- Canada

- /

- Oil and Gas

- /

- TSX:URE

Swelling losses haven't held back gains for Ur-Energy (TSE:URE) shareholders since they're up 87% over 5 years

The Ur-Energy Inc. (TSE:URE) share price has had a bad week, falling 10%. On the bright side the returns have been quite good over the last half decade. After all, the share price is up a market-beating 87% in that time.

Although Ur-Energy has shed CA$70m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Ur-Energy

Ur-Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade Ur-Energy's revenue has actually been trending down at about 29% per year. Despite the lack of revenue growth, the stock has returned a respectable 13%, compound, over that time. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

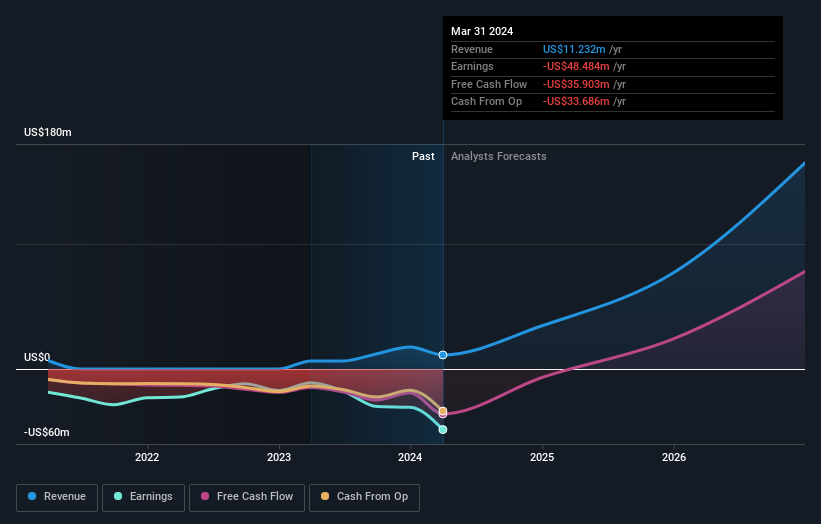

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Ur-Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Ur-Energy shareholders have received a total shareholder return of 57% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Ur-Energy you should be aware of, and 1 of them is a bit concerning.

Of course Ur-Energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:URE

Ur-Energy

Engages in the uranium mining, recovery and processing activities, including the acquisition, exploration, development and operation of uranium mineral properties in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives