- Canada

- /

- Oil and Gas

- /

- TSXV:ALV

Top TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Canadian market has shown resilience, supported by strong consumer spending and positive real wage growth, even amidst challenges such as elevated inflation and higher interest rates. For investors seeking opportunities beyond the major players, penny stocks—typically representing smaller or newer companies—can present intriguing possibilities. Despite the term's outdated connotation, these stocks remain a relevant investment area for those looking to explore potential value in companies with solid financial foundations and growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$180.6M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.34 | CA$387.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$119.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$228.37M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.19 | CA$31.7M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.52 | CA$994.26M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.18M | ★★★★★★ |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Alvopetro Energy (TSXV:ALV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alvopetro Energy Ltd. is an independent upstream and midstream operator with a market cap of CA$180.60 million.

Operations: The company's revenue is derived entirely from its Oil & Gas - Exploration & Production segment, totaling $49.24 million.

Market Cap: CA$180.6M

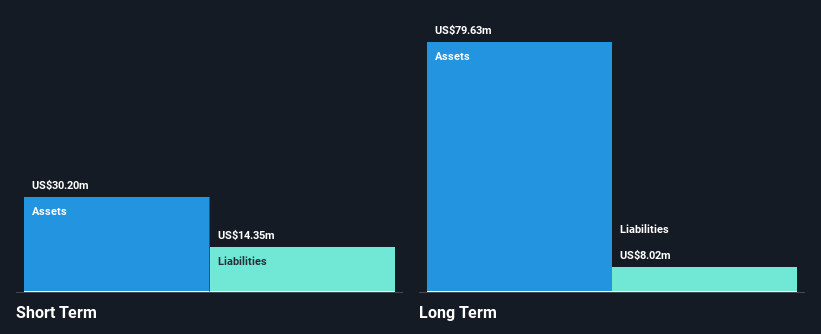

Alvopetro Energy Ltd., with a market cap of CA$180.60 million, has shown mixed financial performance recently. Despite being debt-free and having stable weekly volatility, the company experienced negative earnings growth over the past year, affecting its profit margins which are now 29.9%, down from 55.9% last year. However, it maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities significantly. The management team is seasoned with an average tenure of 11 years, but the dividend yield of 10.31% is not well covered by earnings, indicating potential sustainability concerns for investors seeking income stability in penny stocks.

- Click here to discover the nuances of Alvopetro Energy with our detailed analytical financial health report.

- Explore Alvopetro Energy's analyst forecasts in our growth report.

Pacific Booker Minerals (TSXV:BKM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pacific Booker Minerals Inc. is involved in the exploration of mineral properties in Canada with a market cap of CA$14.29 million.

Operations: Pacific Booker Minerals Inc. does not report any specific revenue segments as it is focused on the exploration of mineral properties in Canada.

Market Cap: CA$14.29M

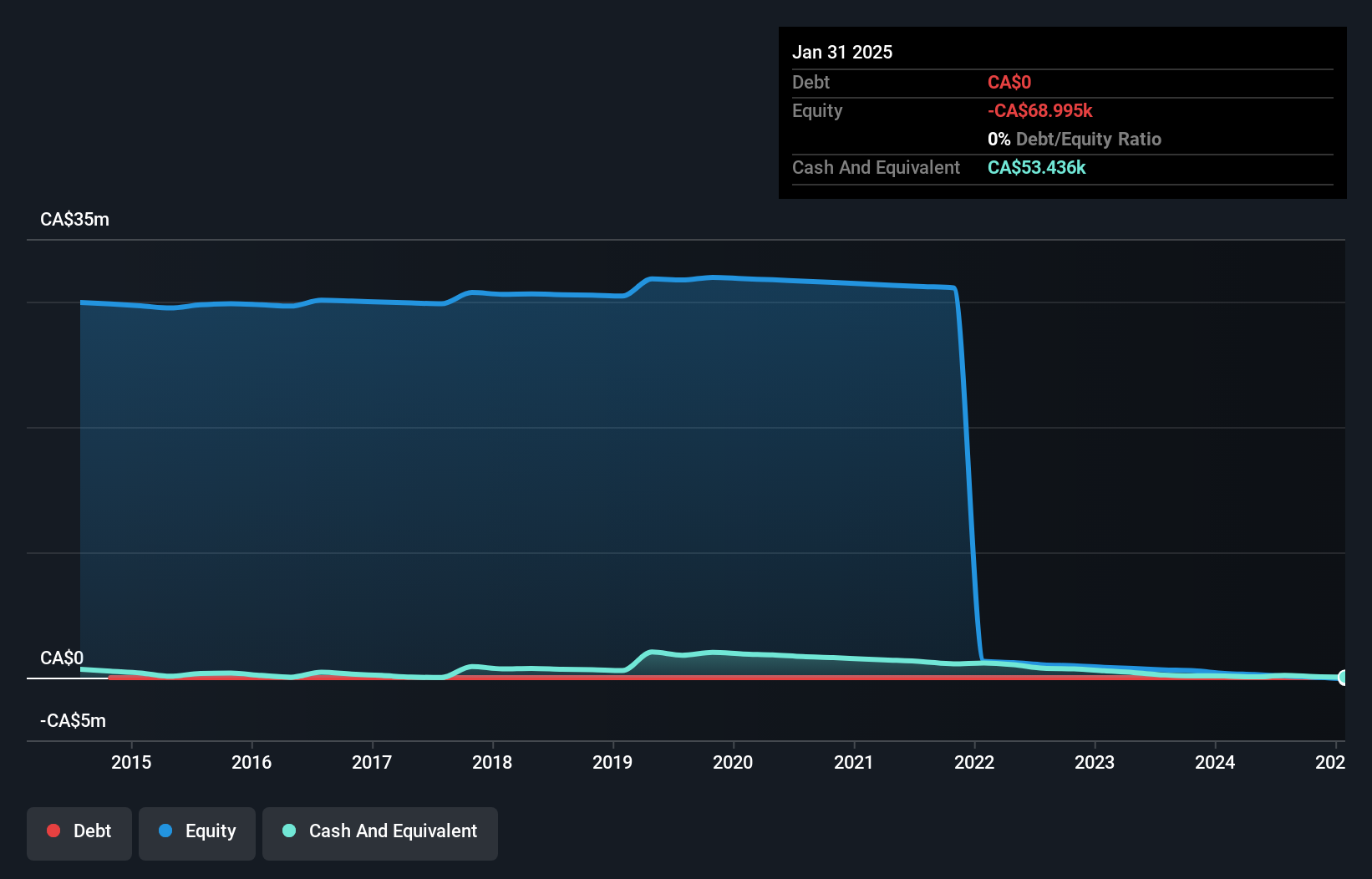

Pacific Booker Minerals Inc., with a market cap of CA$14.29 million, is pre-revenue and currently unprofitable, reporting increased losses over the past year. Despite this, it remains debt-free and has a stable cash runway exceeding three years. The company exhibits high share price volatility compared to most Canadian stocks but benefits from a seasoned board with an average tenure of 19.5 years. Short-term assets do not cover short-term liabilities; however, long-term liabilities are well managed by existing assets. Shareholders have not faced significant dilution recently, maintaining their stake in the company's exploration potential.

- Unlock comprehensive insights into our analysis of Pacific Booker Minerals stock in this financial health report.

- Understand Pacific Booker Minerals' track record by examining our performance history report.

KDA Group (TSXV:KDA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: KDA Group Inc., along with its subsidiaries, offers technological solutions to general and specialized health sectors in Canada, with a market cap of CA$45.94 million.

Operations: The company's revenue is primarily derived from its Pharmaceutical Technology segment, which generated CA$0.037 million, alongside a contribution of CA$0.11 million from Corporate and Others.

Market Cap: CA$45.94M

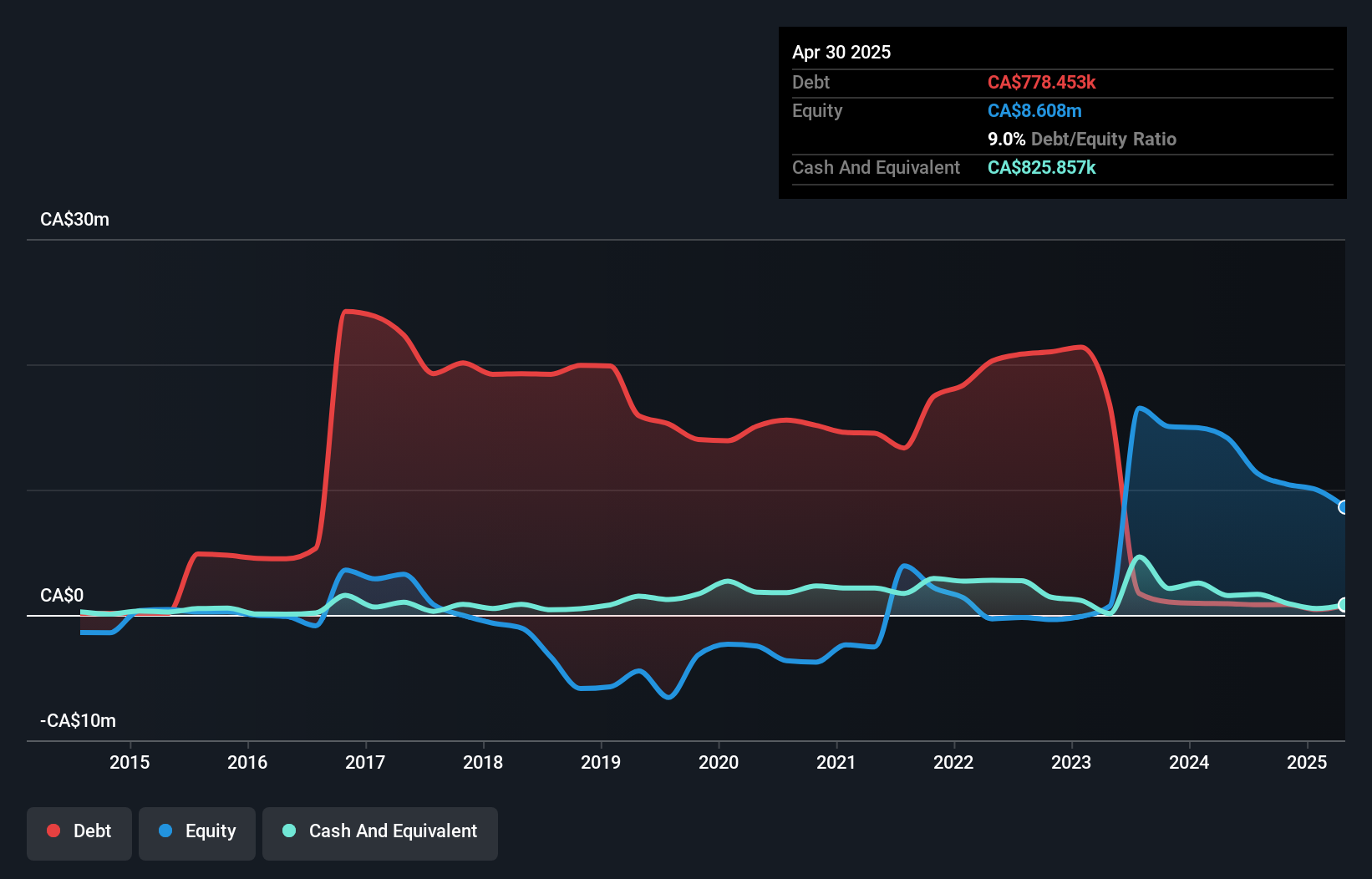

KDA Group Inc., with a market cap of CA$45.94 million, is pre-revenue and currently unprofitable, experiencing a net loss of CA$6.91 million for the fiscal year ending July 31, 2024. Despite reducing losses over five years by 18.6% annually, concerns about its ability to continue as a going concern persist due to an auditor's report and less than a year of cash runway at current burn rates. The company benefits from more cash than debt and covers both short- and long-term liabilities with assets but has diluted shareholders over the past year by increasing shares outstanding by 3.2%.

- Take a closer look at KDA Group's potential here in our financial health report.

- Gain insights into KDA Group's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 923 more companies for you to explore.Click here to unveil our expertly curated list of 926 TSX Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALV

Alvopetro Energy

Operates as an independent upstream and midstream operator.

Flawless balance sheet and undervalued.