- Canada

- /

- Metals and Mining

- /

- TSXV:PJX

Discover 3 TSX Penny Stocks With Market Caps Above CA$10M

Reviewed by Simply Wall St

As the Canadian economy navigates a period of contraction, with the Bank of Canada cutting rates amid tariff uncertainties, investors are seeking opportunities that align with current market dynamics. Penny stocks, though often seen as relics from past market eras, continue to offer potential for growth and affordability. These smaller or newer companies can provide unique investment opportunities when supported by strong financial health; let's explore several that stand out in today's landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.05 | CA$184.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$989.91M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.69 | CA$447.95M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$126.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$230.34M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.87M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$14.32M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$28.21M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$138.93M | ★★★★★☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tartisan Nickel (CNSX:TN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tartisan Nickel Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada and Peru, with a market cap of CA$28.93 million.

Operations: Tartisan Nickel Corp. currently does not report any revenue segments.

Market Cap: CA$28.93M

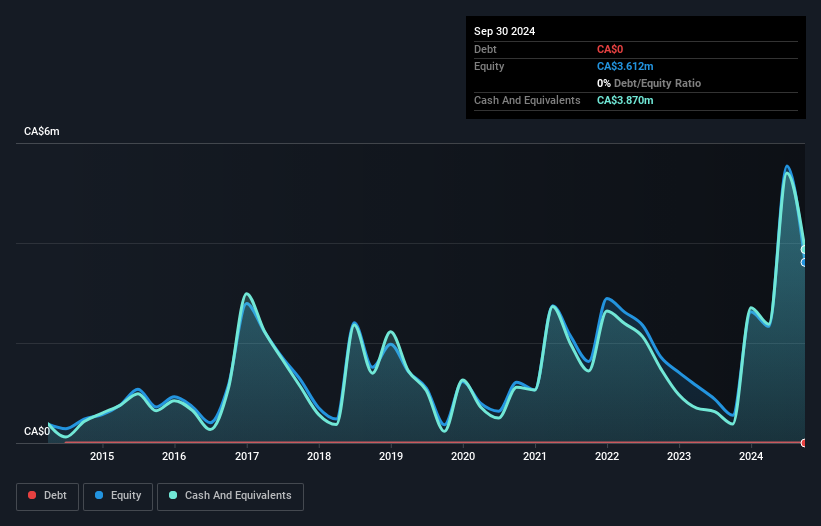

Tartisan Nickel Corp., with a market cap of CA$28.93 million, is pre-revenue and unprofitable, reporting increased losses over the past five years. The company has improved its financial position by reducing debt to zero and maintaining more cash than total debt. Recent capital raises through private placements have strengthened its cash runway, despite short-term liabilities exceeding short-term assets by CA$1.3 million as of September 2024. Tartisan's recent geophysical survey at Turtle Pond Knight Danger Project could potentially enhance exploration prospects, although results are pending. The board is experienced with an average tenure of 4.4 years, providing stability amidst financial challenges.

- Navigate through the intricacies of Tartisan Nickel with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Tartisan Nickel's track record.

Condor Resources (TSXV:CN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in Canada and Peru with a market cap of CA$19.06 million.

Operations: Condor Resources Inc. does not report any revenue segments as it is an exploration stage company.

Market Cap: CA$19.06M

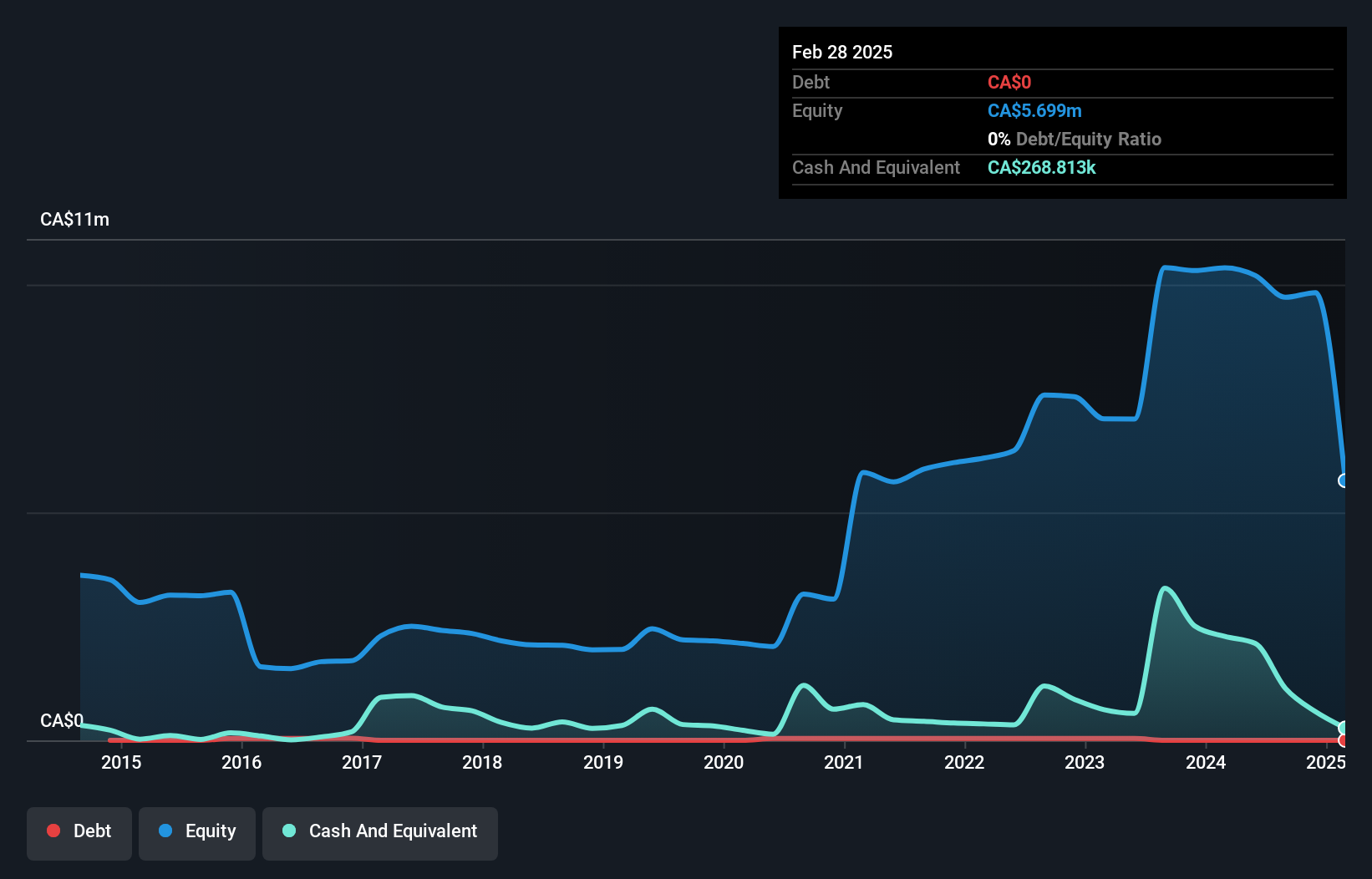

Condor Resources Inc., with a market cap of CA$19.06 million, is pre-revenue and currently unprofitable, having reported a net loss of CA$0.59 million for the nine months ending November 2024. The company is debt-free and has no long-term liabilities, but its cash runway remains uncertain due to insufficient data on free cash flow. Recent developments include acquiring additional exploration concessions at Huiñac Punta in Peru and completing necessary permits for exploration activities, highlighting potential in high-grade silver deposits. Despite stable weekly volatility over the past year, Condor's share price remains highly volatile short-term.

- Click here and access our complete financial health analysis report to understand the dynamics of Condor Resources.

- Assess Condor Resources' previous results with our detailed historical performance reports.

PJX Resources (TSXV:PJX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PJX Resources Inc. is involved in the acquisition, exploration, and development of mineral resource properties in Canada, with a market cap of CA$22.68 million.

Operations: PJX Resources Inc. does not currently report any revenue segments.

Market Cap: CA$22.68M

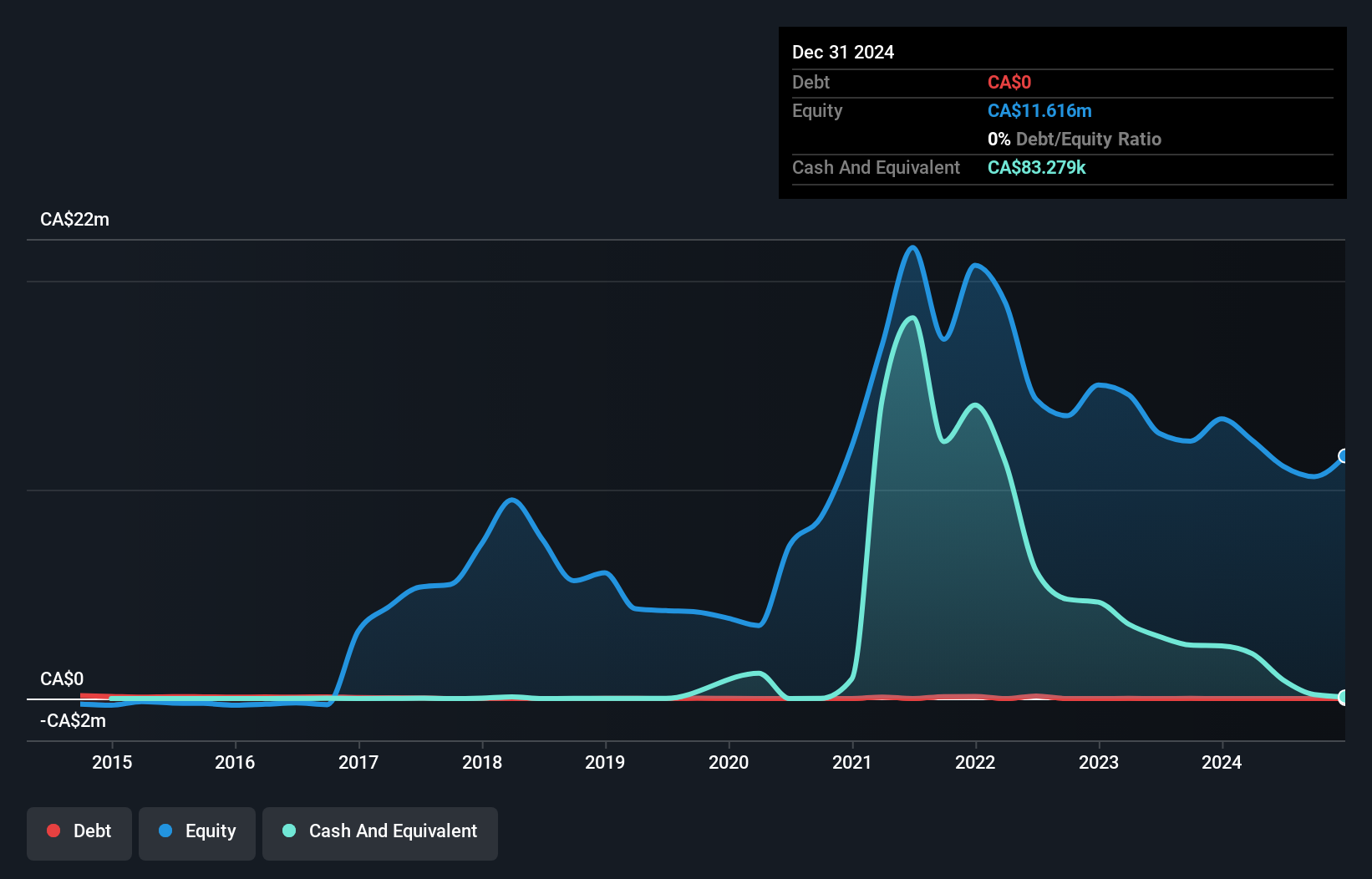

PJX Resources Inc., with a market cap of CA$22.68 million, remains pre-revenue and unprofitable, reporting increasing losses over the past five years. The company is debt-free and has sufficient cash runway for over a year based on current free cash flow. Recent drilling at its Dewdney Trail Property in British Columbia identified three Sedimentary Exhalative (Sedex) horizons, suggesting potential for discovering significant mineral deposits similar to the Sullivan deposit. Despite high short-term share price volatility, PJX's experienced board and strategic exploration efforts underscore its commitment to unlocking value from its extensive mineral claims portfolio.

- Click to explore a detailed breakdown of our findings in PJX Resources' financial health report.

- Understand PJX Resources' track record by examining our performance history report.

Summing It All Up

- Get an in-depth perspective on all 930 TSX Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PJX

PJX Resources

Engages in the acquisition, exploration, and development of mineral resource properties in Canada.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)