- Canada

- /

- Oil and Gas

- /

- TSXV:ORC.B

Here's Why I Think Orca Energy Group (CVE:ORC.B) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Orca Energy Group (CVE:ORC.B). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Orca Energy Group

Orca Energy Group's Improving Profits

Over the last three years, Orca Energy Group has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Orca Energy Group's EPS shot from US$0.43 to US$1.10, over the last year. You don't see 154% year-on-year growth like that, very often.

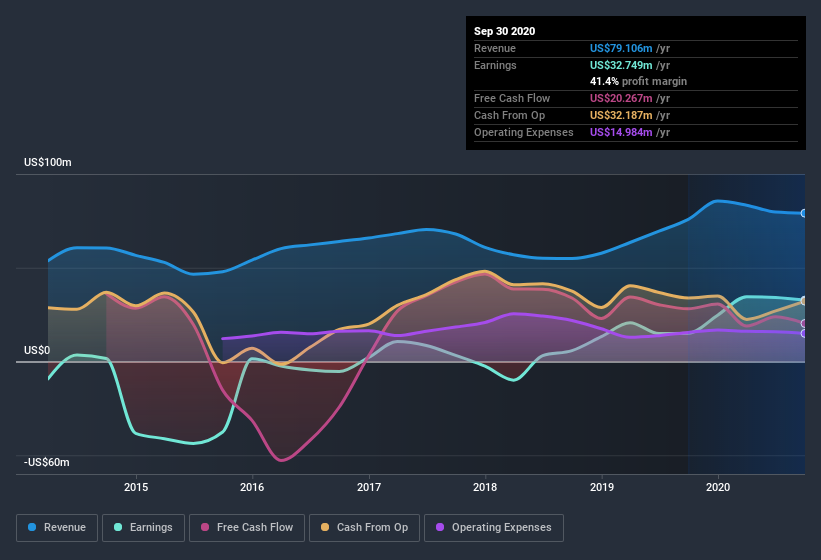

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Orca Energy Group maintained stable EBIT margins over the last year, all while growing revenue 4.2% to US$79m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Orca Energy Group isn't a huge company, given its market capitalization of CA$200m. That makes it extra important to check on its balance sheet strength.

Are Orca Energy Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last twelve months Orca Energy Group insiders spent US$52k on stock; good news for shareholders. While this isn't much, we also note an absence of sales. Zooming in, we can see that the biggest insider purchase was by Chief Financial Officer Blaine Karst for CA$36k worth of shares, at about CA$5.09 per share.

It's reassuring that Orca Energy Group insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like Orca Energy Group with market caps between US$100m and US$400m is about US$460k.

The Orca Energy Group CEO received total compensation of just US$161k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Orca Energy Group Deserve A Spot On Your Watchlist?

Orca Energy Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that Orca Energy Group is at an inflection point, given the EPS growth. For those chasing fast growth, then, I'd suggest to stock merits monitoring. What about risks? Every company has them, and we've spotted 3 warning signs for Orca Energy Group (of which 1 is concerning!) you should know about.

As a growth investor I do like to see insider buying. But Orca Energy Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Orca Energy Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ORC.B

Orca Energy Group

Engages in the exploration, development, production, and supply of petroleum and natural gas to the power and industrial sectors in Tanzania.

Flawless balance sheet slight.