- Canada

- /

- Metals and Mining

- /

- TSX:AGI

Should Investors Rethink Alamos Gold After Record Production and 65% Jump in 2024?

Reviewed by Bailey Pemberton

Thinking about what to do with Alamos Gold stock? You’re definitely not alone. With a YTD return of 65.8% and an impressive 71.6% gain over the past year, Alamos Gold has been on a tear, and you may be wondering whether the stock still offers room to run or if it’s time to lock in some profits. Despite a slight dip of 4.3% over the last week, the company’s multi-year surge—351.5% over three years and 310.7% in five—shows a long-term trend that cannot be ignored. Much of this momentum has been driven by stronger gold prices, increased demand for safe-haven assets, and market confidence in the company’s operational strengths.

But is Alamos Gold undervalued, overbought, or priced just right? That is where it gets interesting. Looking at traditional methods, Alamos scores a 3 out of 6 on valuation checks, indicating it is undervalued by half of the most common measures analysts look at. That is enough to turn heads but leaves plenty of room for debate, especially if you are thinking about adding to your position or looking for an entry point.

Let us walk through the different ways experts assess a company’s value, and, by the end, you will see why some approaches tell only part of the story and how there might be an even better way to get the full picture.

Why Alamos Gold is lagging behind its peers

Approach 1: Alamos Gold Discounted Cash Flow (DCF) Analysis

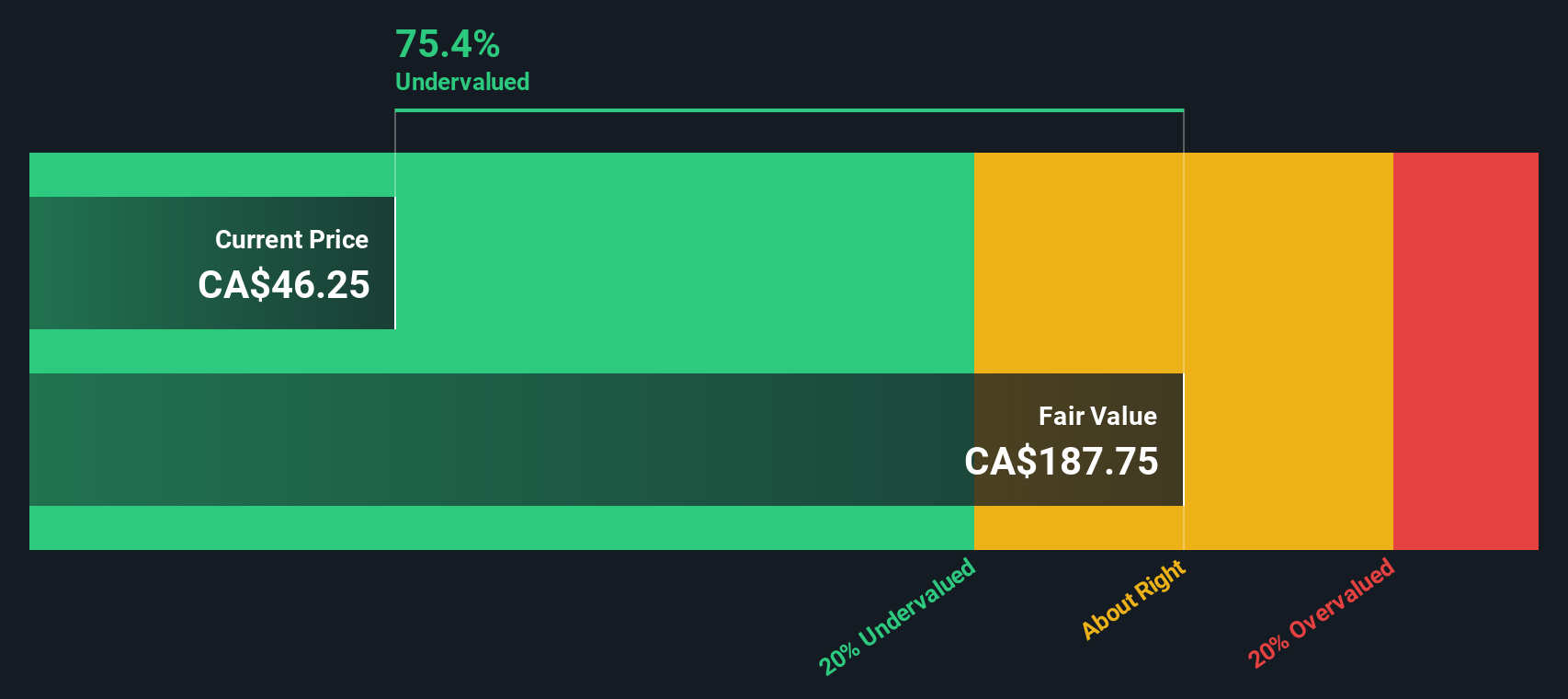

A Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting those amounts back to today's dollars. For Alamos Gold, the DCF model relies on expected cash generation, with a particular focus on its ability to produce free cash flow over time.

Looking at the numbers, Alamos Gold's current Free Cash Flow (FCF) stands at $149.4 million. Analysts project robust growth, expecting the FCF to reach $1.798 billion by 2029, with further increases estimated beyond that. These long-range values are based on extrapolation more than direct analyst forecasts. These projections show a steady climb in Alamos’s cash generation power, giving a sense of both strong operational performance and expanding production scale.

The DCF model calculates an intrinsic value of $188.30 per share. Given market prices, this translates to the stock being approximately 75.6% undervalued compared to its projected fair value. In practical terms, the market price has a wide gap to close before reaching what the DCF suggests is a fair level.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alamos Gold is undervalued by 75.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alamos Gold Price vs Earnings

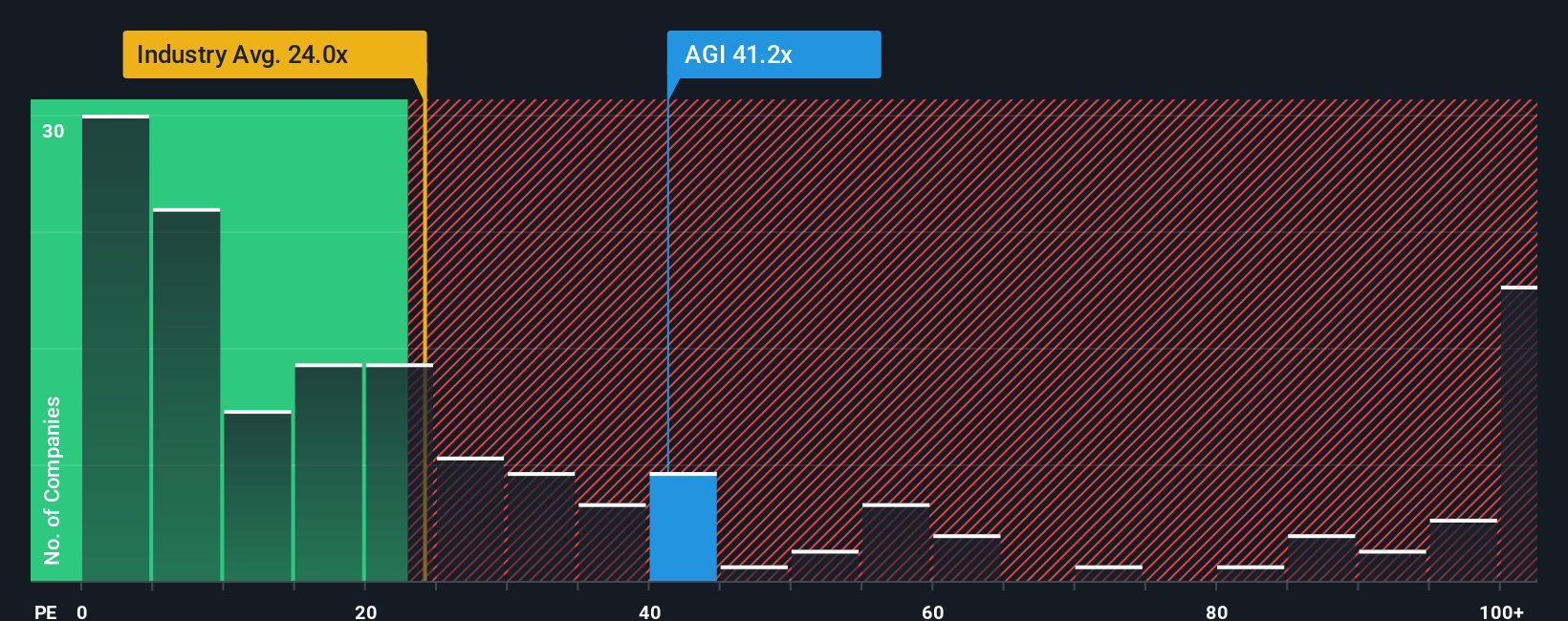

The Price-to-Earnings (PE) ratio is a common and meaningful metric for valuing profitable companies because it allows investors to see how much they are paying for each dollar of earnings. A lower PE can suggest undervaluation, while a higher one can point to growth expectations or increased risk pricing.

The "right" PE ratio for any stock can vary widely, depending on both growth prospects and perceived risks. Companies expected to deliver rapid earnings growth or those in more stable industries typically command higher PE ratios than their peers, while higher perceived risk or lagging growth often lead to lower multiples.

Alamos Gold’s current PE ratio stands at 39.7x. Compared to the Metals and Mining industry average of 23.6x and a peer average of 30.1x, Alamos is trading at a premium. This premium suggests investors see higher growth potential or less risk in Alamos than in its direct competitors. However, looking only at averages can be misleading, as it does not factor in Alamos’s specific growth, profitability, and risk profile.

That is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric combines elements like the company’s expected earnings growth, profit margins, industry outlook, and market cap to paint a more nuanced picture of fair value. It offers a sharper lens than just comparing with peers or industry norms.

Alamos Gold’s Fair Ratio is 24.5x, meaning the market is valuing the company’s earnings at a level significantly higher than what fundamentals suggest is justified. The actual PE is well above this figure, indicating the stock is likely overvalued from this perspective.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alamos Gold Narrative

Earlier we hinted at a smarter way to cut through the noise in valuation. Let’s introduce you to Narratives. A Narrative connects your unique perspective on Alamos Gold, whether you focus on its integration strategy, future gold prices, or margin expansion, to the numbers behind the company by mapping your outlook to a forecast and then to a calculated fair value.

This approach is easy and accessible, available right now for millions on Simply Wall St’s Community page, so you can define and update your investment thesis whenever new information appears. Narratives empower investors to see where their own “fair value” stands versus the current market price, helping clarify when to buy, hold, or sell. The best part is that they automatically update to reflect fresh news and results.

For example, one Narrative for Alamos Gold might be optimistic, reflecting analyst consensus that production growth at Magino and Island Gold will drive revenues and margins up, justifying a fair value near CA$54.56 per share. Another, more cautious Narrative might envision cost overruns or weaker gold prices, supporting a fair value closer to CA$44.30. Narratives give you real, evolving tools for smarter, personalized decisions so you are not just reacting to the latest PE or price target, but leading with your story backed by numbers.

Do you think there's more to the story for Alamos Gold? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AGI

Alamos Gold

Operates as a gold producer in Canada, Mexico, and the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives