- Canada

- /

- Personal Products

- /

- CNSX:AAWH.U

Ascend Wellness Holdings Independent Director Acquires 2.9% More Stock

Even if it's not a huge purchase, we think it was good to see that Scott Swid, the Independent Director of Ascend Wellness Holdings, Inc. (CSE:AAWH.U) recently shelled out US$60k to buy stock, at US$0.46 per share. However, it only increased their shares held by 2.9%, and it wasn't a huge purchase by absolute value, either.

See our latest analysis for Ascend Wellness Holdings

The Last 12 Months Of Insider Transactions At Ascend Wellness Holdings

Over the last year, we can see that the biggest insider sale was by the Co- Founder & Executive Chairman of The Board, Abner Kurtin, for US$195k worth of shares, at about US$1.17 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (US$0.45). So it is hard to draw any strong conclusion from it. Abner Kurtin was the only individual insider to sell over the last year.

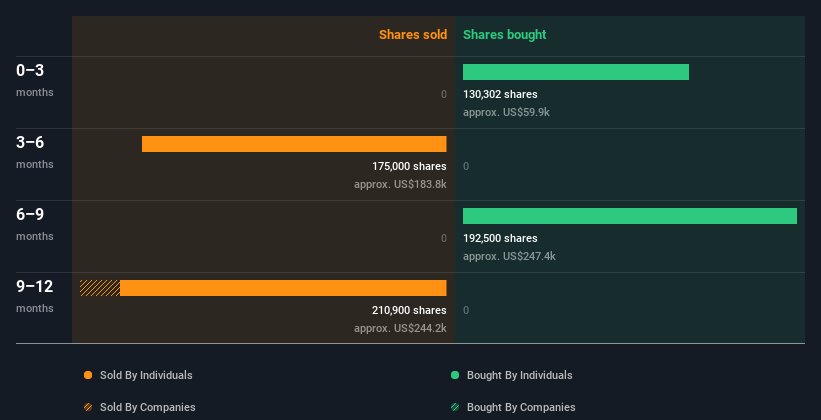

Happily, we note that in the last year insiders paid US$308k for 322.80k shares. But insiders sold 363.00k shares worth US$401k. Abner Kurtin sold a total of 363.00k shares over the year at an average price of US$1.10. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Insider Ownership Of Ascend Wellness Holdings

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 6.2% of Ascend Wellness Holdings shares, worth about US$6.2m, according to our data. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. Whilst better than nothing, we're not overly impressed by these holdings.

What Might The Insider Transactions At Ascend Wellness Holdings Tell Us?

It's certainly positive to see the recent insider purchase. On the other hand the transaction history, over the last year, isn't so positive. The transactions over the last year don't give us confidence, and nor does the fairly low insider ownership, but at least the recent buying is a positive. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. While conducting our analysis, we found that Ascend Wellness Holdings has 2 warning signs and it would be unwise to ignore these.

But note: Ascend Wellness Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:AAWH.U

Ascend Wellness Holdings

Engages in the cultivation, manufacture, and distribution of cannabis consumer packaged goods in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives