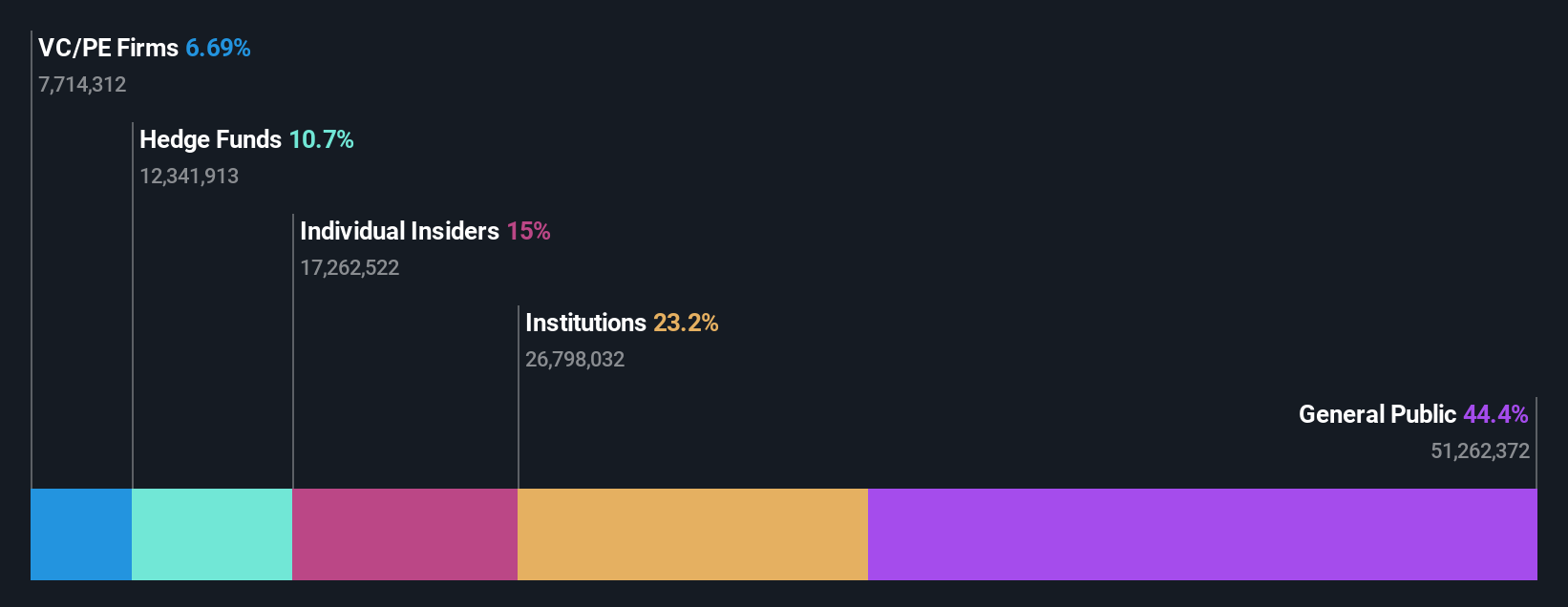

Insider Ownership: 15%

Return On Equity Forecast: N/A (2028 estimate)

Allied Gold's revenue is forecast to grow at 19.1% annually, outpacing the Canadian market, with profitability expected within three years. Despite past shareholder dilution, insiders have increased their holdings recently. The company trades at a significant discount to its estimated fair value and analysts anticipate a 49.9% price rise. Recent developments include a stock split and NYSE listing transition, while Q1 2025 saw sales of US$346.41 million and net income of US$15.12 million.

- Take a closer look at Allied Gold's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Allied Gold's share price might be too pessimistic.

Almonty Industries (TSX:AII)

Simply Wall St Growth Rating: ★★★★★★

Overview: Almonty Industries Inc. is involved in the mining, processing, and shipping of tungsten concentrate with a market cap of CA$1.22 billion.

Operations: The company's revenue primarily comes from its Panasqueira segment, which generated CA$28.88 million.

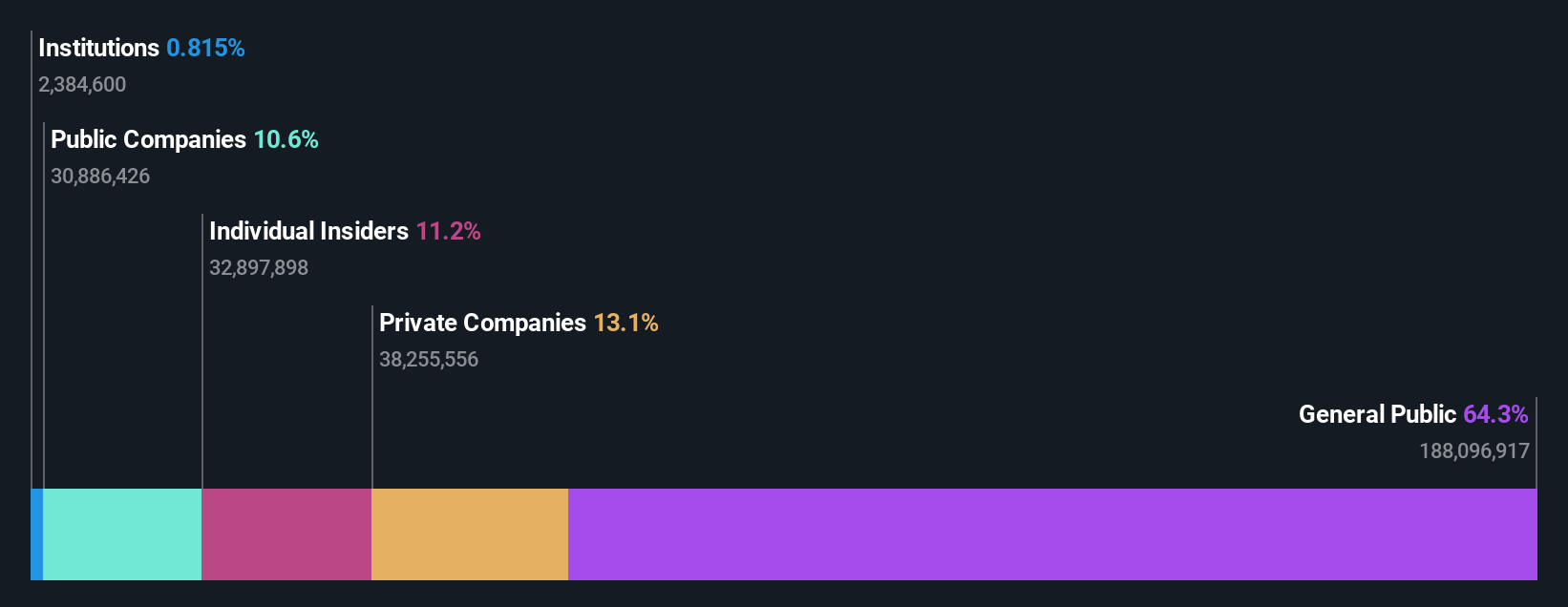

Insider Ownership: 11.2%

Return On Equity Forecast: 53% (2028 estimate)

Almonty Industries is positioned for substantial growth, with revenue projected to increase by 45.4% annually, surpassing the Canadian market average. The company trades at a significant discount to its estimated fair value and aims for profitability within three years. Recent developments include a strategic offtake agreement with U.S.-based defense contractor Tungsten Parts Wyoming Inc., enhancing its role in national security supply chains. Despite recent financial losses, Almonty's high insider ownership aligns interests with shareholders.

- Navigate through the intricacies of Almonty Industries with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Almonty Industries' current price could be inflated.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company, with a market cap of CA$1.47 billion.

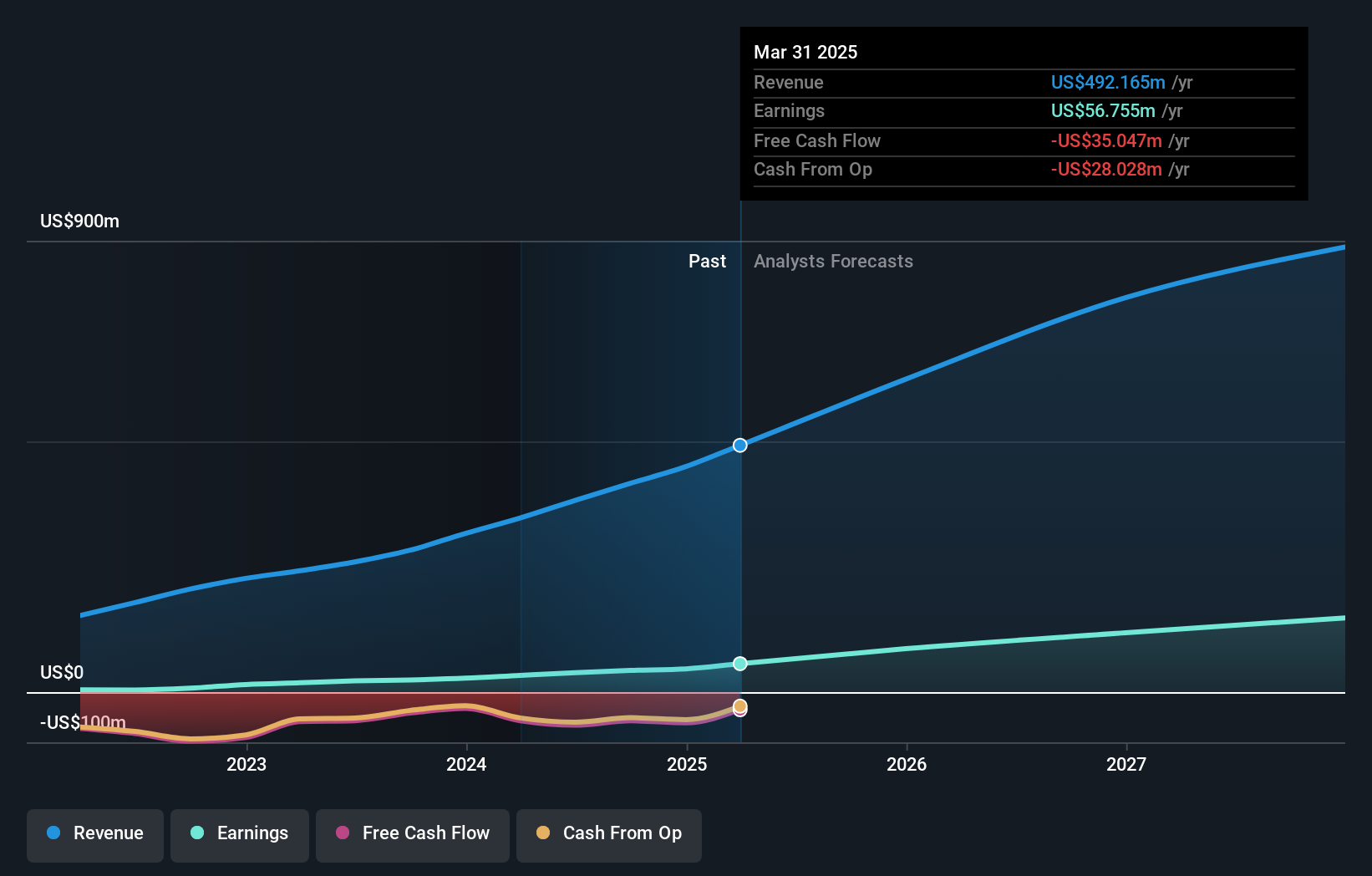

Operations: The company generates revenue of $492.16 million from providing lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 36.2%

Return On Equity Forecast: 36% (2028 estimate)

Propel Holdings is poised for growth, with revenues forecasted to rise by 22.5% annually, outpacing the Canadian market. The company reported a significant increase in Q1 2025 earnings and revenue, enhancing its financial position despite debt coverage concerns. Recent dividend hikes reflect confidence in future performance. While insider buying has been limited recently, Propel remains undervalued relative to its fair value estimate and anticipates robust profit growth exceeding market expectations over the next three years.

- Get an in-depth perspective on Propel Holdings' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Propel Holdings' share price might be on the expensive side.

Key Takeaways

- Embark on your investment journey to our 45 Fast Growing TSX Companies With High Insider Ownership selection here.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives