Does Insider Buying At Saputo (TSX:SAP) Quietly Redefine Its Long-Term Governance And Earnings Story?

Reviewed by Sasha Jovanovic

- Recent insider buying at Saputo, combined with already substantial institutional ownership, has recently drawn fresh attention to the Canadian dairy group’s governance and long-term positioning.

- This alignment between management and large shareholders is being read by many investors as a meaningful signal about confidence in Saputo’s future direction.

- We’ll now explore how this renewed insider confidence reshapes Saputo’s investment narrative and interacts with existing expectations for earnings growth.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Saputo Investment Narrative Recap

To own Saputo today, you need to believe that a focused dairy group can still compound value despite structural headwinds from alternatives, regulation and volatile milk supply. The recent insider buying and already high institutional ownership support sentiment, but do not materially change the key near term swing factor, which is whether management can translate modest revenue growth into sustainable profitability, or the biggest current risk, that secular shifts away from dairy gradually cap that upside.

The announcement that stands out alongside the insider activity is Saputo’s new normal course issuer bid, allowing repurchases of up to 20,498,278 shares, alongside ongoing dividends of C$0.20 per quarter. For many investors, this capital return framework sits right at the heart of the Saputo story, because it amplifies any improvement in earnings while also sharpening attention on the risk that the core dairy focus may face growing pressure from plant based alternatives over time.

Yet against this backdrop, the rising threat from changing consumer preferences is something investors should be aware of...

Read the full narrative on Saputo (it's free!)

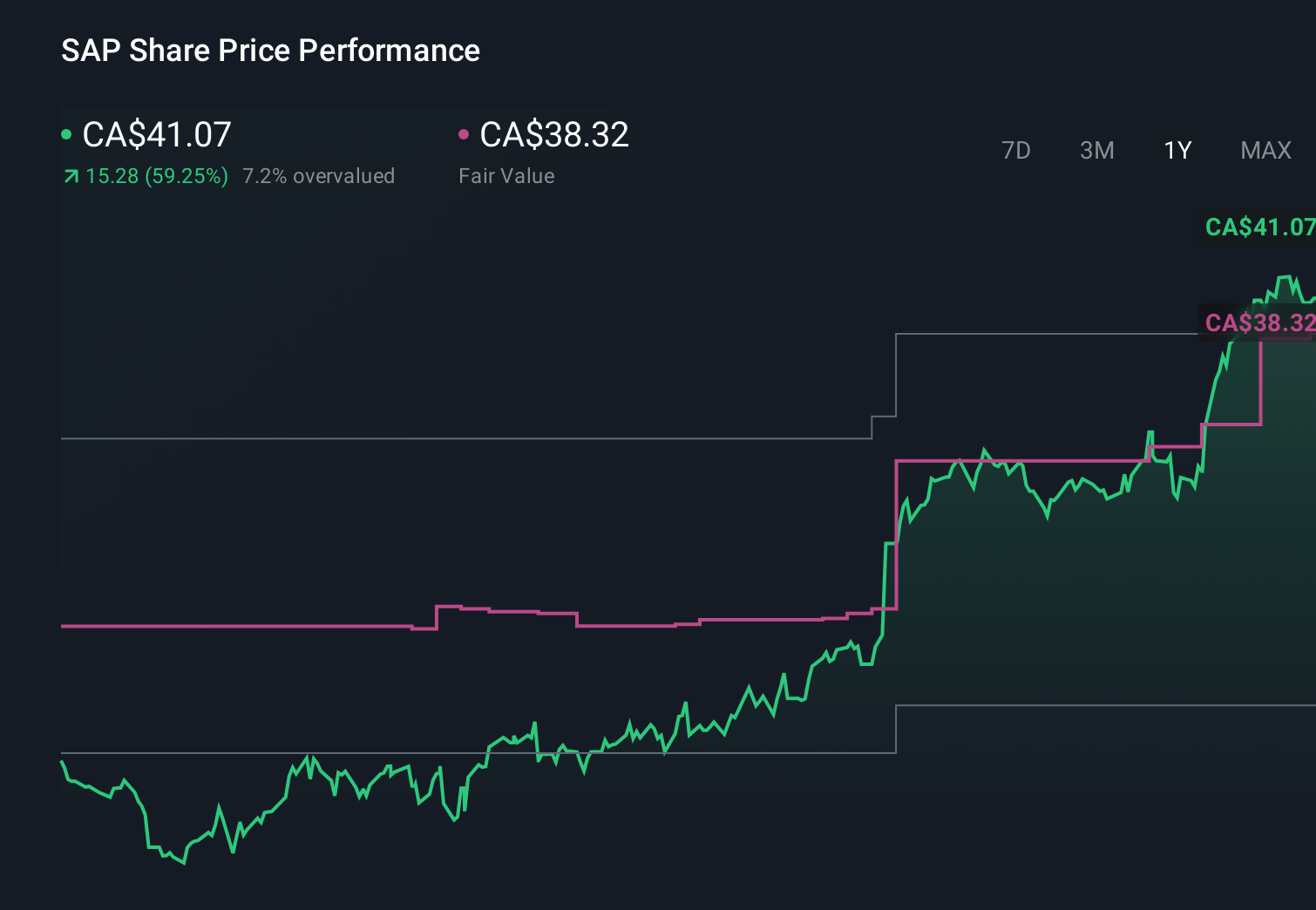

Saputo’s narrative projects CA$20.7 billion revenue and CA$853.8 million earnings by 2028. This requires 2.7% yearly revenue growth and about a CA$1.0 billion earnings increase from CA$-153.0 million today.

Uncover how Saputo's forecasts yield a CA$38.32 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span from C$22.50 to about C$79.70, showing how far apart individual views can be. When you set those opinions against the central risk that dairy demand could be eroded by plant based alternatives, it underlines why many readers may want to explore several different scenarios for Saputo’s future performance.

Explore 7 other fair value estimates on Saputo - why the stock might be worth 45% less than the current price!

Build Your Own Saputo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saputo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Saputo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saputo's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SAP

Saputo

Produces, markets, and distributes dairy products in Canada, the United States, Australia, Argentina, and the United Kingdom.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)