The Market Doesn't Like What It Sees From Fairfax Financial Holdings Limited's (TSE:FFH) Earnings Yet

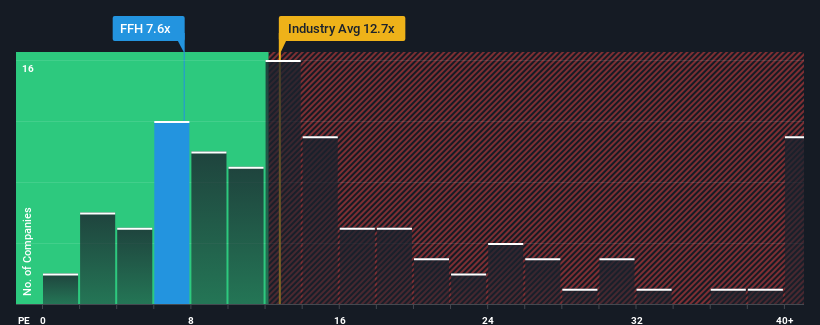

With a price-to-earnings (or "P/E") ratio of 7.6x Fairfax Financial Holdings Limited (TSE:FFH) may be sending bullish signals at the moment, given that almost half of all companies in Canada have P/E ratios greater than 15x and even P/E's higher than 32x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Fairfax Financial Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Fairfax Financial Holdings

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Fairfax Financial Holdings would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. Still, the latest three year period has seen an excellent 42% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 17% per year during the coming three years according to the five analysts following the company. Meanwhile, the broader market is forecast to expand by 8.9% per year, which paints a poor picture.

With this information, we are not surprised that Fairfax Financial Holdings is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Fairfax Financial Holdings' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Fairfax Financial Holdings maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Fairfax Financial Holdings (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on Fairfax Financial Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Fairfax Financial Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FFH

Fairfax Financial Holdings

Through its subsidiaries, provides property and casualty insurance and reinsurance, and investment management services in the United States, Canada, the Middle East, Asia, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives