- Canada

- /

- Metals and Mining

- /

- TSXV:EML

3 TSX Penny Stocks With Market Caps Below CA$20M

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a landscape marked by political changes and economic uncertainties, with investors keeping a close eye on central-bank policies and potential shifts in government leadership. In this context, penny stocks—often smaller or newer companies—remain an intriguing area for investors seeking opportunities beyond the mainstream. While the term "penny stocks" may seem outdated, these investments can still offer significant potential when backed by strong financials and strategic growth plans.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.02 | CA$392.54M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.22 | CA$948.57M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.49 | CA$13.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$629.3M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.32 | CA$225.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$180.43M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.95 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Avricore Health (TSXV:AVCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avricore Health Inc. operates in the health data and point-of-care technologies sector in Canada, with a market cap of CA$5.57 million.

Operations: The company generates revenue from its Healthtab - Point of Care segment, amounting to CA$4.72 million.

Market Cap: CA$5.57M

Avricore Health Inc., with a market cap of CA$5.57 million, has recently shown signs of profitability, reporting a net income of CA$0.043 million for the first nine months of 2024 compared to a loss in the previous year. Despite its small revenue base and high share price volatility, Avricore benefits from an experienced management team and board, no debt burden, and sufficient short-term assets to cover liabilities. While its earnings quality is high, the company’s low return on equity suggests limited efficiency in generating profits from shareholders' investments.

- Get an in-depth perspective on Avricore Health's performance by reading our balance sheet health report here.

- Understand Avricore Health's track record by examining our performance history report.

Electric Metals (USA) (TSXV:EML)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Electric Metals (USA) Limited focuses on the acquisition, exploration, and development of mineral properties in the United States, Canada, and Australia with a market cap of CA$9.41 million.

Operations: Electric Metals (USA) Limited does not report any specific revenue segments.

Market Cap: CA$9.41M

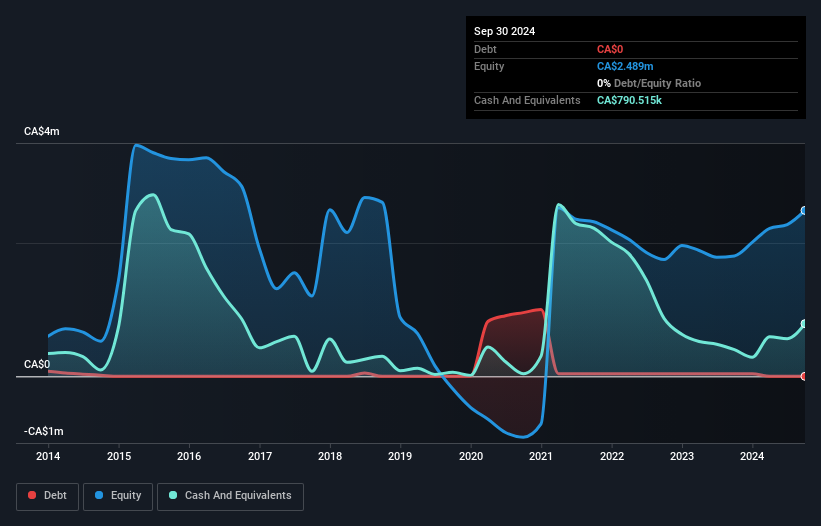

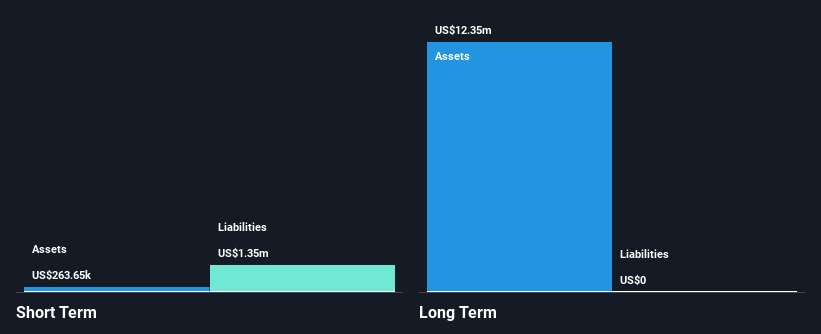

Electric Metals (USA) Limited, with a market cap of CA$9.41 million, remains pre-revenue and unprofitable, highlighting the speculative nature typical of penny stocks. The company recently reported reduced losses for Q3 2024 compared to the previous year and announced a private placement to raise up to CA$1 million. Despite being debt-free, Electric Metals faces challenges such as insufficient short-term assets to cover liabilities and high share price volatility. Its board lacks experience with an average tenure of 1.3 years, while its cash runway is limited but bolstered by recent capital raising efforts.

- Unlock comprehensive insights into our analysis of Electric Metals (USA) stock in this financial health report.

- Assess Electric Metals (USA)'s previous results with our detailed historical performance reports.

ZincX Resources (TSXV:ZNX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZincX Resources Corp. is involved in acquiring, exploring, and evaluating mineral resource properties in Canada with a market cap of CA$15.03 million.

Operations: ZincX Resources Corp. does not report any specific revenue segments.

Market Cap: CA$15.03M

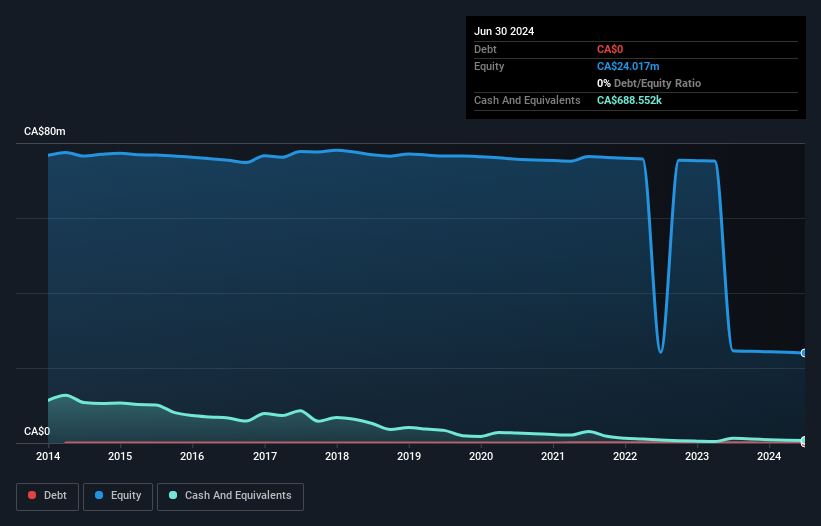

ZincX Resources Corp., with a market cap of CA$15.03 million, is pre-revenue and unprofitable, reflecting the speculative nature of penny stocks. Despite being debt-free and having an experienced board with an average tenure of 17.2 years, the company faces financial challenges such as insufficient short-term assets to cover liabilities and a negative return on equity (-2.34%). Recent earnings announcements indicated reduced quarterly losses compared to last year; however, annual losses increased. Concerns about its ability to continue as a going concern were raised by auditors in their latest report, highlighting potential risks for investors.

- Take a closer look at ZincX Resources' potential here in our financial health report.

- Evaluate ZincX Resources' historical performance by accessing our past performance report.

Summing It All Up

- Discover the full array of 928 TSX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electric Metals (USA) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EML

Electric Metals (USA)

Engages in the acquisition, exploration, and development of mineral properties in the United States, Canada, and Australia.

Excellent balance sheet slight.

Market Insights

Community Narratives