- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

3 Top TSX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of shifting political dynamics and evolving central-bank policies, investors are reminded of the importance of fundamentals over headlines. In this environment, dividend stocks on the TSX offer a compelling opportunity to enhance portfolios by providing steady income and potential for long-term growth amidst market volatility.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.05% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.79% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 4.23% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.36% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.47% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.16% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.64% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.41% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.66% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.07% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

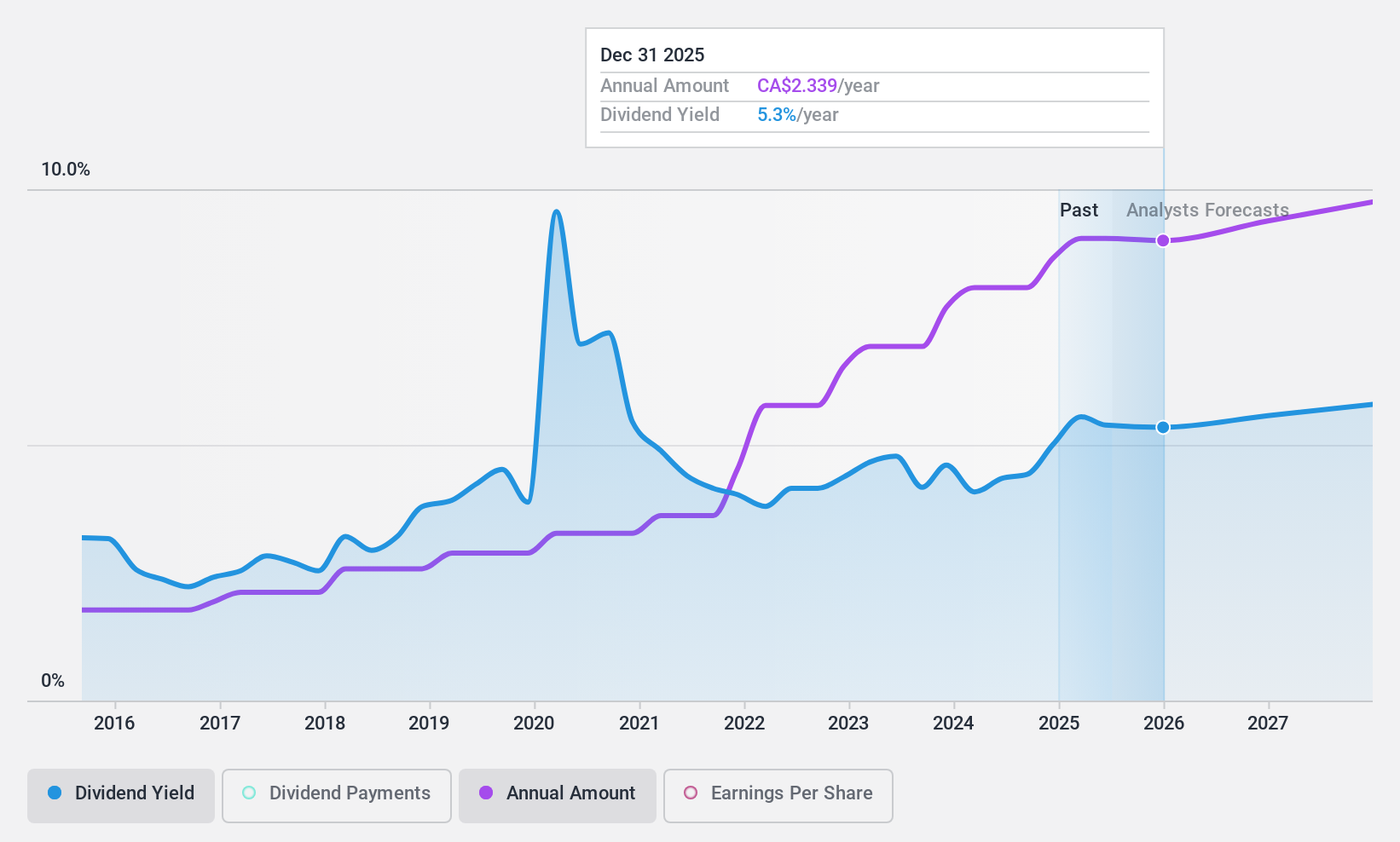

Canadian Natural Resources (TSX:CNQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited is involved in acquiring, exploring, developing, producing, marketing, and selling crude oil, natural gas, and natural gas liquids (NGLs), with a market cap of CA$96.62 billion.

Operations: Canadian Natural Resources Limited's revenue segments include CA$16.30 billion from Oil Sands Mining and Upgrading, CA$17.21 billion from Exploration and Production in North America, CA$0.54 billion from Exploration and Production in the North Sea, CA$0.56 billion from Exploration and Production Offshore Africa, and CA$0.94 billion from Midstream and Refining.

Dividend Yield: 4.6%

Canadian Natural Resources offers a stable dividend with a 4.64% yield, supported by solid earnings coverage and a cash payout ratio of 46.2%. Recent acquisitions, including Chevron's Alberta assets, enhance production capacity and free cash flow potential. The company's strategic debt financing supports these expansions without compromising its ability to maintain dividends. Despite being below top-tier yields in Canada, CNQ's consistent dividend growth over the past decade underscores its reliability for income-focused investors.

- Click to explore a detailed breakdown of our findings in Canadian Natural Resources' dividend report.

- The valuation report we've compiled suggests that Canadian Natural Resources' current price could be quite moderate.

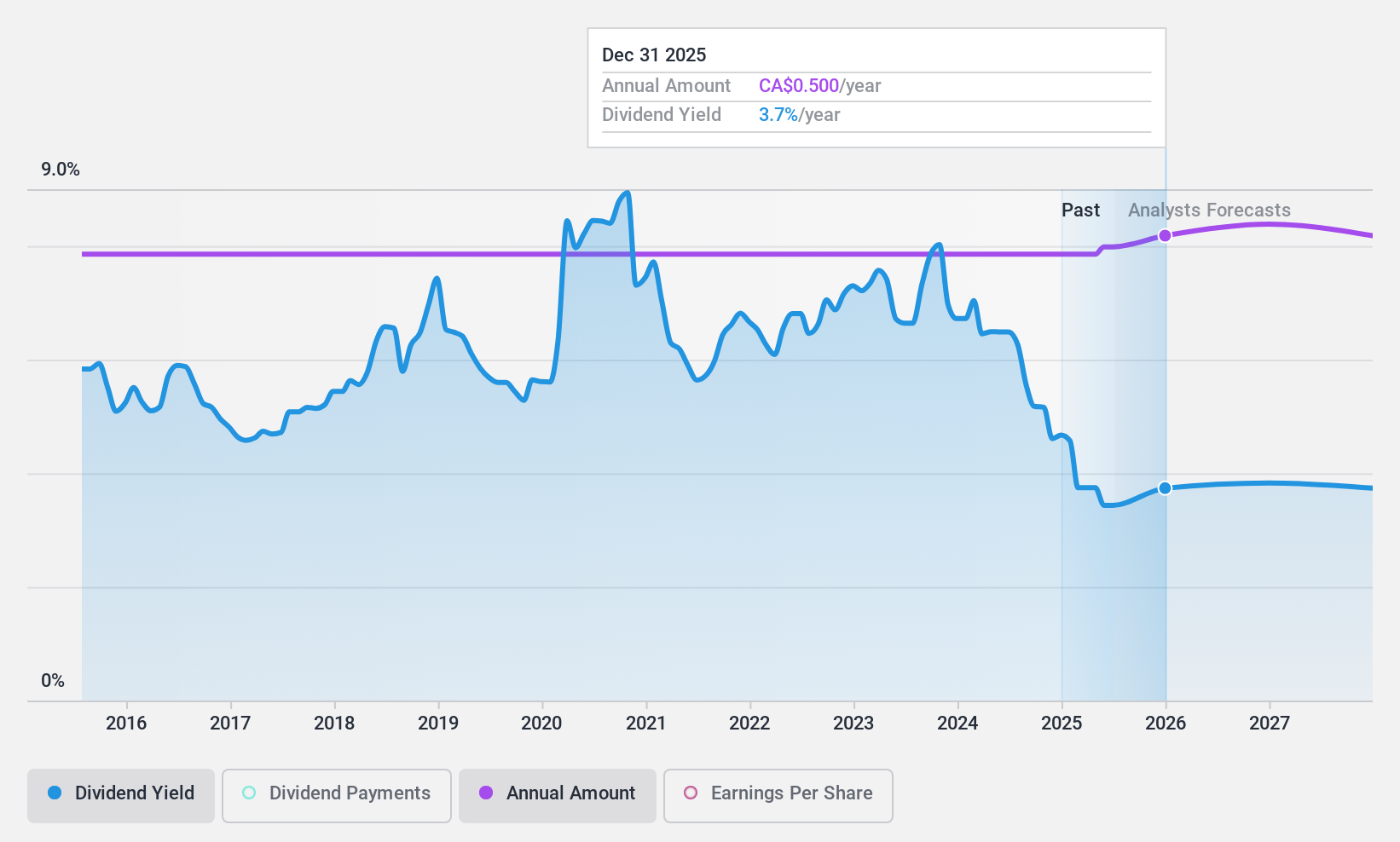

Extendicare (TSX:EXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Extendicare Inc. operates through its subsidiaries to provide care and services for seniors in Canada, with a market cap of CA$860.54 million.

Operations: Extendicare Inc.'s revenue segments include CA$808.94 million from Long-Term Care, CA$545.46 million from Home Health Care, and CA$70.43 million from Managed Services.

Dividend Yield: 4.7%

Extendicare's dividend yield of 4.66% is stable but below the top Canadian payers. Despite past volatility, current dividends are well-covered by earnings and cash flows, with a payout ratio of 63.3% and a cash payout ratio of 41.5%. Recent earnings growth supports dividend sustainability, although no increase in payouts has occurred over the last decade. The company's debt level is high, yet recent credit facilities provide financial flexibility for operations and obligations management.

- Take a closer look at Extendicare's potential here in our dividend report.

- The analysis detailed in our Extendicare valuation report hints at an inflated share price compared to its estimated value.

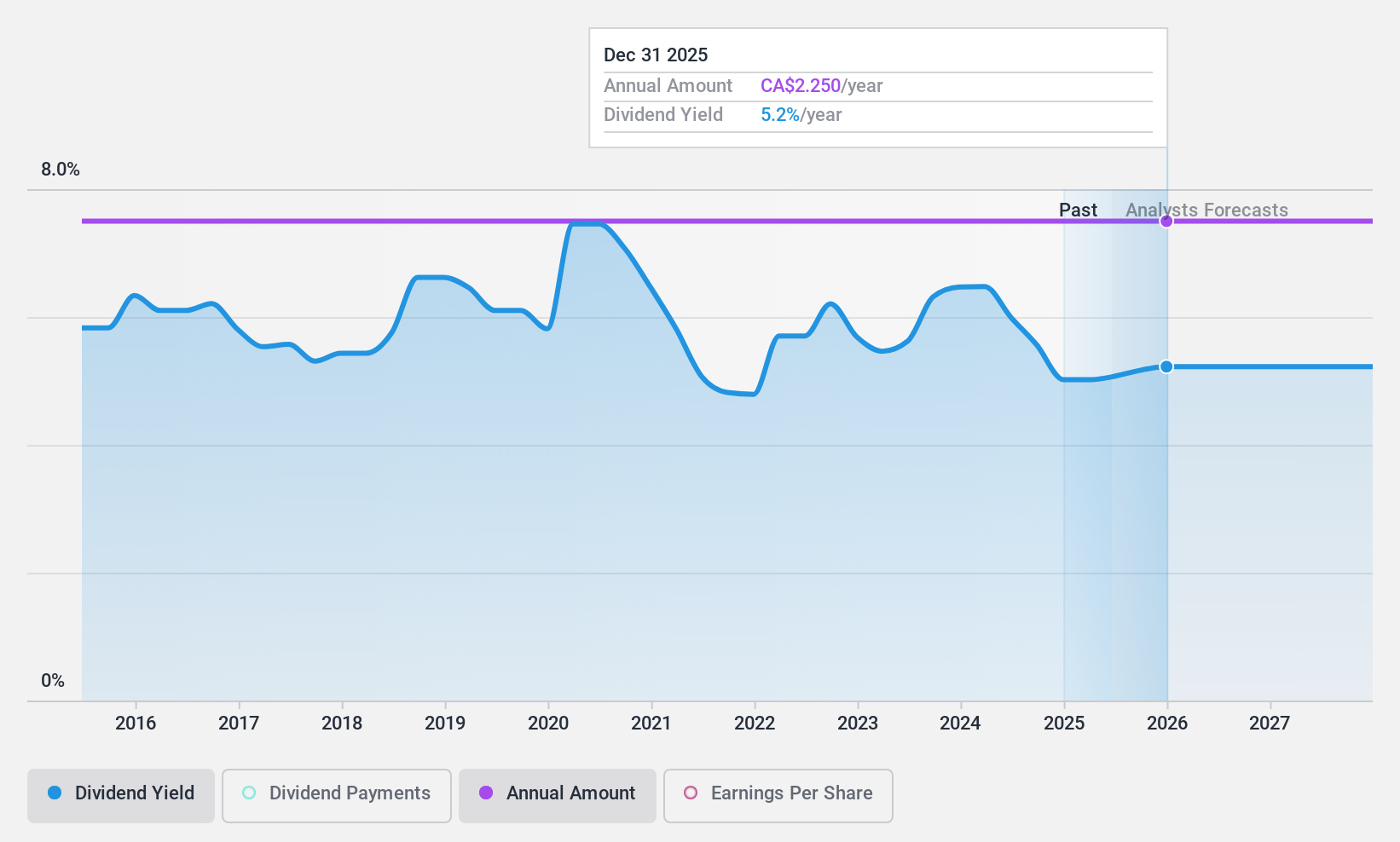

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market cap of CA$10.38 billion.

Operations: IGM Financial Inc.'s revenue is derived from its Asset Management segment, which generated CA$1.23 billion, and its Wealth Management segment, contributing CA$2.35 billion.

Dividend Yield: 5.2%

IGM Financial offers a stable dividend yield of 5.16%, supported by earnings and cash flows, with payout ratios around 60%. Despite being below the top Canadian dividend payers, its dividends have grown steadily over the past decade. Recent earnings growth enhances sustainability, while a share buyback program aims to manage capital effectively. Trading at a significant discount to estimated fair value suggests good relative value compared to peers and industry benchmarks.

- Navigate through the intricacies of IGM Financial with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, IGM Financial's share price might be too pessimistic.

Next Steps

- Take a closer look at our Top TSX Dividend Stocks list of 26 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs).

Established dividend payer and good value.