- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Barrick Gold (TSX:ABX): Reviewing Valuation After Recent Share Price Momentum and Investor Focus

Reviewed by Simply Wall St

Barrick Mining (TSX:ABX) has been attracting renewed investor attention this week, as trading volumes and share price momentum rise. After climbing 3% over the past week, the stock’s performance is sparking discussion about evolving trends in the mining sector.

See our latest analysis for Barrick Mining.

This surge in Barrick Mining’s share price is part of a much stronger pattern that has taken shape over 2024, with momentum building as the company’s price has more than doubled year-to-date. While the stock’s rally is impressive in the short run, what is striking is the 74.9% total shareholder return over the past year, a sign that optimism about Barrick’s growth and risk profile is reaching new highs without being derailed by broader market turbulence.

If you are eyeing where the biggest moves could be next, now is a smart moment to broaden your outlook and discover fast growing stocks with high insider ownership

With Barrick’s eye-catching gains and solid earnings growth, the real question for investors is whether there is room left for the stock to run or if the market has already priced in all the good news.

Most Popular Narrative: 22.9% Undervalued

Barrick Mining's prevailing narrative values its shares at a fair value significantly above the last close. The narrative sees room for meaningful upside, suggesting that recent momentum may only be part of a larger valuation story driven by market uncertainty and defensive demand.

“Barrick looks undervalued at CAD 48.07 with fair value closer to CAD 55, as gold’s safe-haven role comes into focus with a looming U.S. shutdown. As investors brace for a likely U.S. government shutdown on October 1, gold is again in the spotlight as a hedge against political and financial instability. Barrick Mining (ABX:CA), one of the world’s largest gold producers, stands out as a direct beneficiary of rising safe-haven demand.”

Want to see which growth levers and profit assumptions push Barrick's fair value so high? The key setup involves bold moves in future margins and portfolio shifts. Find out what might surprise even long-time mining bulls and see what holds this narrative together.

Result: Fair Value of $60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a swift resolution to U.S. fiscal issues or a sharp fall in gold prices could quickly shift the outlook for Barrick’s shares.

Find out about the key risks to this Barrick Mining narrative.

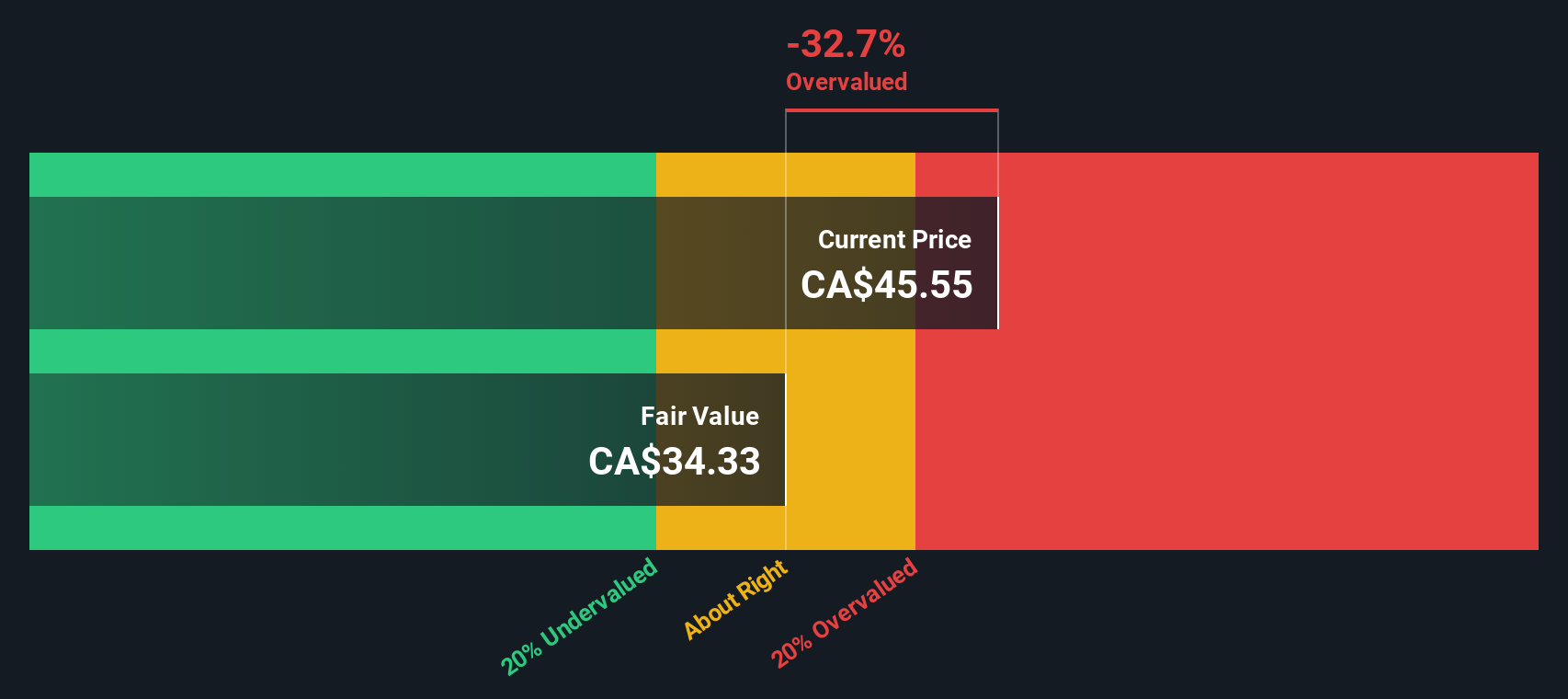

Another View: Our DCF Model Questions the Upside

While market narratives highlight Barrick Mining’s undervaluation, our DCF model presents a more cautious picture. It estimates fair value well below the current share price. This approach indicates a possible overvaluation. Could the market’s optimism be exceeding the underlying fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Barrick Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 833 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Barrick Mining Narrative

If you have a different perspective or want to dive deeper into Barrick Mining's numbers, you can easily analyze the data and craft your own view in just a few minutes, Do it your way.

A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

No seasoned investor bets everything on one stock. See what else could shape your portfolio with these standout opportunities. The next big move might be closer than you think.

- Uncover high-potential companies with solid financials among these 3575 penny stocks with strong financials that could offer eye-catching upside without the usual hype.

- Strengthen your income strategy and tap into reliable returns by exploring these 24 dividend stocks with yields > 3% boasting yields above 3%.

- Position yourself early in the booming artificial intelligence sector with these 26 AI penny stocks on the forefront of revolutionizing entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)