- Canada

- /

- Metals and Mining

- /

- TSXV:CAF

TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Canadian market has shown resilience, supported by strong consumer spending and positive wage growth, which have bolstered economic confidence. Amidst this backdrop, investors may find opportunities in penny stocks—often smaller or newer companies—that can offer significant potential when backed by solid financials. This article will explore three such stocks that stand out for their balance sheet strength and potential for growth, providing a glimpse into the hidden value within the Canadian market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.87 | CA$180.6M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.39 | CA$387.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.32 | CA$119.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.465 | CA$12.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.61 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$228.37M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$31.7M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.67 | CA$994.26M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.18M | ★★★★★★ |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Mistango River Resources (CNSX:MIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mistango River Resources Inc. is involved in the acquisition and exploration of mineral properties in Canada, with a market cap of CA$5.35 million.

Operations: Currently, there are no revenue segments reported for the company.

Market Cap: CA$5.35M

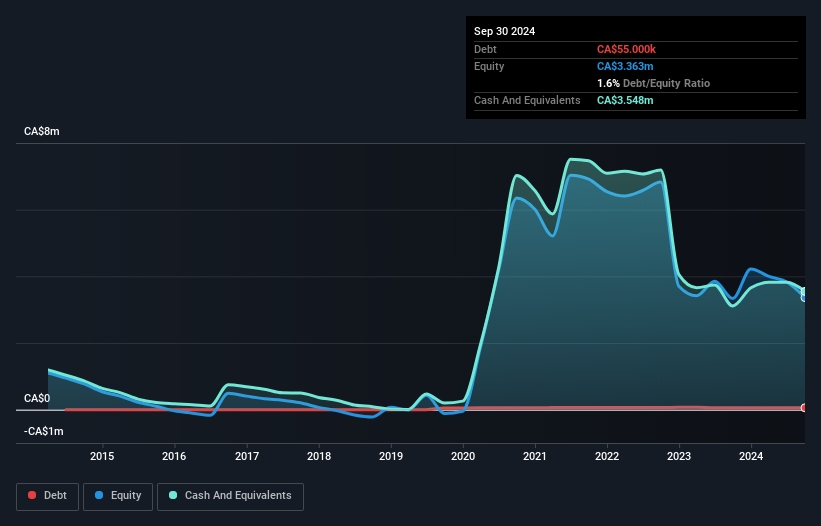

Mistango River Resources, with a market cap of CA$5.35 million, remains pre-revenue and recently reported a net loss for the third quarter of 2024. The company has shown improvement in reducing its losses compared to the previous year. Recent drilling at the Omega Mine property revealed promising gold mineralization results, which could enhance its exploration prospects. Despite high volatility and negative operating cash flow, Mistango's financial position is somewhat bolstered by having more cash than debt and no long-term liabilities. The board's average tenure suggests experienced oversight as they navigate these exploratory phases.

- Take a closer look at Mistango River Resources' potential here in our financial health report.

- Assess Mistango River Resources' previous results with our detailed historical performance reports.

AnalytixInsight (TSXV:ALY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AnalytixInsight Inc. is a data analytics and enterprise software solutions provider serving global institutions across various industries, with a market cap of CA$1.46 million.

Operations: The company generates revenue primarily from its Big Data segment, amounting to CA$0.21 million.

Market Cap: CA$1.46M

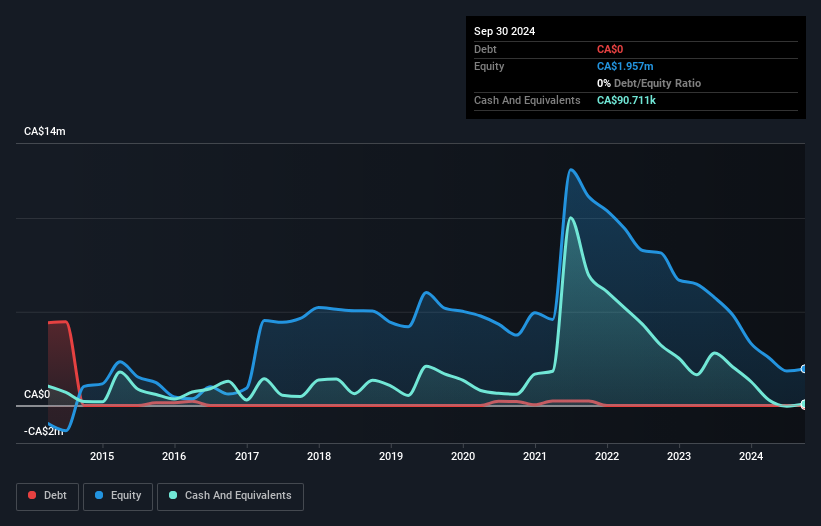

AnalytixInsight Inc., with a market cap of CA$1.46 million, is pre-revenue and has experienced increased volatility in its share price recently. The company reported a net income for the third quarter of 2024, although revenue decreased from the previous year. AnalytixInsight remains debt-free but faces challenges covering short-term liabilities with its assets. A recent private placement aims to raise CA$270,000 to bolster finances amid limited cash runway. Leadership changes include appointing an experienced board member from the fintech sector, potentially strengthening strategic direction following a settlement-related board reshuffle earlier this year.

- Navigate through the intricacies of AnalytixInsight with our comprehensive balance sheet health report here.

- Evaluate AnalytixInsight's historical performance by accessing our past performance report.

Canaf Investments (TSXV:CAF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Canaf Investments Inc., operating in Canada and South Africa, processes anthracite coal into de-volatized anthracite and has a market cap of CA$13.99 million.

Operations: Canaf Investments Inc. does not report specific revenue segments.

Market Cap: CA$13.99M

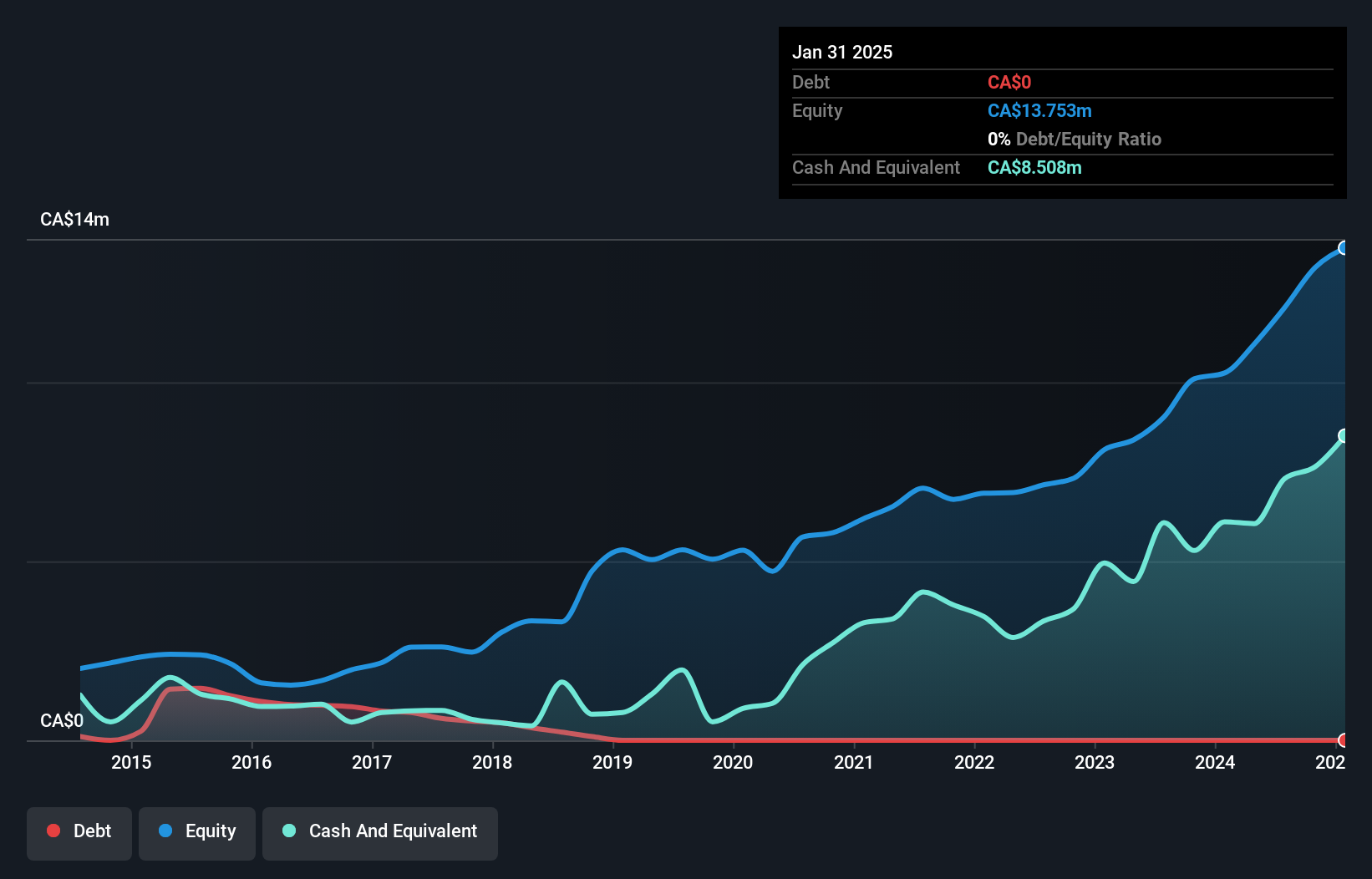

Canaf Investments Inc., with a market cap of CA$13.99 million, has shown robust financial health and growth. The company is debt-free, with short-term assets (CA$12.1M) exceeding both short-term (CA$3.3M) and long-term liabilities (CA$29.4K), ensuring strong liquidity. Canaf's earnings have grown significantly by 31.3% annually over the past five years, outpacing industry averages, and its return on equity stands at a high 24.3%. Recent expansions include establishing Canaf Capital in South Africa to provide asset-backed financing, potentially diversifying revenue streams beyond its core anthracite processing operations.

- Unlock comprehensive insights into our analysis of Canaf Investments stock in this financial health report.

- Learn about Canaf Investments' historical performance here.

Summing It All Up

- Dive into all 926 of the TSX Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CAF

Canaf Investments

Processes anthracite coal into de-volatized anthracite in Canada and South Africa.

Flawless balance sheet with solid track record.