- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

TSX Stocks That Might Be Trading Below Their Estimated Value In October 2025

Reviewed by Simply Wall St

As the Canadian market navigates through potential volatility, driven by uncertainties around trade and emerging credit concerns, the outlook remains cautiously optimistic with support from anticipated interest-rate cuts and positive corporate earnings growth. In this environment, identifying stocks that are trading below their estimated value can present strategic opportunities for investors looking to rebalance, diversify, or add quality investments to their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WELL Health Technologies (TSX:WELL) | CA$4.97 | CA$9.90 | 49.8% |

| Vitalhub (TSX:VHI) | CA$10.39 | CA$18.82 | 44.8% |

| Savaria (TSX:SIS) | CA$21.50 | CA$40.92 | 47.5% |

| Magellan Aerospace (TSX:MAL) | CA$16.19 | CA$28.02 | 42.2% |

| Heliostar Metals (TSXV:HSTR) | CA$2.05 | CA$4.01 | 48.9% |

| GURU Organic Energy (TSX:GURU) | CA$5.35 | CA$8.97 | 40.3% |

| Boyd Group Services (TSX:BYD) | CA$210.25 | CA$358.96 | 41.4% |

| Bird Construction (TSX:BDT) | CA$29.58 | CA$56.73 | 47.9% |

| Artemis Gold (TSXV:ARTG) | CA$36.80 | CA$64.07 | 42.6% |

| Aritzia (TSX:ATZ) | CA$91.42 | CA$159.61 | 42.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Allied Gold (TSX:AAUC)

Overview: Allied Gold Corporation, along with its subsidiaries, is engaged in the exploration and production of mineral deposits in Africa, with a market cap of CA$3.26 billion.

Operations: The company's revenue segments include $213.19 million from the Agbaou Mine, $247.48 million from the Bonikro Mine, and $497.42 million from the Sadiola Mine.

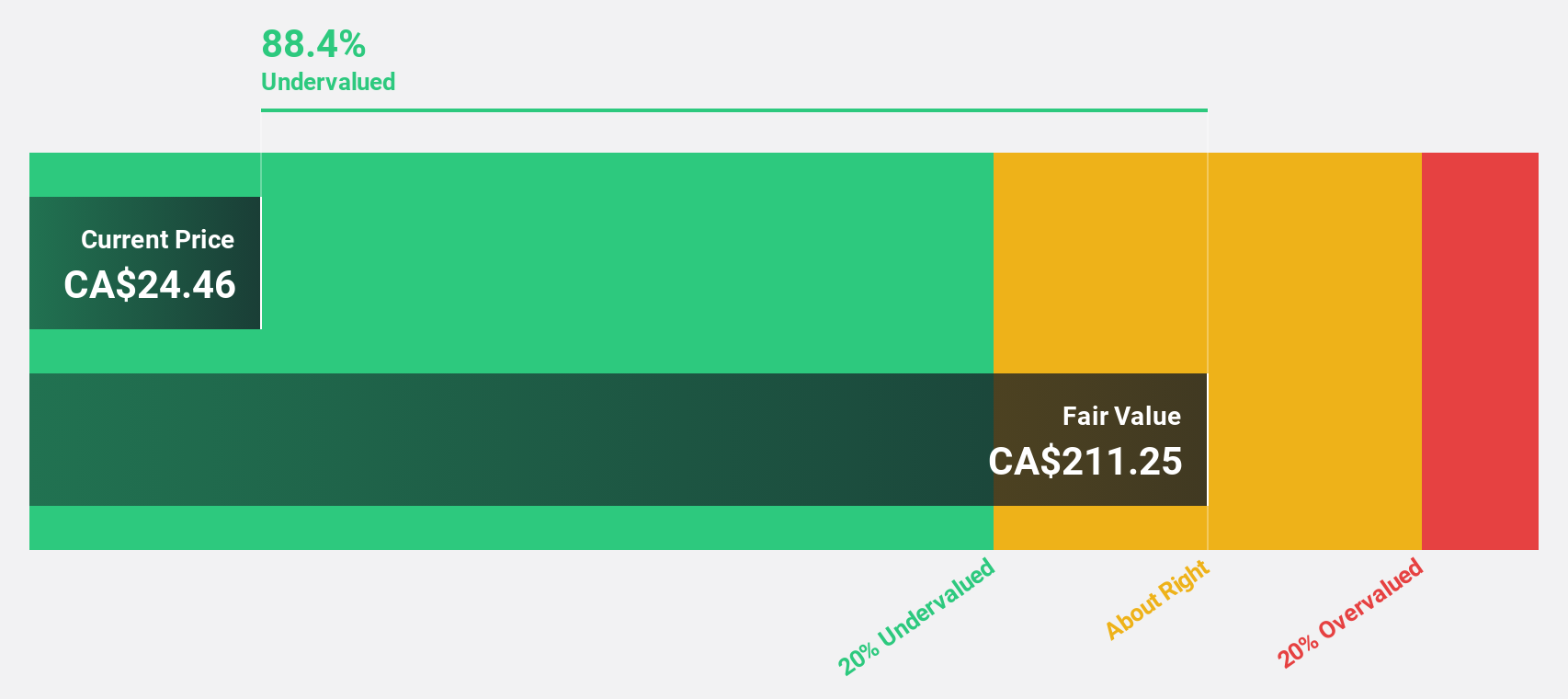

Estimated Discount To Fair Value: 20.3%

Allied Gold is trading at CA$26.8, below its estimated fair value of CA$33.64, suggesting it may be undervalued based on cash flows. The company's revenue is forecast to grow over 23% annually, outpacing the Canadian market's growth rate. Recent production guidance indicates strong performance with expected annual gold output exceeding 375,000 ounces. A recent follow-on equity offering raised CA$175 million, potentially strengthening its financial position for future growth initiatives.

- In light of our recent growth report, it seems possible that Allied Gold's financial performance will exceed current levels.

- Take a closer look at Allied Gold's balance sheet health here in our report.

Vitalhub (TSX:VHI)

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally with a market cap of CA$654.73 million.

Operations: The company's revenue is primarily derived from its Healthcare Software segment, which generated CA$82.63 million.

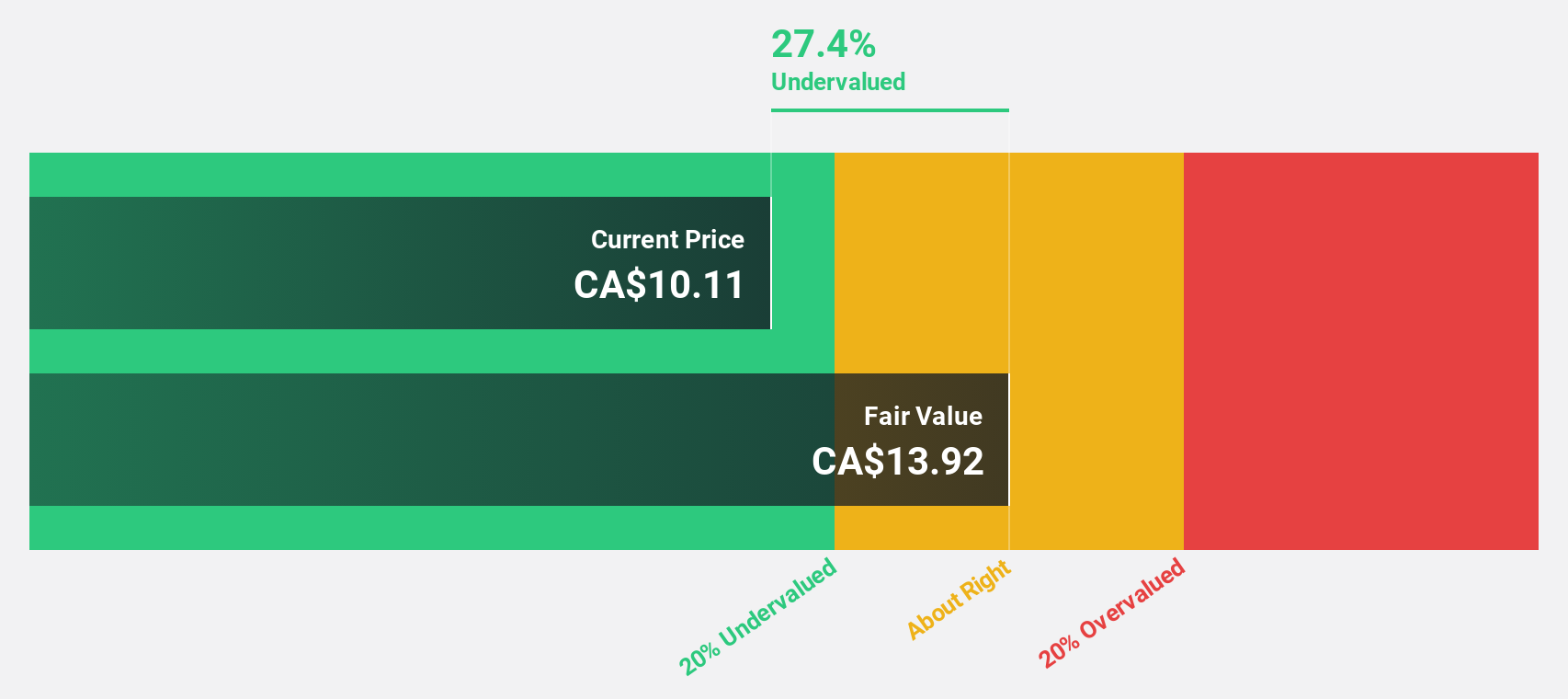

Estimated Discount To Fair Value: 44.8%

Vitalhub, trading at CA$10.39, is significantly undervalued with an estimated fair value of CA$18.82. Earnings are projected to grow substantially at 54.8% annually, surpassing the Canadian market's growth rate of 12.3%. However, recent shareholder dilution and substantial insider selling may raise concerns about management's confidence in future prospects. The company reported strong revenue growth for Q2 2025 but has undergone auditor changes and completed a follow-on equity offering worth CA$65 million in August 2025.

- Our comprehensive growth report raises the possibility that Vitalhub is poised for substantial financial growth.

- Navigate through the intricacies of Vitalhub with our comprehensive financial health report here.

WELL Health Technologies (TSX:WELL)

Overview: WELL Health Technologies Corp. is a practitioner-focused digital healthcare company operating in Canada, the United States, and internationally, with a market cap of CA$1.26 billion.

Operations: The company's revenue segments include SaaS and Technology Services (CA$80.89 million), Specialized-provider Staffing (CA$168.94 million), Canadian Patient Services - Primary (CA$229.16 million), WELL Health USA Patient Services - Primary WISP (CA$113.10 million), Canadian Patient Services - Specialized Myhealth (CA$152.50 million), WELL Health USA Patient Services - Primary Circle Medical (CA$103.19 million), and WELL Health USA Patient Services - Specialized CRH Medical (CA$241.55 million).

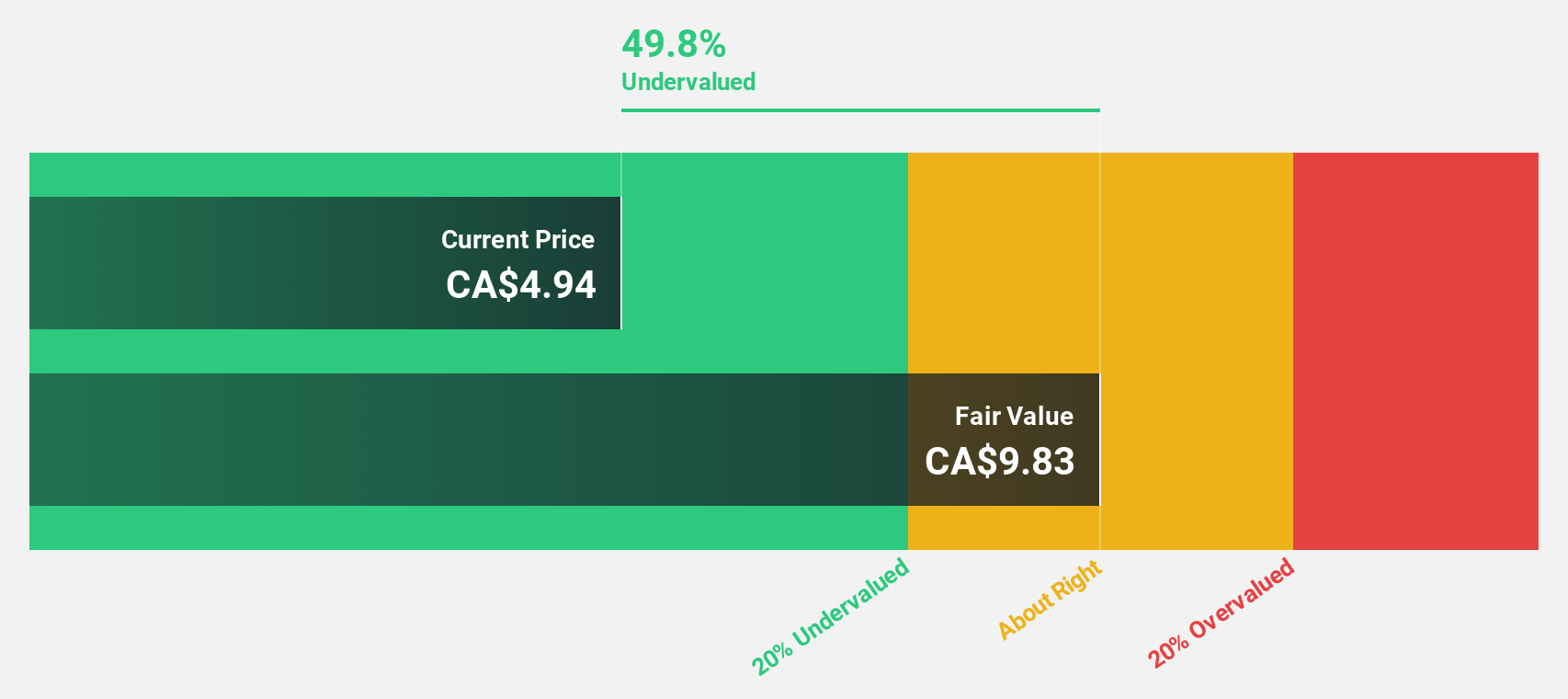

Estimated Discount To Fair Value: 49.8%

WELL Health Technologies, trading at CA$4.97, is highly undervalued with a fair value estimate of CA$9.9 and trades at 49.8% below this estimate. Revenue growth is forecasted at 13.8% annually, outpacing the Canadian market's average and indicating strong future potential despite recent insider selling activity. The company reaffirmed its annual revenue guidance between CA$1.35 billion to CA$1.45 billion for 2025, showing confidence in achieving robust financial performance amidst challenges in net income figures reported for Q2 2025.

- Our growth report here indicates WELL Health Technologies may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of WELL Health Technologies.

Taking Advantage

- Get an in-depth perspective on all 25 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)