- Canada

- /

- Capital Markets

- /

- TSX:CF

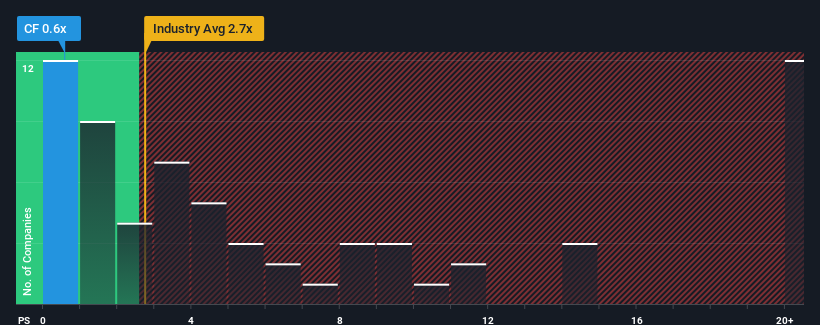

Market Still Lacking Some Conviction On Canaccord Genuity Group Inc. (TSE:CF)

You may think that with a price-to-sales (or "P/S") ratio of 0.6x Canaccord Genuity Group Inc. (TSE:CF) is definitely a stock worth checking out, seeing as almost half of all the Capital Markets companies in Canada have P/S ratios greater than 2.7x and even P/S above 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Canaccord Genuity Group

How Canaccord Genuity Group Has Been Performing

Recent times have been pleasing for Canaccord Genuity Group as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Canaccord Genuity Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Canaccord Genuity Group?

The only time you'd be truly comfortable seeing a P/S as depressed as Canaccord Genuity Group's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.4% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 30% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.3%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Canaccord Genuity Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Canaccord Genuity Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Canaccord Genuity Group (1 makes us a bit uncomfortable!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CF

Canaccord Genuity Group

Operates as a full-service investment dealer in Canada, the United States, the United Kingdom, Europe, Crown Dependencies, and Australia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026