- Canada

- /

- Metals and Mining

- /

- TSXV:CHY.H

Could Cypress Hills Resource Corp.'s (CVE:CHY.H) Investor Composition Influence The Stock Price?

Every investor in Cypress Hills Resource Corp. (CVE:CHY.H) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

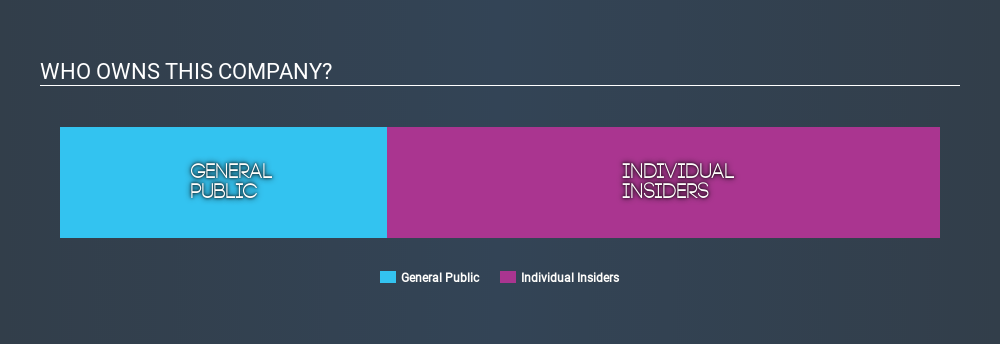

Cypress Hills Resource is not a large company by global standards. It has a market capitalization of CA$847k, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions don't own shares in the company. Let's take a closer look to see what the different types of shareholder can tell us about Cypress Hills Resource.

View our latest analysis for Cypress Hills Resource

What Does The Lack Of Institutional Ownership Tell Us About Cypress Hills Resource?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. Cypress Hills Resource might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Cypress Hills Resource is not owned by hedge funds. The company's CEO Ted Fostey is the largest shareholder with 34% of shares outstanding. Brian Bayley is the second largest shareholder with 16% of common stock, followed by Alistair Sinclair, holding 12% of the stock.

Additionally, we found that 2 of the top shareholders have a considerable amount of ownership in the company, via their 50% stake.

While studying institutional ownership for a company can add value to your research, It is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Cypress Hills Resource

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders own more than half of Cypress Hills Resource Corp.. This gives them effective control of the company. So they have a CA$531k stake in this CA$847k business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public holds a 37% stake in CHY.H. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Cypress Hills Resource better, we need to consider many other factors.

For example, we've discovered 5 warning signs for Cypress Hills Resource (of which 4 are major) which any shareholder or potential investor should be aware of.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

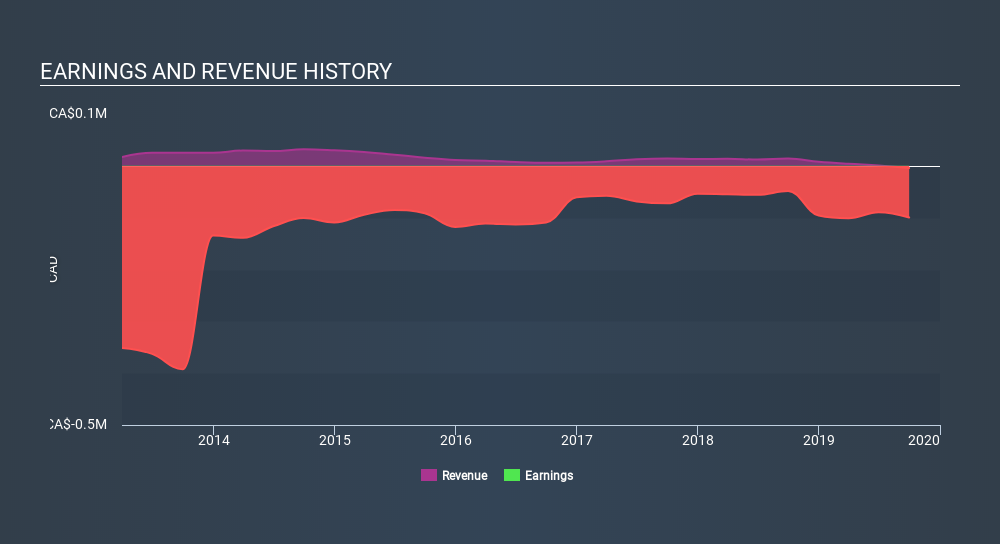

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:CHY.H

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)