- Canada

- /

- Oil and Gas

- /

- TSX:VET

Vermilion Energy (TSX:VET) Reports Q3 Earnings and Announces CAD 0.12 Dividend for Shareholders

Reviewed by Simply Wall St

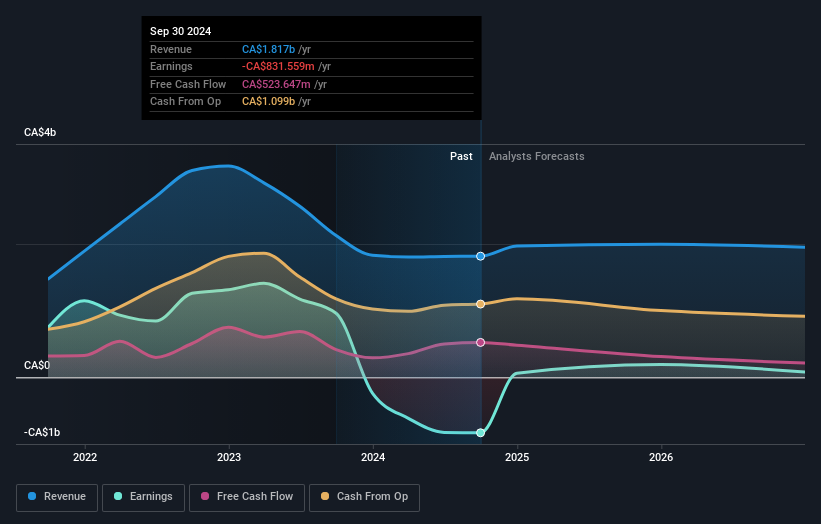

Vermilion Energy (TSX:VET) is navigating a complex environment with promising developments and notable challenges. The company recently reported a decrease in third-quarter earnings, highlighting ongoing financial pressures, yet it continues to make strides in operational advancements, particularly in Germany and Croatia. As Vermilion Energy seeks to capitalize on its assets and address its financial vulnerabilities, readers can expect a detailed discussion on its strategic initiatives, financial performance, and market positioning.

Get an in-depth perspective on Vermilion Energy's performance by reading our analysis here.

Key Assets Propelling Vermilion Energy Forward

Vermilion Energy is on a promising trajectory with expectations to turn profitable within three years, supported by a forecasted profit growth that surpasses market averages. The company's financial health is reinforced by a satisfactory net debt to equity ratio of 24.7%, ensuring stability. Insider confidence is evident through substantial insider buying, indicating management's belief in the company's future. Additionally, the company is trading at a Price-To-Sales Ratio of 1.2x, considerably lower than the industry average of 2x, suggesting potential undervaluation.

Vulnerabilities Impacting Vermilion Energy

However, Vermilion faces challenges, notably its current unprofitability, complicating performance comparisons. The revenue growth forecast of 0.3% per year lags behind the market's 6.9% growth rate, reflecting a need for strategic adjustments. Dividend payments remain volatile and are not backed by earnings or cash flows, with a return on equity at -28.89%. Furthermore, the dividend yield of 3.5% is less attractive compared to top-tier payers at 6.12%.

Areas for Expansion and Innovation for Vermilion Energy

Opportunities abound as Vermilion's earnings are projected to grow significantly by 76.15% annually, with analysts predicting a 29.7% increase in stock price. The company is actively exploring market expansion in Eastern Europe, which could drive future growth. Recent product-related announcements highlight successful testing operations in Germany and increased production in Croatia, showcasing Vermilion's commitment to leveraging its assets for enhanced market presence.

Regulatory Challenges Facing Vermilion Energy

Despite these prospects, Vermilion must navigate potential economic headwinds and supply chain issues that threaten operational efficiency. The company is also cautious of regulatory hurdles that could arise, despite seeing opportunities in upcoming changes. These external factors necessitate vigilant management to safeguard growth and market share.

Conclusion

Vermilion Energy is poised for a promising turnaround, with expectations to achieve profitability within three years, driven by a profit growth forecast that exceeds market averages. The company's financial stability is underscored by a net debt to equity ratio of 24.7%, and insider confidence is bolstered by significant insider buying, reflecting management's positive outlook. Despite current challenges such as unprofitability and slow revenue growth, Vermilion's strategic expansion into Eastern Europe and successful operations in Germany and Croatia indicate potential for substantial earnings growth of 76.15% annually. Furthermore, trading at a Price-To-Sales Ratio of 1.2x, well below both the industry and peer averages, suggests the stock may be attractively priced, offering a compelling opportunity for investors as the company navigates economic and regulatory challenges.

Next Steps

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:VET

Vermilion Energy

Engages in the acquisition, exploration, development, and optimization of producing properties in North America, Europe, and Australia.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives