- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

3 TSX Dividend Stocks With Yields Up To 6.3%

Reviewed by Simply Wall St

In the last week, the Canadian market has stayed flat, though it has seen a significant rise of 27% over the past year and earnings are expected to grow by 16% per annum in the coming years. In this context, identifying dividend stocks with strong yields can be an attractive strategy for investors seeking steady income alongside potential capital appreciation.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.84% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.15% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.10% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.26% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.36% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.65% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.13% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.34% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.40% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.25% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

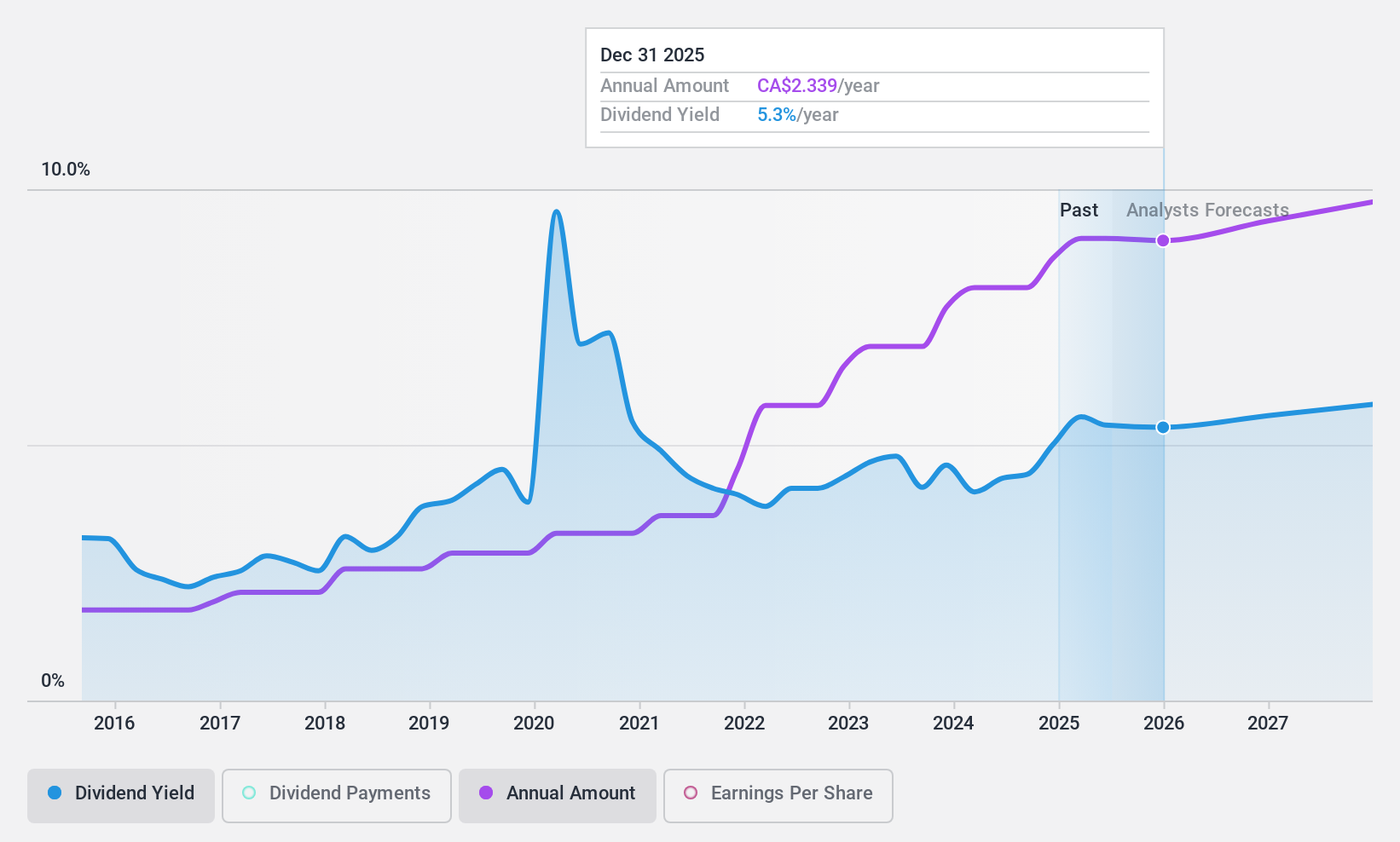

Canadian Natural Resources (TSX:CNQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs), with a market cap of approximately CA$104.39 billion.

Operations: Canadian Natural Resources Limited generates revenue from several segments, including CA$0.98 billion from Midstream and Refining, CA$16.47 billion from Oil Sands Mining and Upgrading, CA$0.52 billion from Exploration and Production in the North Sea, CA$18.15 billion from Exploration and Production in North America, and CA$0.49 billion from Exploration and Production Offshore Africa.

Dividend Yield: 4.3%

Canadian Natural Resources has demonstrated stable and reliable dividend payments over the past decade, with a recent 7% increase to $0.5625 per share effective January 2025. The dividends are well-covered by earnings and cash flows, maintaining payout ratios of around 41-42%. Despite trading below estimated fair value, its dividend yield of 4.25% is lower than top-tier Canadian payers. Recent earnings growth supports sustainability, with revenue reaching C$9 billion in Q2 2024.

- Unlock comprehensive insights into our analysis of Canadian Natural Resources stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Canadian Natural Resources is priced higher than what may be justified by its financials.

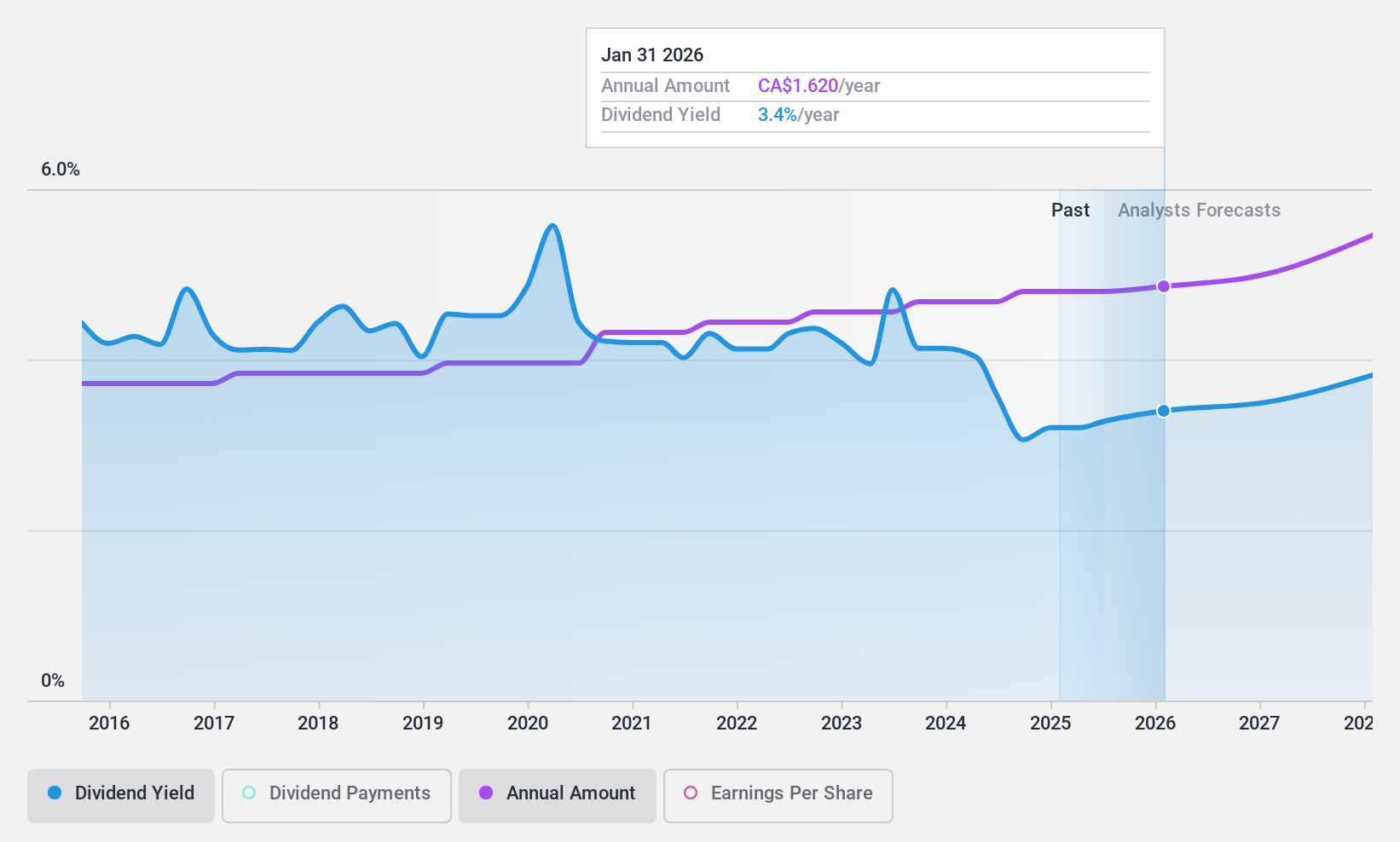

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates retail stores providing food and everyday products to rural and urban markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.44 billion.

Operations: The North West Company Inc. generates CA$2.52 billion in revenue from its retail operations, which include food and everyday products and services across various regions.

Dividend Yield: 3.1%

North West Company has consistently increased its dividends over the past decade, recently raising its quarterly dividend by 2.6% to C$0.40 per share. Dividends remain well-covered by earnings and cash flows, with payout ratios of 56.2% and 71.9%, respectively, indicating sustainability despite significant insider selling in the past quarter. While trading below estimated fair value, its dividend yield of 3.13% is modest compared to top-tier Canadian payers at 6.02%.

- Navigate through the intricacies of North West with our comprehensive dividend report here.

- According our valuation report, there's an indication that North West's share price might be on the cheaper side.

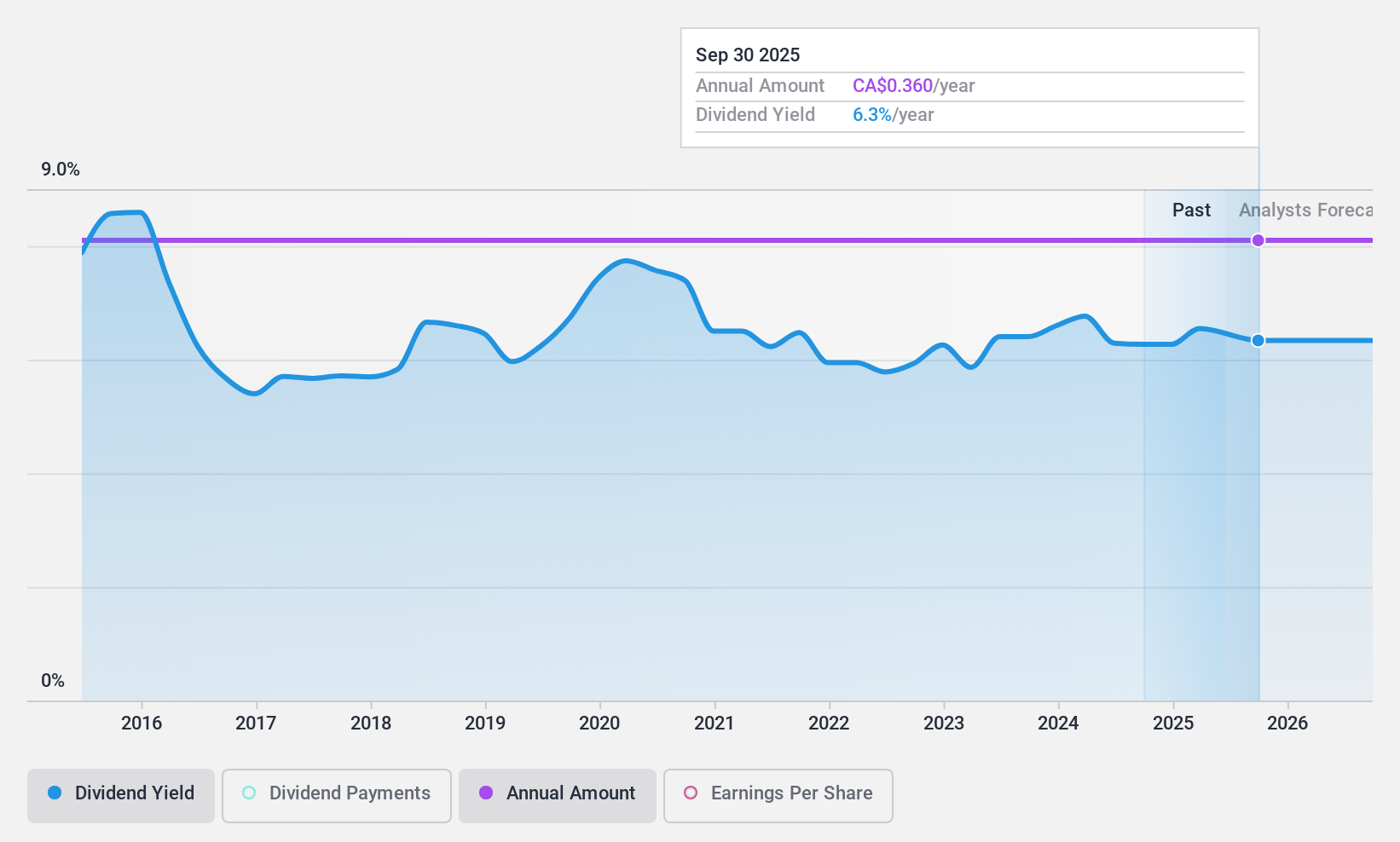

Rogers Sugar (TSX:RSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. is involved in the refining, packaging, marketing, and distribution of sugar and maple products across Canada, the United States, Europe, and internationally with a market cap of CA$720.17 million.

Operations: Rogers Sugar Inc. generates revenue through its two primary segments: Sugar, contributing CA$981.45 million, and Maple Products, accounting for CA$225.32 million.

Dividend Yield: 6.4%

Rogers Sugar's dividend yield of 6.39% ranks in the top 25% among Canadian dividend payers, yet its sustainability is questionable as dividends are not covered by free cash flows. Despite stable dividends over the past decade, there has been no growth in payments, and recent shareholder dilution raises concerns. The company reported declining net income for Q3 2024 compared to the previous year, although it remains profitable with a payout ratio of 86%.

- Dive into the specifics of Rogers Sugar here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Rogers Sugar is priced lower than what may be justified by its financials.

Where To Now?

- Discover the full array of 29 Top TSX Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet established dividend payer.