- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Is Barrick Gold Still Worth a Look After 21.8% Surge and Strong Cash Flow Growth?

Reviewed by Bailey Pemberton

Thinking about what to do with your Barrick Mining shares or considering jumping in? You are not alone. The stock has been on a wild ride lately, and investors are taking notice. With a one-year return of 80.7% and an impressive 111.6% gain year to date, Barrick has outperformed many of its peers. Even in the past 30 days, shares have surged 21.8%, showing renewed enthusiasm after a stretch of relative quiet in the mining sector.

Behind these moves is a mix of market forces, including everything from global commodity price swings to shifts in investor risk appetite. A particularly notable factor has been renewed demand for gold and copper, both driving Barrick’s top-line expectations. The stock’s three-year growth of 161.9% highlights that this appears to be more than just a short-term surge, but genuine momentum building over the longer term.

But is the company really undervalued after this run? To answer that, I have dug into a range of valuation checks, and Barrick scores a 4 out of 6, which definitely stands out among major resource companies. Next, let’s look at exactly how that score came together, walk through each valuation approach in turn, and consider whether there might be an even better way to understand what Barrick is truly worth.

Why Barrick Mining is lagging behind its peers

Approach 1: Barrick Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model takes the company’s expected future cash flows and projects them forward, then discounts those amounts back to today’s value using a required rate of return. This lets investors estimate how much Barrick Mining is really worth, based on its future ability to generate real cash for shareholders.

Barrick Mining’s latest reported Free Cash Flow sits at $1.43 Billion, with analysts projecting steady growth over the next decade. In 2029, estimates call for Free Cash Flow to rise to $3.36 Billion as demand for gold and copper remains robust. Projections for the years beyond 2029 are based on extrapolations by Simply Wall St, and highlight the potential for continued increases, albeit at a more moderate pace as the business matures.

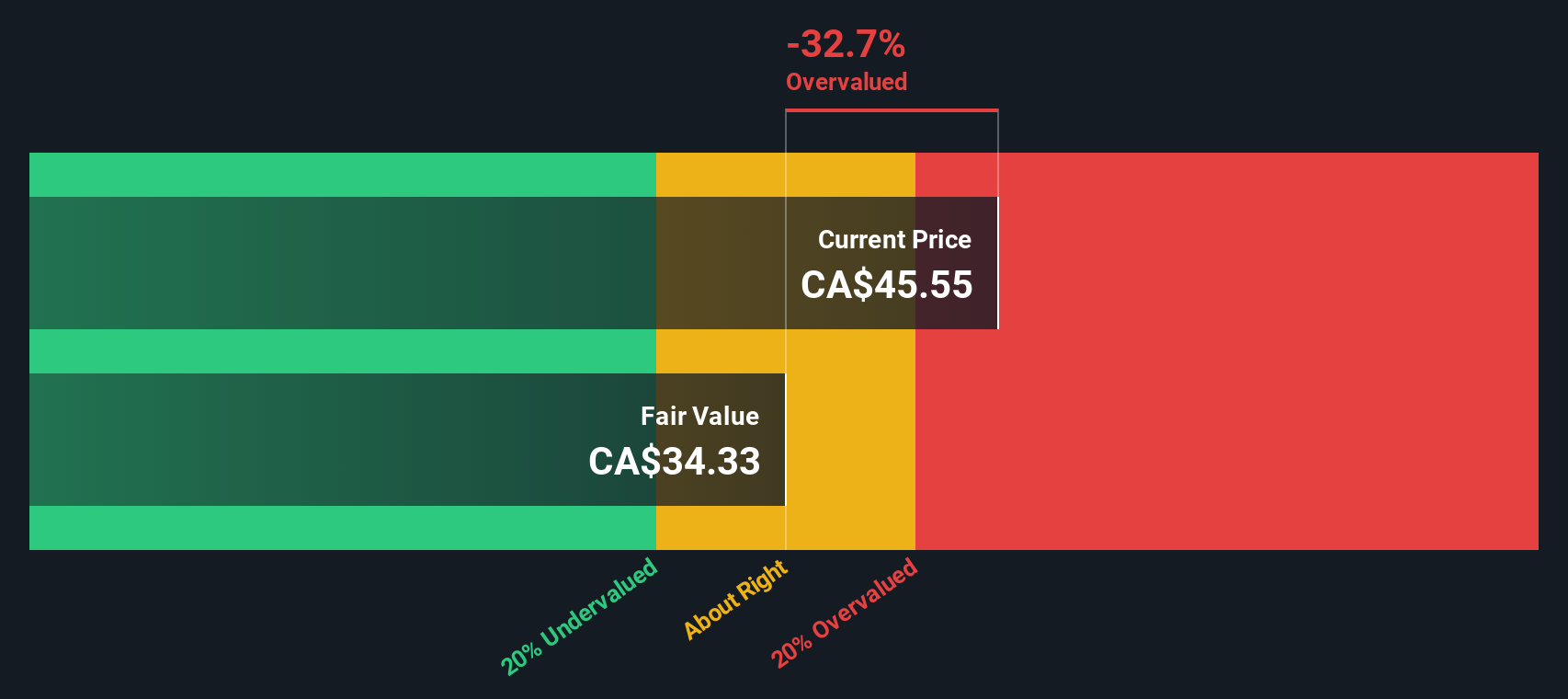

This DCF analysis arrives at a fair value of $52.09 per share for Barrick Mining. With the current share price sitting about 6.5% below this estimated value, the stock is judged to be ABOUT RIGHT in terms of valuation at this time. It is not a significant bargain, but not overhyped either.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Barrick Mining's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Barrick Mining Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a classic valuation tool for profitable companies like Barrick Mining because it directly connects the company’s share price to its reported earnings. Investors use the PE ratio as a simple, intuitive snapshot of how much they are paying for each dollar of profit today. For businesses with steady revenue, positive earnings, and some growth potential, the PE ratio is widely accepted for evaluating whether a stock is expensive or reasonably valued.

However, what counts as a “normal” or “fair” PE ratio can change depending on factors such as earnings growth and business risk. Faster-growing companies or those with stable and predictable earnings generally trade at higher PE multiples compared to slower-growing or riskier firms. Riskier businesses or those facing uncertainty often see their PE discounted by the market.

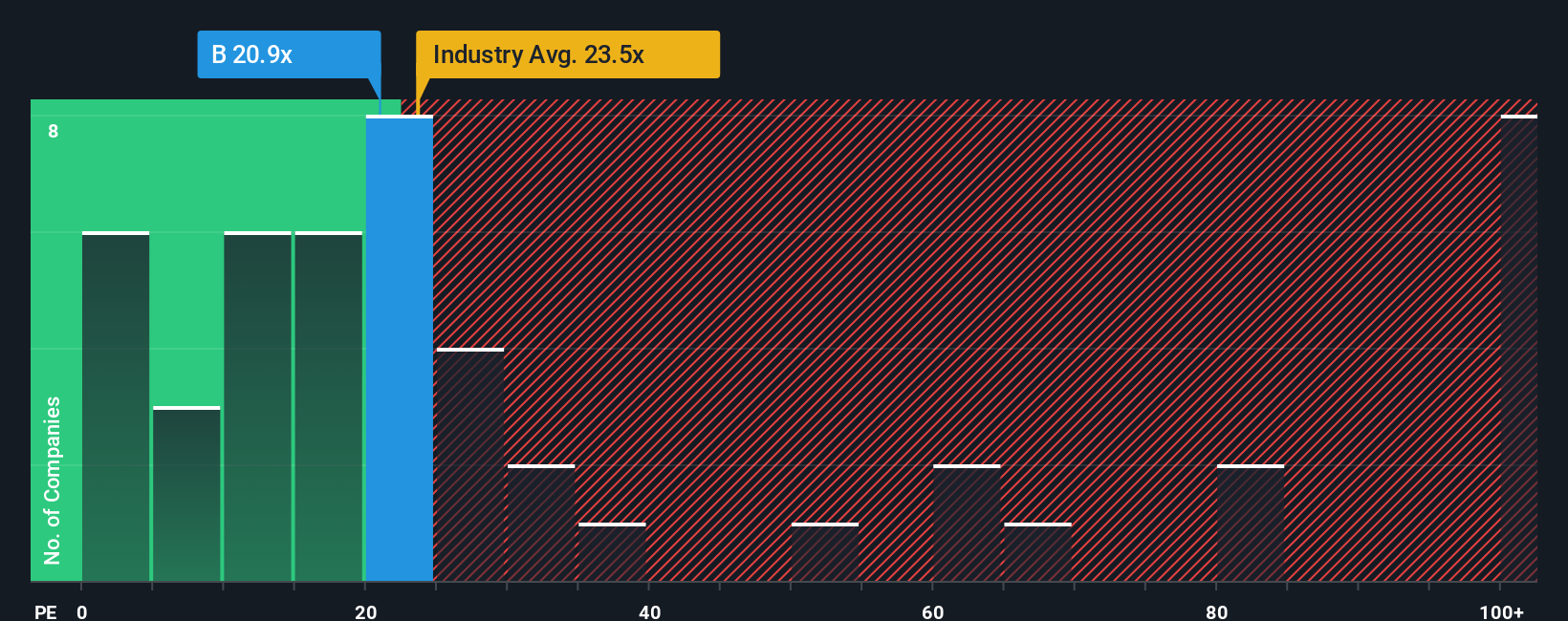

Barrick Mining currently trades at 21.4 times earnings. For context, the average PE among Metals and Mining industry peers is 23.7 times, and the broader peer group average stands at 41.2 times. Simply Wall St goes a step further with the “Fair Ratio,” which is a proprietary estimate that factors in Barrick's own profit margins, earnings growth outlook, industry dynamics, and market cap. Instead of simply comparing to industry or peers, the Fair Ratio (in this case, 25.9 times) is tailored to Barrick’s specific profile and may serve as a more accurate benchmark of value. With Barrick’s actual PE at 21.4 times and the Fair Ratio at 25.9 times, this analysis suggests the stock is priced about right for its expected performance and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Barrick Mining Narrative

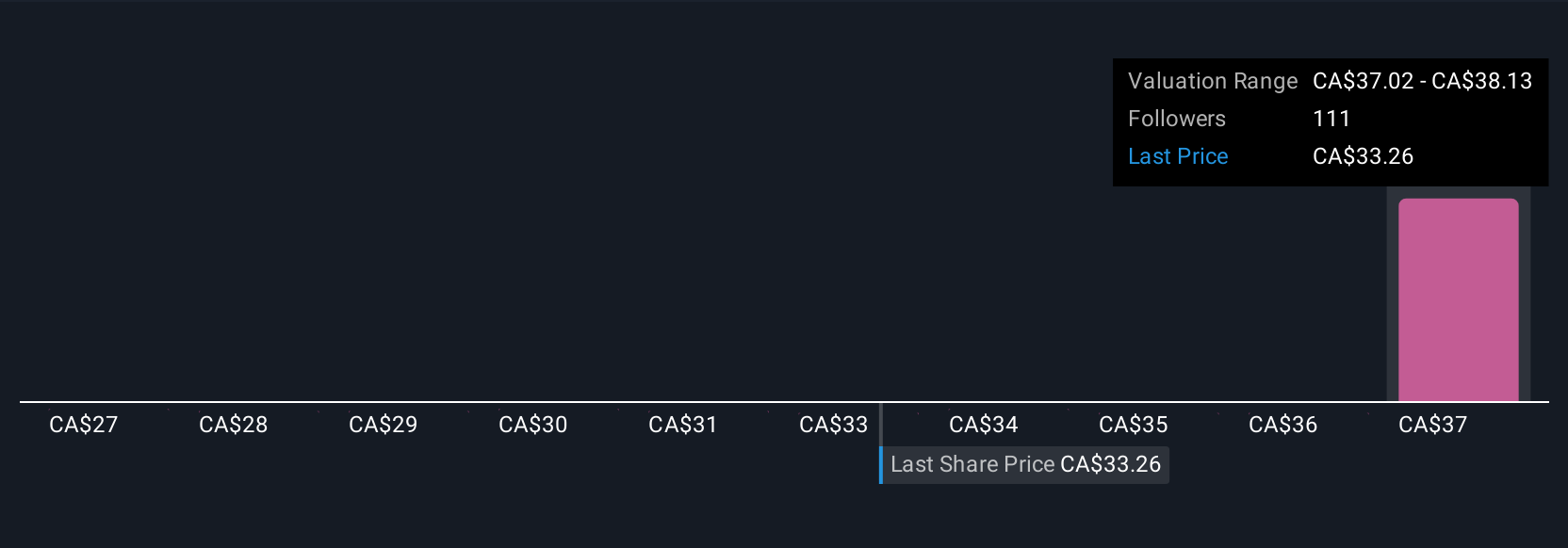

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your way of giving a story, your own perspective behind the numbers, by setting what you think Barrick Mining's fair value should be based on your assumptions about the company’s future revenue, earnings, and margins.

Narratives bridge the gap between a company’s story, a financial forecast, and an actionable fair value, making investing more personal and insightful. Using the Narratives feature on Simply Wall St's Community page (home to millions of investors), anyone can quickly build or browse these stories, see how fair value changes as forecasts shift, and discover the reasoning behind different price targets.

Narratives are updated dynamically whenever new facts emerge, from earnings reports to breaking news, helping you decide whether the current price is above, below, or near your target fair value. For example, some Barrick Mining investors focus on long-term gold demand and believe strong capital returns justify a higher fair value, while others emphasize political and operational risks, leading them to more conservative estimates. Both perspectives are visible as public Narratives with high and low analyst price targets to compare.

Do you think there's more to the story for Barrick Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives