Does Sun Life Still Offer Long Term Value After Its Wealth and Health Expansion Push?

Reviewed by Bailey Pemberton

- If you are wondering whether Sun Life Financial is still a smart place to put fresh capital at today's price, you are not alone. That is exactly what this breakdown is here to unpack.

- After a modest 2.9% gain over the last week and 1.3% over the past month, the stock is roughly flat year to date at -0.8%, but still up 3.1% over 1 year, 53.8% over 3 years, and 87.6% over 5 years. This hints at a longer-term story that may not be fully reflected in short-term moves.

- Recent headlines have focused on Sun Life's ongoing expansion in wealth and asset management, its push into health benefits and digital distribution, and strategic partnerships that deepen its footprint in key Asian and North American markets. Together, these moves help explain why the market has been willing to re-rate the shares, even if the price action has been gradual rather than explosive.

- Right now, Sun Life scores a 2 out of 6 on our valuation checks. This suggests some pockets of value but also areas where the market may be pricing in a lot of the good news. In the next sections we will walk through the main valuation approaches we use, before finishing with a more holistic way to think about what the stock is really worth.

Sun Life Financial scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sun Life Financial Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the return that shareholders reasonably demand on their capital, and then capitalizes those surplus profits into an intrinsic value per share.

For Sun Life Financial, the starting point is its Book Value of CA$42.01 per share and an Average Return on Equity of 18.34%. Analysts expect this to translate into Stable EPS of CA$8.44 per share, based on future return on equity estimates from 5 analysts. The implied Cost of Equity is CA$2.82 per share, so the company is projected to earn an Excess Return of CA$5.63 per share each year over the long run.

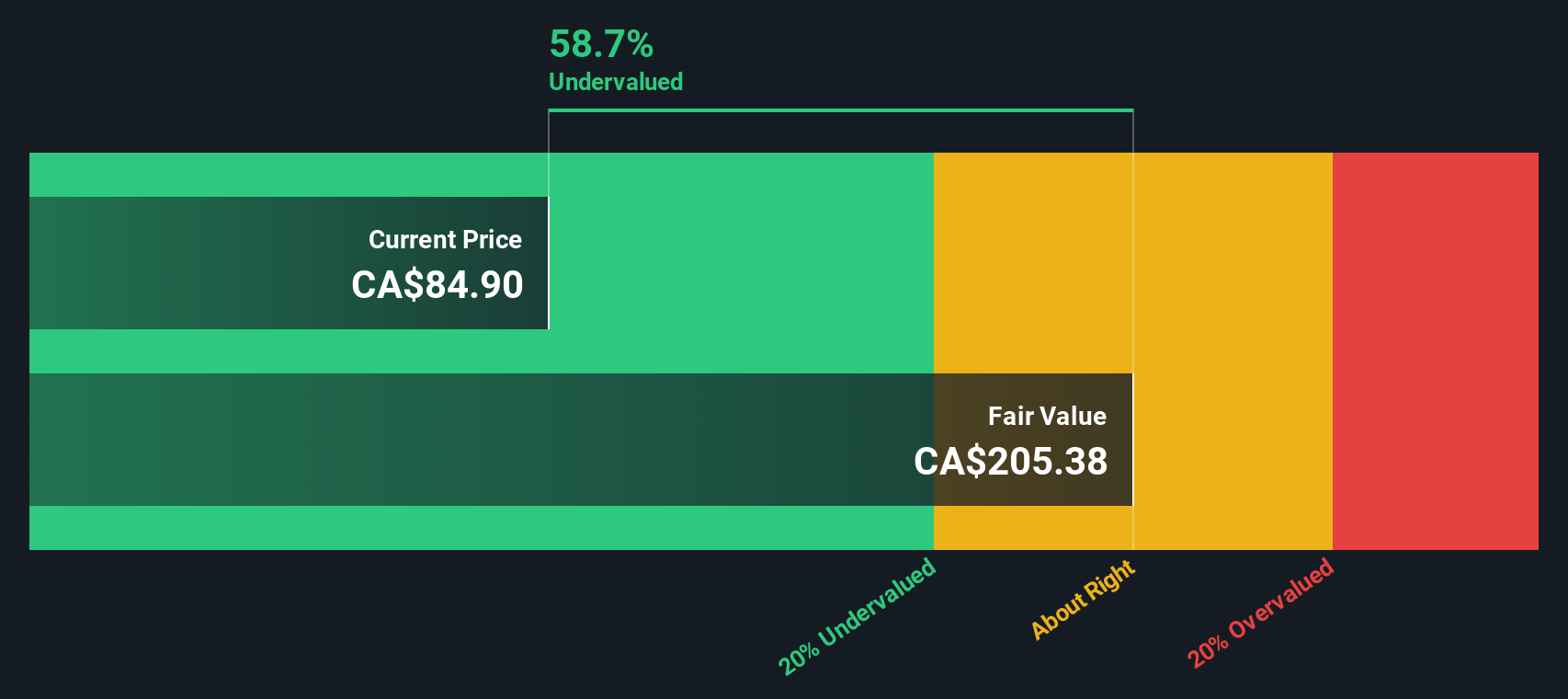

With Stable Book Value forecast to rise to CA$46.04 per share, based on estimates from 8 analysts, the model suggests Sun Life can keep compounding value at attractive rates. When those excess returns are extrapolated and discounted, the Excess Returns valuation points to an intrinsic value around CA$213.09 per share, implying the stock is about 60.5% undervalued versus its current price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Sun Life Financial is undervalued by 60.5%. Track this in your watchlist or portfolio, or discover 911 more undervalued stocks based on cash flows.

Approach 2: Sun Life Financial Price vs Earnings

For consistently profitable companies like Sun Life Financial, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. A higher PE typically reflects expectations of stronger growth or lower perceived risk, while a lower PE tends to signal slower growth prospects or higher uncertainty.

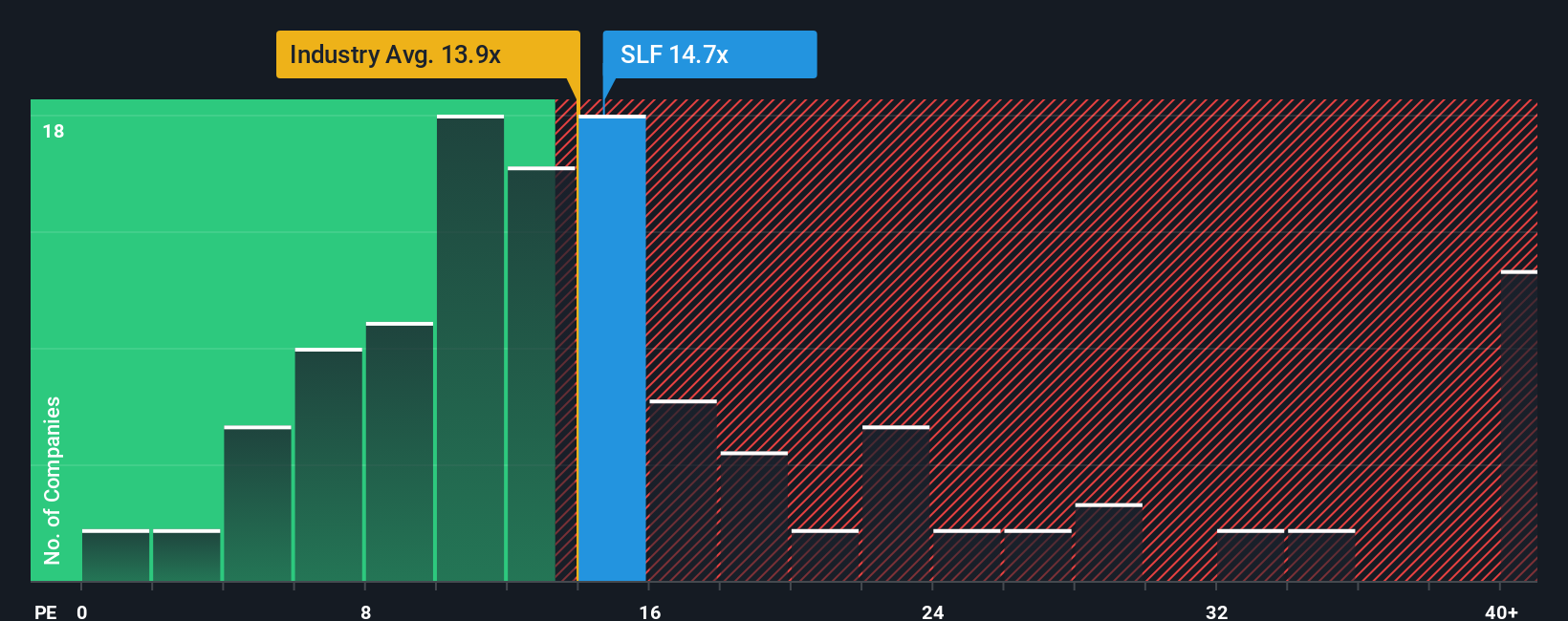

Sun Life currently trades on a PE of 15.7x, which is above the broader Insurance industry average of 11.8x and slightly above its peer group average of 15.1x. On the surface, that premium suggests the market is assigning Sun Life a higher quality or growth profile than many insurers.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a “normal” PE should be for this specific business, based on its earnings growth outlook, profit margins, risk factors, industry and market cap. For Sun Life, the Fair Ratio comes out at 14.6x, modestly below the current 15.7x, which implies the shares are trading a little ahead of where fundamentals alone might justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sun Life Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a clear story about Sun Life Financial to your assumptions for future revenue, earnings and margins. It automatically links that story to a financial forecast, a Fair Value, and a clear buy or sell view by comparing that Fair Value to today’s price, while updating dynamically as new news or earnings arrive. For example, one investor might build a bullish Sun Life Narrative that leans into accelerating Asian growth, margin gains from digital efficiency, steady dividend increases and a target near the high end of recent estimates around CA$95 per share. In contrast, a more cautious investor might focus on U.S. Dental headwinds, fee pressure at MFS, and regulatory or rate cut risks to justify a lower Fair Value closer to CA$74, both using the same framework but different perspectives to decide whether the current price offers enough upside.

Do you think there's more to the story for Sun Life Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)