- Canada

- /

- Metals and Mining

- /

- TSX:MNO

3 TSX Growth Stocks With High Insider Ownership And Up To 81% Earnings Growth

Reviewed by Simply Wall St

As the Canadian market navigates through a period of economic uncertainty, with interest rate expectations and trade-policy concerns at the forefront, investors are closely watching for growth opportunities. In this environment, stocks with high insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 23.1% | 93.4% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.4% |

| Orla Mining (TSX:OLA) | 10.7% | 74.9% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Heliostar Metals (TSXV:HSTR) | 16.4% | 41% |

| goeasy (TSX:GSY) | 21.9% | 17.9% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| Almonty Industries (TSX:AII) | 12.5% | 64.9% |

Let's review some notable picks from our screened stocks.

Almonty Industries (TSX:AII)

Simply Wall St Growth Rating: ★★★★★★

Overview: Almonty Industries Inc. focuses on the mining, processing, and shipping of tungsten concentrate, with a market cap of CA$2.44 billion.

Operations: Almonty Industries generates its revenue through the activities of mining, processing, and shipping tungsten concentrate.

Insider Ownership: 12.5%

Earnings Growth Forecast: 64.9% p.a.

Almonty Industries, with significant insider ownership, is poised for substantial growth. The company has initiated a large-scale drilling program at its Sangdong Molybdenum Project in South Korea to address local supply shortages and potentially expedite production. Despite recent financial losses, Almonty's revenue is forecast to grow rapidly at 50.4% annually, outpacing the Canadian market average. Additionally, its return on equity is expected to reach a very high level in three years.

- Navigate through the intricacies of Almonty Industries with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Almonty Industries is trading beyond its estimated value.

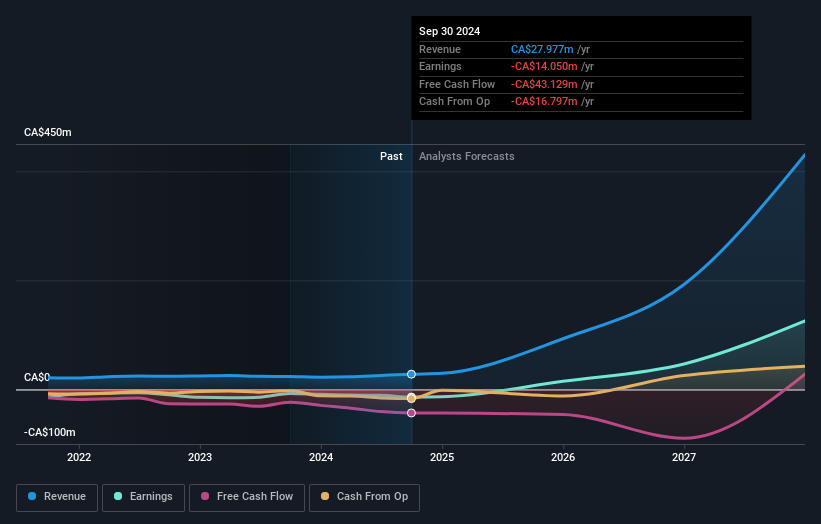

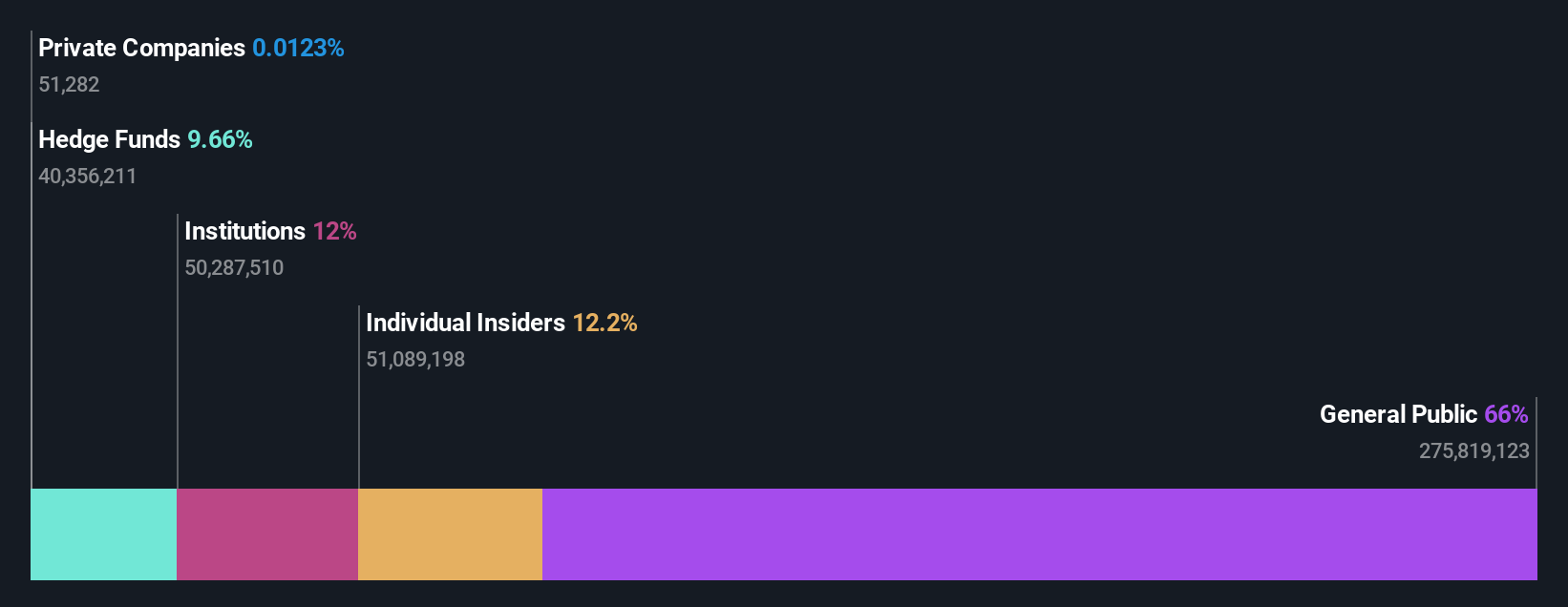

Meridian Mining UK Societas (TSX:MNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meridian Mining UK Societas, with a market cap of CA$522.00 million, focuses on acquiring, exploring, and developing mineral properties in Brazil.

Operations: Meridian Mining UK Societas does not have any reported revenue segments in the provided text.

Insider Ownership: 12.2%

Earnings Growth Forecast: 81.6% p.a.

Meridian Mining UK Societas, characterized by high insider ownership, is set for substantial growth with its Cabaçal and Santa Helena projects. Despite past shareholder dilution and minimal revenue, the company anticipates becoming profitable within three years. Recent drilling at Cabaçal revealed robust gold-copper-silver mineralization, supporting future resource upgrades. The company's stock trades significantly below estimated fair value, while its revenue is projected to grow over 55% annually—far exceeding market expectations.

- Get an in-depth perspective on Meridian Mining UK Societas' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Meridian Mining UK Societas' share price might be too optimistic.

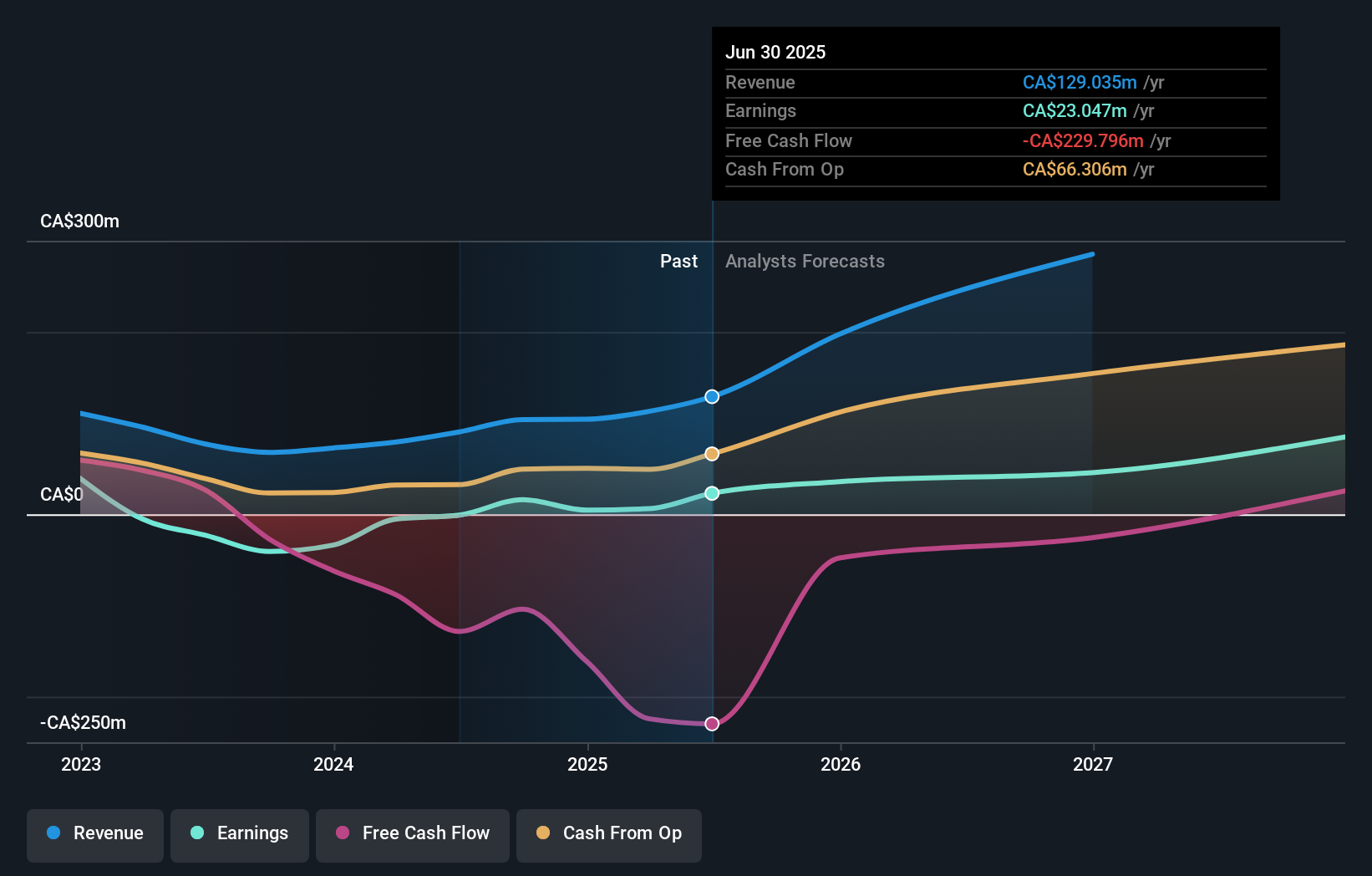

Logan Energy (TSXV:LGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Logan Energy Corp. is involved in the exploration, development, and production of crude oil and natural gas properties with a market cap of CA$464.63 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, amounting to CA$129.04 million.

Insider Ownership: 17.4%

Earnings Growth Forecast: 40% p.a.

Logan Energy, with significant insider ownership, is positioned for robust growth. The company recently became profitable and reported substantial revenue increases, with CAD 40.51 million in Q2 2025 compared to CAD 24.35 million a year ago. Forecasts indicate Logan's revenue will grow over 50% annually, outpacing the Canadian market significantly. Earnings are also expected to rise by about 40% per year. Despite trading well below fair value estimates, Logan maintains high-quality earnings and strong production growth across its resources.

- Take a closer look at Logan Energy's potential here in our earnings growth report.

- Our expertly prepared valuation report Logan Energy implies its share price may be too high.

Summing It All Up

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 41 companies by clicking here.

- Contemplating Other Strategies? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MNO

Meridian Mining UK Societas

Engages in the acquisition, exploration, and development of mineral properties in Brazil.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives