3 TSX Dividend Stocks Yielding Up To 6.8% For Your Portfolio

Reviewed by Simply Wall St

As the Canadian economy shows signs of cooling, with the unemployment rate inching higher and interest rates on a downward trend, investors are navigating a landscape where financial markets remain resilient. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to bolster their portfolios amidst shifting economic conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.87% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.61% | ★★★★★★ |

| Olympia Financial Group (TSX:OLY) | 7.35% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.88% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.02% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.44% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.79% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.34% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.32% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.09% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

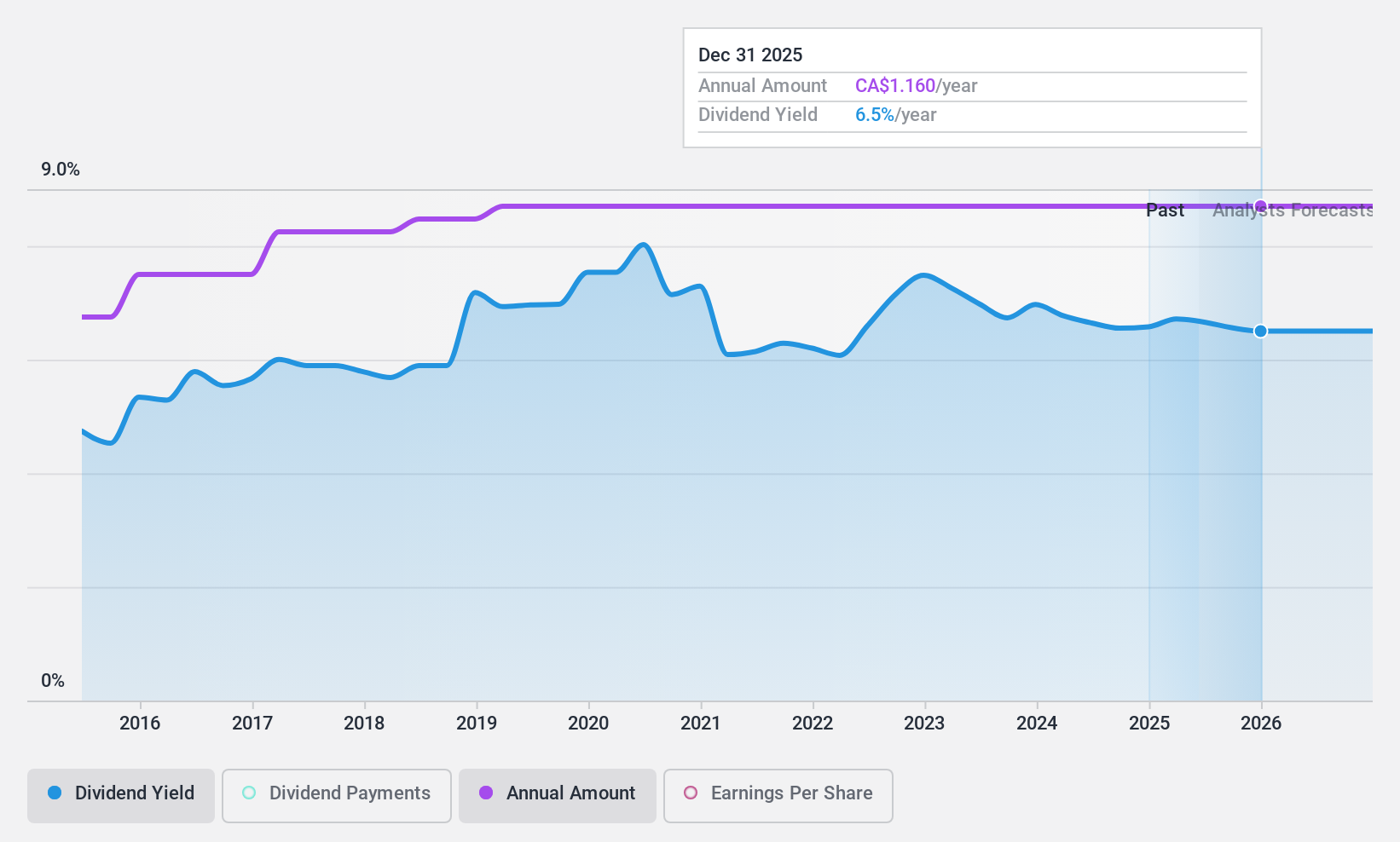

Acadian Timber (TSX:ADN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Acadian Timber Corp. is a company that supplies primary forest products in Eastern Canada and the Northeastern United States, with a market cap of CA$314.63 million.

Operations: Acadian Timber Corp.'s revenue comes from its Maine Timberlands segment, contributing CA$18.31 million, and its New Brunswick Timberlands segment, contributing CA$76.88 million.

Dividend Yield: 6.6%

Acadian Timber's recent earnings report shows a decline in net income for Q3 2024, with CAD 2.22 million compared to CAD 6.41 million the previous year, yet its dividend remains stable and reliable at $0.29 per share, payable January 2025. Despite lower profit margins and shareholder dilution, the company's dividend yield of 6.61% is among Canada's top tier, supported by a sustainable payout ratio of 72.8% from earnings and cash flows.

- Unlock comprehensive insights into our analysis of Acadian Timber stock in this dividend report.

- The valuation report we've compiled suggests that Acadian Timber's current price could be inflated.

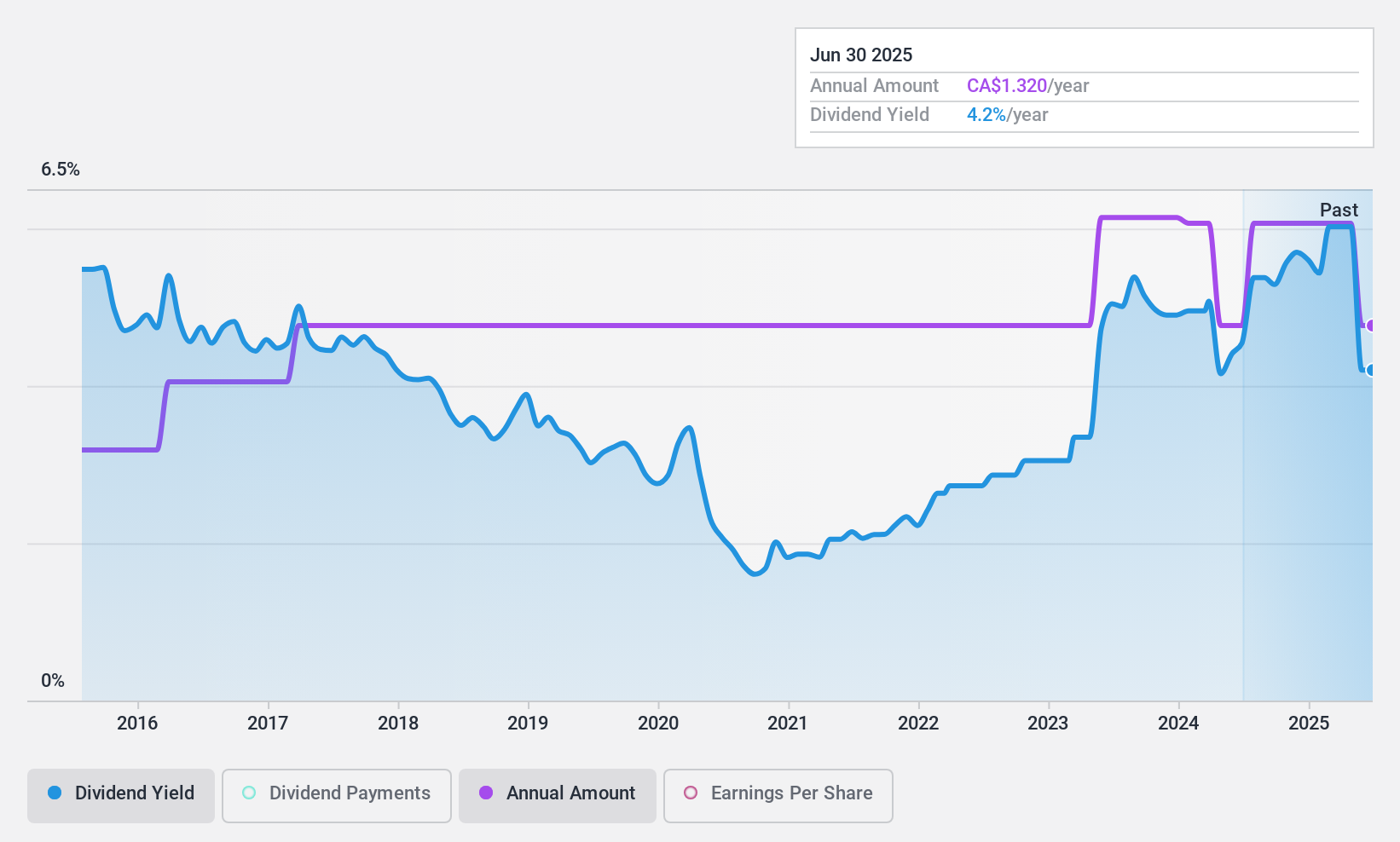

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, along with its subsidiaries, operates in North America by designing, manufacturing, and distributing packaging containers and healthcare supplies and products; it has a market cap of CA$327.34 million.

Operations: Richards Packaging Income Fund generates revenue primarily through its Wholesale - Miscellaneous segment, which accounts for CA$411.82 million.

Dividend Yield: 5.6%

Richards Packaging Income Fund maintains a reliable dividend, distributing CAD 0.11 monthly, supported by a sustainable payout ratio of 38.7% from earnings and 32.6% from cash flows. Despite recent declines in Q3 sales to CAD 97.68 million and net income to CAD 6.92 million, the dividend remains stable over the past decade with modest growth, although its yield of 5.62% is below Canada's top quartile for dividend payers at 6.17%.

- Get an in-depth perspective on Richards Packaging Income Fund's performance by reading our dividend report here.

- Our valuation report here indicates Richards Packaging Income Fund may be undervalued.

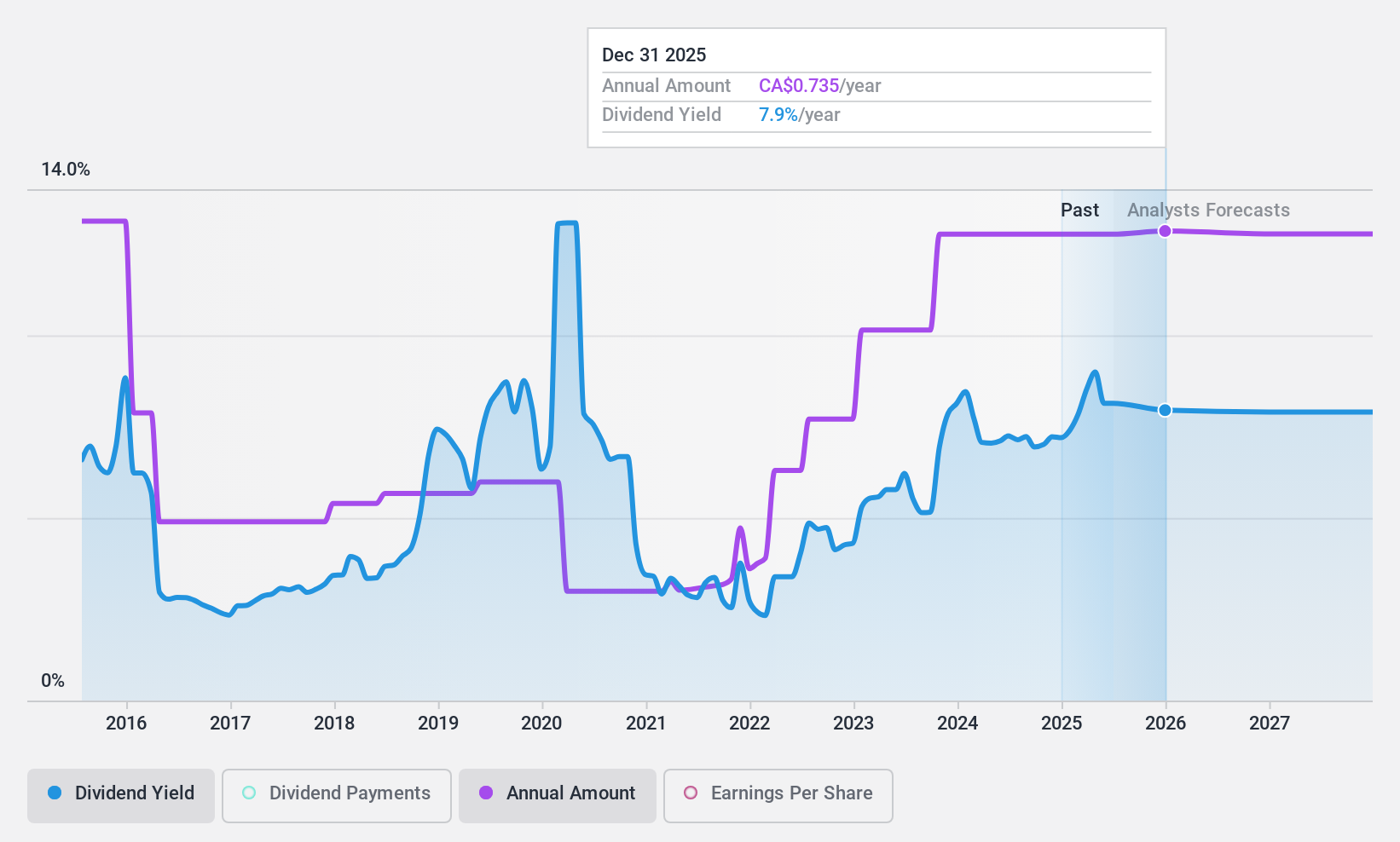

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is an oil and gas company that specializes in the acquisition, development, and production of petroleum and natural gas assets in Western Canada, with a market cap of CA$6.13 billion.

Operations: Whitecap Resources Inc.'s revenue is primarily derived from its Oil & Gas - Exploration & Production segment, which generated CA$3.31 billion.

Dividend Yield: 6.9%

Whitecap Resources offers a high dividend yield of 6.87%, ranking in the top 25% of Canadian dividend payers, supported by a sustainable payout ratio of 49.3% from earnings and 52.6% from cash flows. Recent financing through $400 million in senior notes will repay existing debt, potentially stabilizing future cash flow for dividends. Despite growth in revenue to C$972.3 million in Q3, forecasted earnings declines may impact long-term dividend prospects.

- Click to explore a detailed breakdown of our findings in Whitecap Resources' dividend report.

- The valuation report we've compiled suggests that Whitecap Resources' current price could be quite moderate.

Key Takeaways

- Dive into all 29 of the Top TSX Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RPI.UN

Richards Packaging Income Fund

Designs, manufactures, and distributes packaging containers and healthcare supplies and products in North America.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives