- Canada

- /

- Metals and Mining

- /

- TSX:AG

Optimistic Investors Push First Majestic Silver Corp. (TSE:AG) Shares Up 31% But Growth Is Lacking

First Majestic Silver Corp. (TSE:AG) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

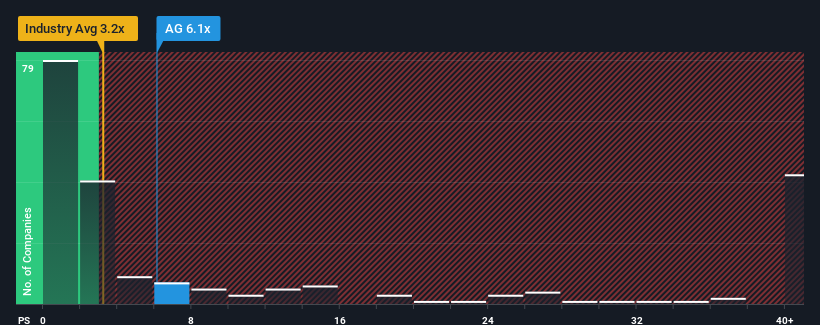

After such a large jump in price, First Majestic Silver may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 6.1x, when you consider almost half of the companies in the Metals and Mining industry in Canada have P/S ratios under 3.3x and even P/S lower than 1.2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for First Majestic Silver

What Does First Majestic Silver's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, First Majestic Silver's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on First Majestic Silver will help you uncover what's on the horizon.How Is First Majestic Silver's Revenue Growth Trending?

In order to justify its P/S ratio, First Majestic Silver would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.3%. This means it has also seen a slide in revenue over the longer-term as revenue is down 4.0% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the four analysts watching the company. With the industry predicted to deliver 37% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that First Majestic Silver's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does First Majestic Silver's P/S Mean For Investors?

The strong share price surge has lead to First Majestic Silver's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for First Majestic Silver, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 1 warning sign for First Majestic Silver that we have uncovered.

If you're unsure about the strength of First Majestic Silver's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives