- Canada

- /

- Electrical

- /

- TSXV:BES

TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Canadian market has shown resilience, supported by strong consumer spending and positive real wage gains, despite challenges like elevated inflation and higher interest rates. In this context, penny stocks—often associated with smaller or newer companies—remain a relevant investment area due to their affordability and potential for growth when backed by robust financials. This article will explore several Canadian penny stocks that exhibit financial strength and could offer long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$180.6M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.34 | CA$387.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$119.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$228.37M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.19 | CA$31.7M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.52 | CA$994.26M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.18M | ★★★★★★ |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Braille Energy Systems (TSXV:BES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braille Energy Systems Inc. operates in the battery manufacturing and energy storage sector both in Canada and internationally, with a market cap of CA$6.45 million.

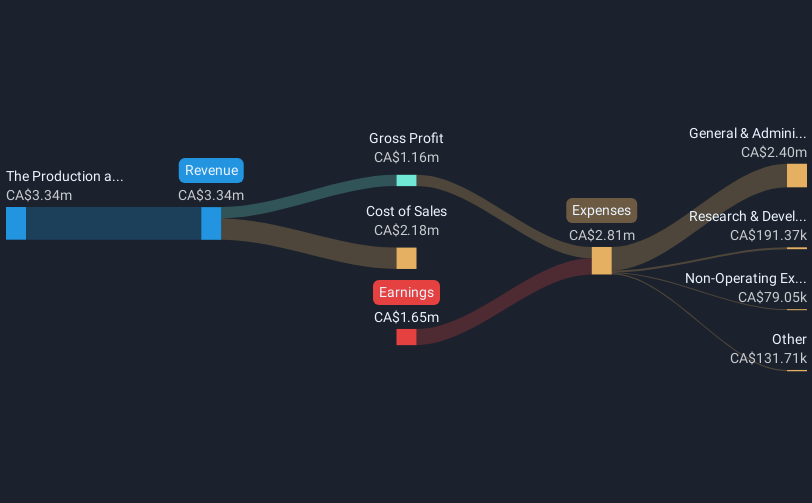

Operations: The company generates CA$3.34 million in revenue from the production and sale of energy storage products.

Market Cap: CA$6.45M

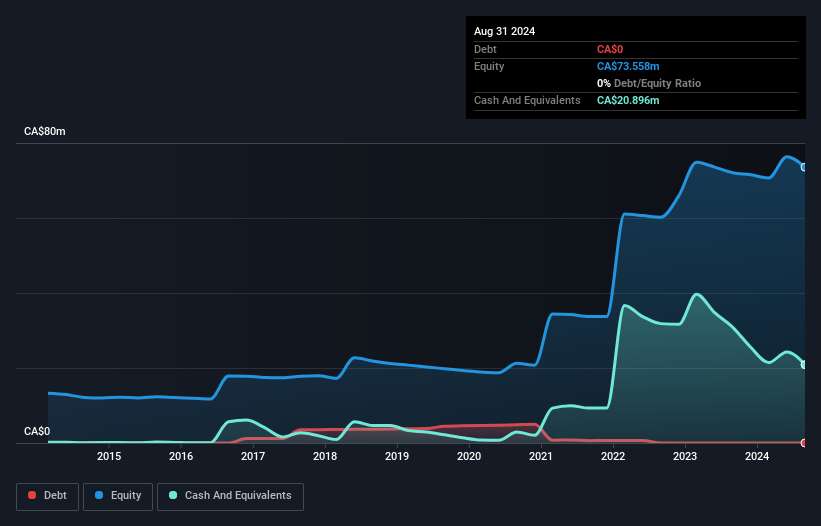

Braille Energy Systems Inc., operating in the energy storage sector, faces challenges typical of penny stocks, such as limited revenue at CA$3.34 million and ongoing unprofitability with a negative Return on Equity. Recent efforts to raise capital through private placements indicate attempts to bolster its financial position amid shareholder dilution. The company’s short-term assets cover both short- and long-term liabilities, reflecting some balance sheet strength. Notably, Braille's EARLYALERT Lithium Battery Thermal Warning System has gained third-party validation, potentially enhancing its market presence in NYC’s e-micromobility sector if approved by the FDNY.

- Dive into the specifics of Braille Energy Systems here with our thorough balance sheet health report.

- Examine Braille Energy Systems' past performance report to understand how it has performed in prior years.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Critical Elements Lithium Corporation focuses on acquiring, exploring, and developing mining properties in Canada, with a market cap of CA$83.87 million.

Operations: Currently, there are no reported revenue segments for Critical Elements Lithium Corporation.

Market Cap: CA$83.87M

Critical Elements Lithium Corporation, with a market cap of CA$83.87 million, is pre-revenue and remains unprofitable, though its recent net loss narrowed significantly compared to the previous year. The company is debt-free and has secured key leases for its Rose Lithium-Tantalum project in Quebec, marking progress toward potential mining operations. However, it faces challenges with less than a year's cash runway if current cash flow trends persist. Management's focus on securing a comprehensive financing package for the Rose Project could be crucial in determining future success without significant shareholder dilution.

- Take a closer look at Critical Elements Lithium's potential here in our financial health report.

- Understand Critical Elements Lithium's earnings outlook by examining our growth report.

Stampede Drilling (TSXV:SDI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stampede Drilling Inc. offers oilfield services to the oil and natural gas industry in North America, with a market cap of CA$39.26 million.

Operations: The company generates revenue of CA$82.62 million from its contract drilling services.

Market Cap: CA$39.26M

Stampede Drilling Inc., with a market cap of CA$39.26 million, exhibits both strengths and challenges as a penny stock. The company reported third-quarter sales of CA$24.26 million, down from the previous year, with net income also declining to CA$1.78 million. Despite this, its financial structure remains solid; short-term assets exceed liabilities and debt is well covered by operating cash flow (82.5%). Recent share buybacks indicate management's confidence in value creation while trading at good relative value compared to peers suggests potential for investors seeking exposure in the oilfield services sector amidst fluctuating earnings growth trends.

- Click here and access our complete financial health analysis report to understand the dynamics of Stampede Drilling.

- Examine Stampede Drilling's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Investigate our full lineup of 926 TSX Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Braille Energy Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BES

Braille Energy Systems

Provides battery manufacturing and energy storage solutions in Canada and internationally.

Medium-low and slightly overvalued.

Market Insights

Community Narratives