- Canada

- /

- Trade Distributors

- /

- TSX:RUS

3 Canadian Dividend Stocks On TSX Offering Up To 3.9% Yield

Reviewed by Simply Wall St

The Canadian market has been navigating a period of economic fluctuations, with investors keenly observing shifts in indices and economic trends. In this environment, dividend stocks can offer a stable income stream, making them an attractive option for those looking to balance their portfolios amidst market uncertainties.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.69% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.48% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 3.90% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.97% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.90% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.42% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.31% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.66% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 4.94% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.00% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates retail stores providing food and everyday products to rural communities and urban neighborhoods in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.34 billion.

Operations: North West's revenue primarily comes from its retail operations, generating CA$2.54 billion by providing food and everyday products and services to diverse communities across northern Canada, rural Alaska, the South Pacific, and the Caribbean.

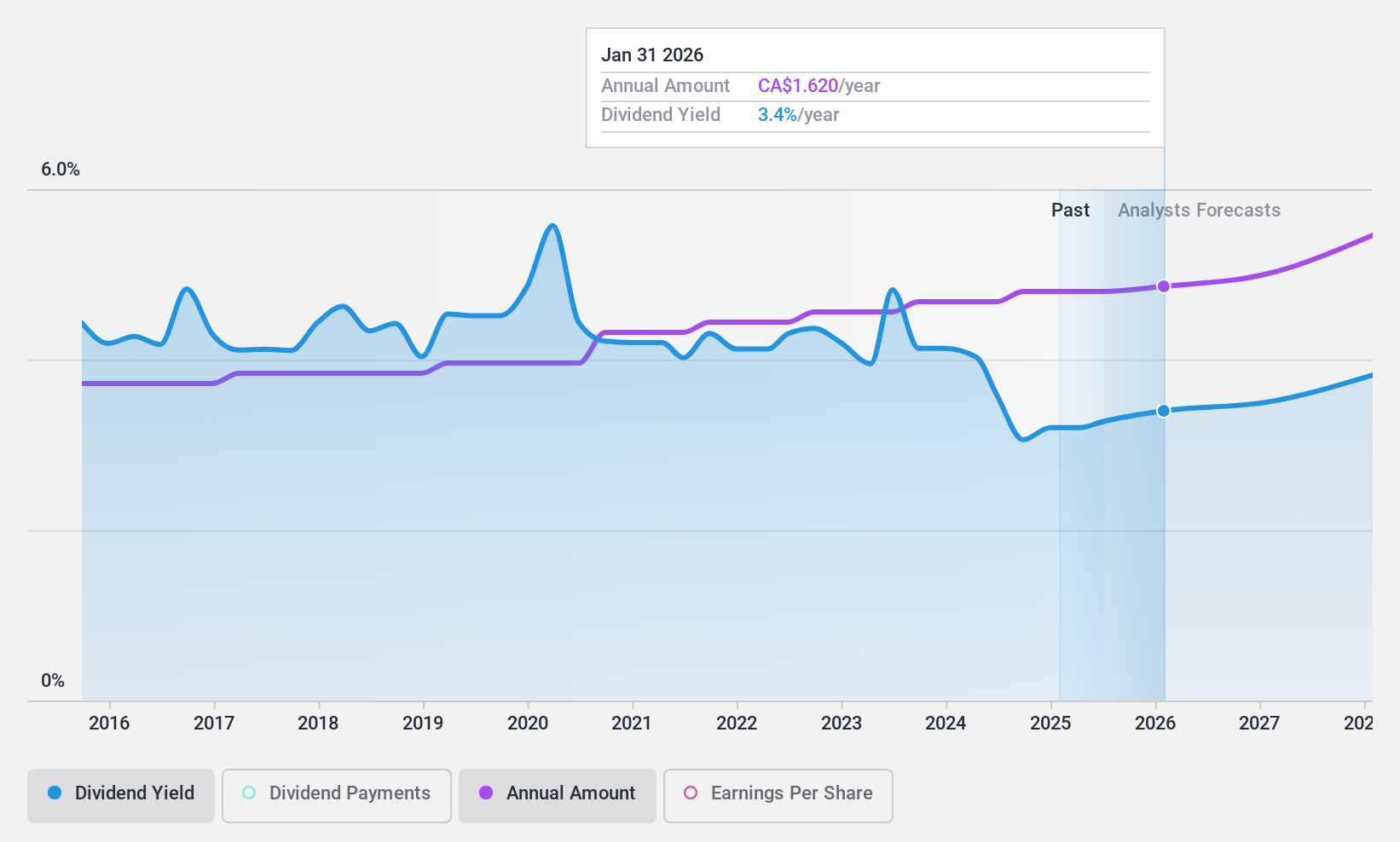

Dividend Yield: 3.3%

North West Company Inc. maintains a stable and reliable dividend history, with payments growing over the past decade. The company's recent quarterly dividend of CAD 0.40 per share continues this trend. Despite a lower yield compared to top Canadian payers, dividends are well-covered by earnings and cash flows, with payout ratios of 57.4% and 84.8%, respectively. Recent earnings show modest growth in revenue but slight declines in net income for Q3 2024, amidst an active share repurchase program.

- Navigate through the intricacies of North West with our comprehensive dividend report here.

- The analysis detailed in our North West valuation report hints at an deflated share price compared to its estimated value.

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company operating in Canada and the United States, with a market cap of CA$2.59 billion.

Operations: Russel Metals Inc. generates its revenue primarily from three segments: Metals Service Centers (CA$2.83 billion), Energy Field Stores (CA$984 million), and Steel Distributors (CA$411 million).

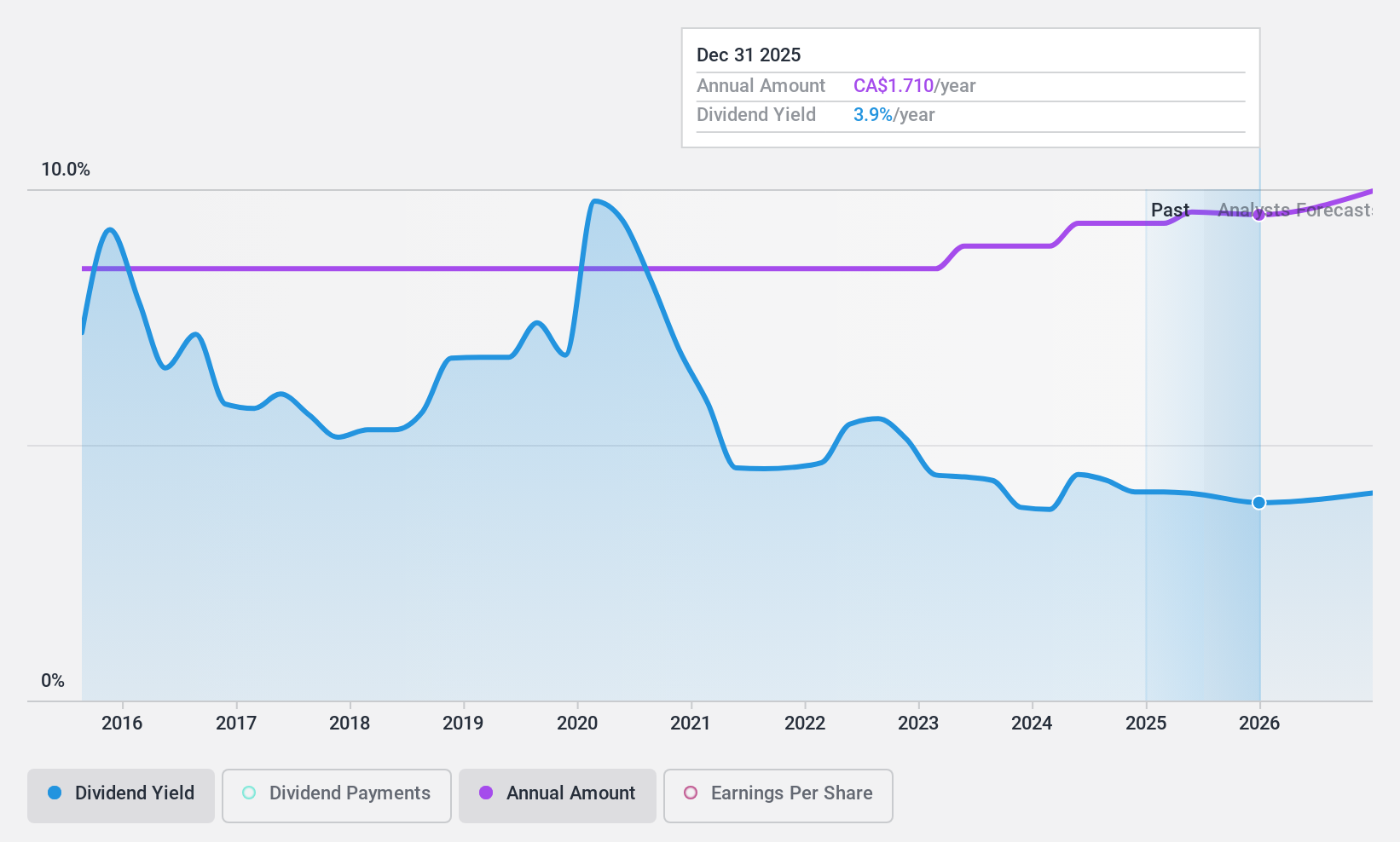

Dividend Yield: 3.9%

Russel Metals Inc. offers a stable dividend history with consistent growth over the past decade. The recent quarterly dividend of CAD 0.42 per share is well-covered by earnings and cash flows, with payout ratios of 54% and 34.5%, respectively. Despite a lower yield than top Canadian payers, the company remains financially sound, evidenced by strategic debt redemption and active share repurchase programs amid declining sales and net income in recent reports.

- Dive into the specifics of Russel Metals here with our thorough dividend report.

- Our valuation report here indicates Russel Metals may be undervalued.

Sun Life Financial (TSX:SLF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a financial services company that offers savings, retirement, and pension products globally, with a market capitalization of CA$49.03 billion.

Operations: Sun Life Financial Inc. generates revenue through its segments in Asia (CA$4.11 billion), Canada (CA$17.99 billion), Asset Management (CA$6.49 billion), and the United States (CA$14.09 billion).

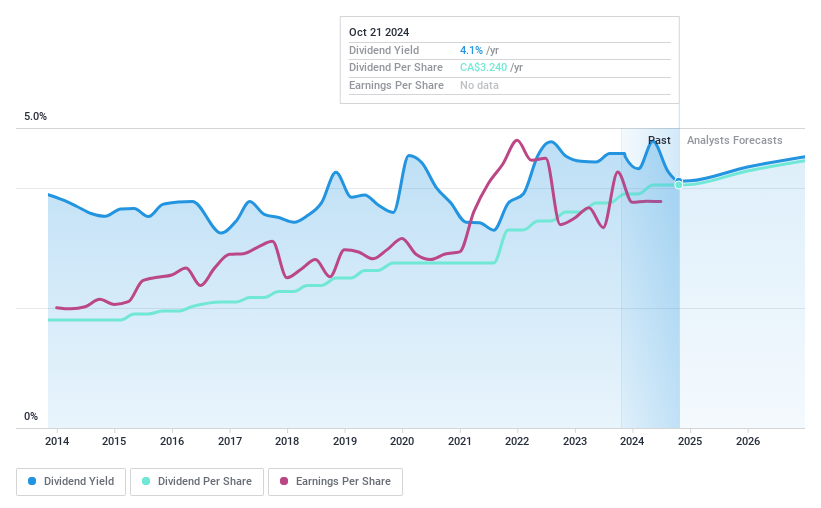

Dividend Yield: 4%

Sun Life Financial's recent dividend increase to CAD 0.84 per share highlights its commitment to returning value to shareholders, supported by a sustainable payout ratio of 51.9% and a cash payout ratio of 37.1%. Despite offering a lower yield than the top Canadian dividend payers, Sun Life maintains stable and reliable dividends over the past decade. Recent earnings growth and strategic share repurchases underscore its financial stability, enhancing its appeal as a dividend stock in Canada.

- Get an in-depth perspective on Sun Life Financial's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sun Life Financial's current price could be quite moderate.

Make It Happen

- Click here to access our complete index of 30 Top TSX Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RUS

Russel Metals

Operates as a metal distribution and processing company in Canada and the United States.

Very undervalued with flawless balance sheet and pays a dividend.