Over the last 7 days, the Canadian market has remained flat, but it is up 21% over the past year with earnings forecast to grow by 15% annually. In this promising environment, identifying strong dividend stocks can provide both income and potential for capital appreciation.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.32% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.31% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 7.84% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.30% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.12% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.68% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.53% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.10% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.38% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.14% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers financial services to individuals, businesses, institutional clients, and governments both domestically and internationally, with a market cap of CA$43.15 billion.

Operations: National Bank of Canada's revenue segments include CA$2.70 billion from Wealth Management, CA$4.41 billion from Personal and Commercial services, CA$2.96 billion from Financial Markets (excluding USSF&I), and CA$1.21 billion from U.S. Specialty Finance and International operations.

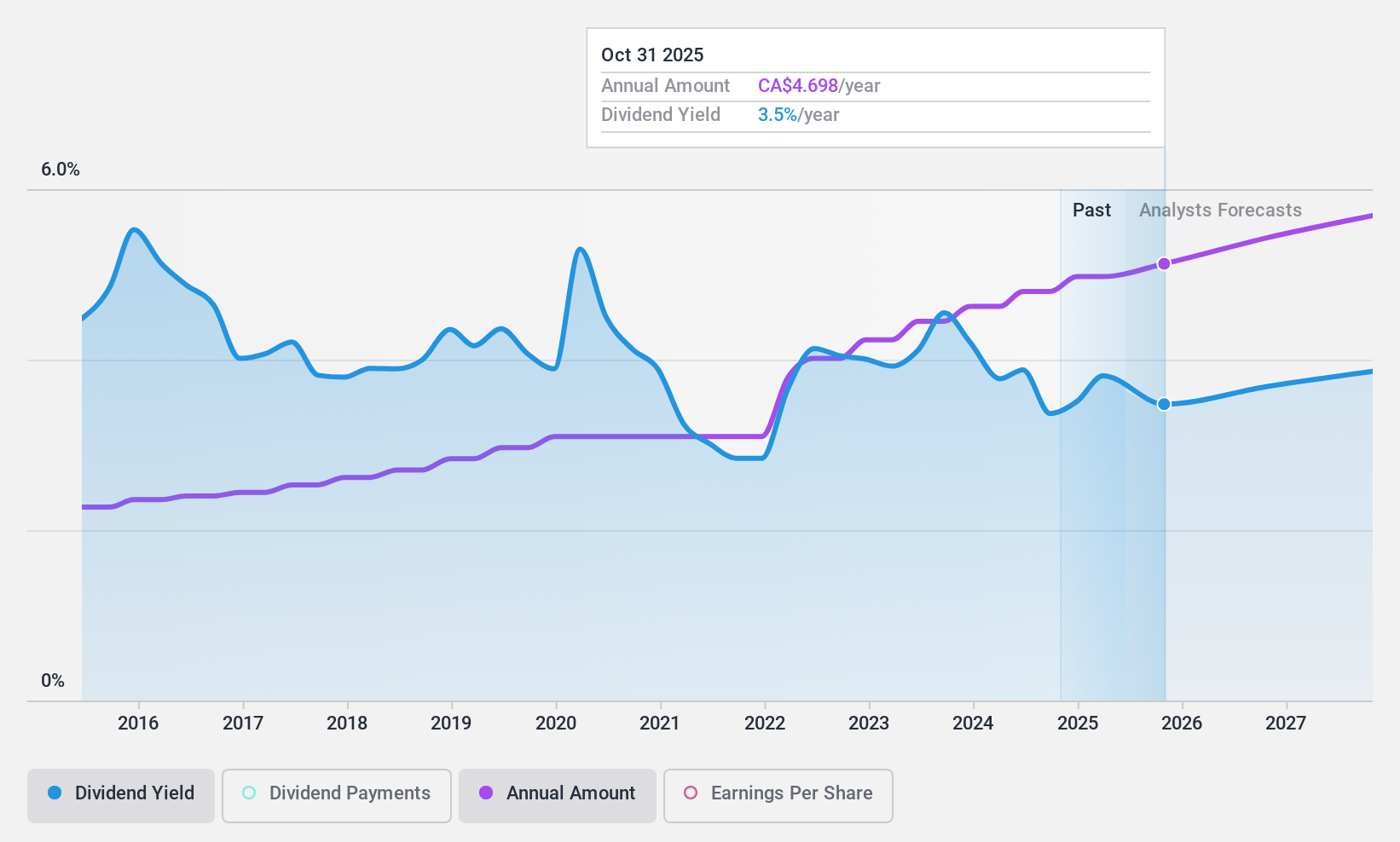

Dividend Yield: 3.5%

National Bank of Canada offers a stable and reliable dividend, currently at $1.10 per common share for the quarter ending October 31, 2024. With a payout ratio of 41%, dividends are well-covered by earnings, ensuring sustainability. Despite recent fluctuations in net interest income, net income has shown growth with CAD 1.03 billion reported for Q3 2024. The bank's consistent dividend payments over the past decade further enhance its appeal to dividend investors seeking stability in their portfolios.

- Take a closer look at National Bank of Canada's potential here in our dividend report.

- Our expertly prepared valuation report National Bank of Canada implies its share price may be lower than expected.

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company with a market cap of CA$27.24 billion, provides financial services across North America, Europe, and Asia.

Operations: Power Corporation of Canada's revenue segments include Lifeco at CA$26.23 billion, Power Financial - IGM at CA$3.65 billion, Holding Company at CA$83 million, and Alternative Asset Investment Platforms and Other at CA$1.69 billion.

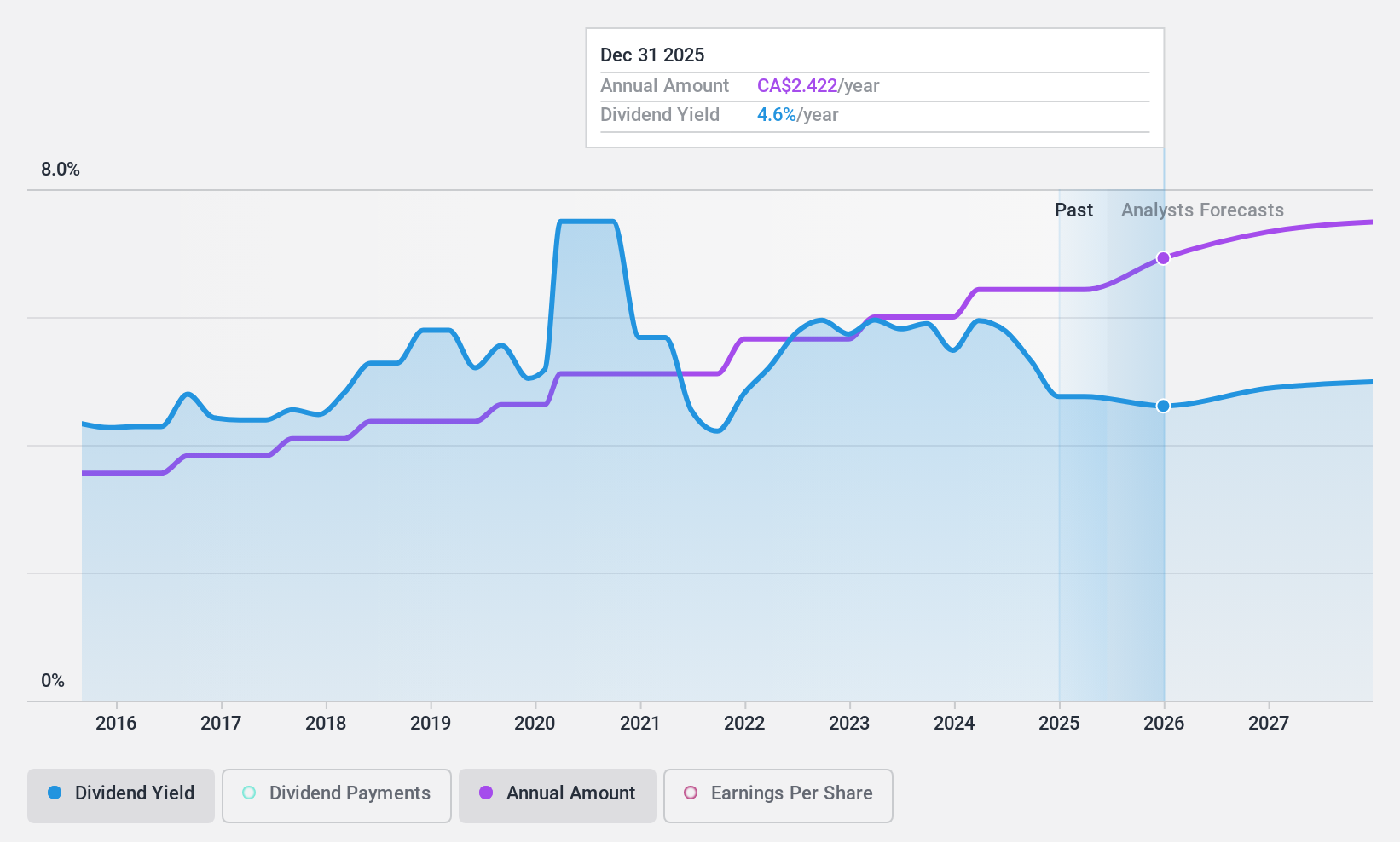

Dividend Yield: 5.3%

Power Corporation of Canada offers a reliable dividend yield of 5.3%, supported by a low payout ratio of 47.8% and cash payout ratio of 33.4%. Recent earnings growth, with net income rising to CAD 1.47 billion for the first half of 2024, underscores its financial strength. Trading at a significant discount to fair value (39.2%), it presents good relative value compared to peers, making it an attractive option for dividend investors seeking stability and growth potential in their portfolios.

- Click here and access our complete dividend analysis report to understand the dynamics of Power Corporation of Canada.

- Our valuation report here indicates Power Corporation of Canada may be undervalued.

Hemisphere Energy (TSXV:HME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hemisphere Energy Corporation acquires, explores, develops, and produces petroleum and natural gas interests in Canada with a market cap of CA$186.08 million.

Operations: Hemisphere Energy Corporation generates CA$77.01 million from its petroleum and natural gas interests in Canada.

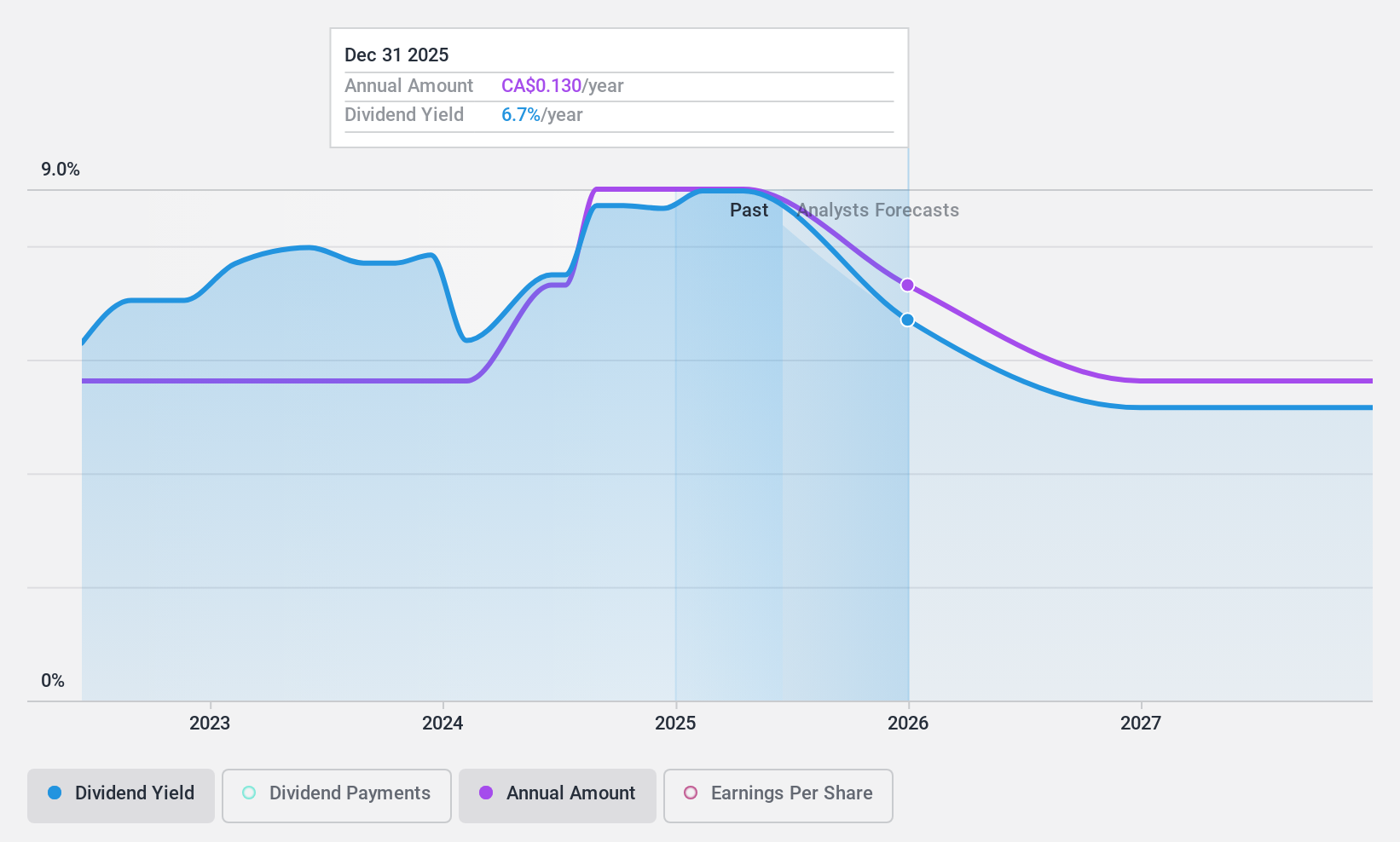

Dividend Yield: 6.8%

Hemisphere Energy recently announced a special dividend of CAD 0.03 per share, adding to its quarterly base dividend of CAD 0.025 per share. The company reported strong earnings growth with net income rising to CAD 10.39 million in Q2 2024 from CAD 5.79 million a year ago, supporting its sustainable payout ratio of 33.6%. Despite a short dividend history, Hemisphere offers an attractive yield and trades at a favorable P/E ratio of 6.3x compared to the Canadian market average.

- Click to explore a detailed breakdown of our findings in Hemisphere Energy's dividend report.

- Our valuation report unveils the possibility Hemisphere Energy's shares may be trading at a discount.

Next Steps

- Embark on your investment journey to our 31 Top TSX Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, offers financial services in North America, Europe, and Asia.

Undervalued with excellent balance sheet and pays a dividend.