- Canada

- /

- Oil and Gas

- /

- TSX:URE

Can Ur-Energy's (TSX:URE) Industry Outreach Strengthen Its Position in the Nuclear Investment Story?

Reviewed by Sasha Jovanovic

- Ur-Energy Inc. recently participated in TD Cowen’s 10th Annual Nuclear Fuel Cycle and Next Generation Nuclear Roundtable, where CEO John W. Cash presented to industry peers on October 9, 2025.

- This platform provided Ur-Energy with an opportunity to highlight its role within the evolving nuclear fuel sector, potentially shaping perceptions among sector stakeholders and analysts.

- We’ll explore how Ur-Energy’s engagement at this influential industry conference supports its positioning in the broader nuclear investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ur-Energy's Investment Narrative?

Being a shareholder in Ur-Energy means being bought in on the thesis that uranium demand and the broader nuclear sector’s momentum can offset the company’s persistent losses and premium valuation. The company’s recent presence at TD Cowen’s Nuclear Fuel Cycle and Next Generation Nuclear Roundtable gives it a chance to elevate its profile with influential peers, but this type of visibility rarely alters short-term catalysts such as production rates, contract wins, or uranium market movements. What continues to matter most are improvements at Lost Creek and Shirley Basin, successful delivery under multi-year contracts, and the ongoing challenge of turning growing sales into profits. Risks like unprofitability, limited cash runway, and substantial insider selling remain in the foreground, even as market enthusiasm has driven the stock price higher in recent months. For now, the latest conference appearance seems unlikely to materially shift the company’s near-term risk or opportunity profile on its own.

On the other hand, persistent unprofitability could impact Ur-Energy’s future capital needs.

Ur-Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

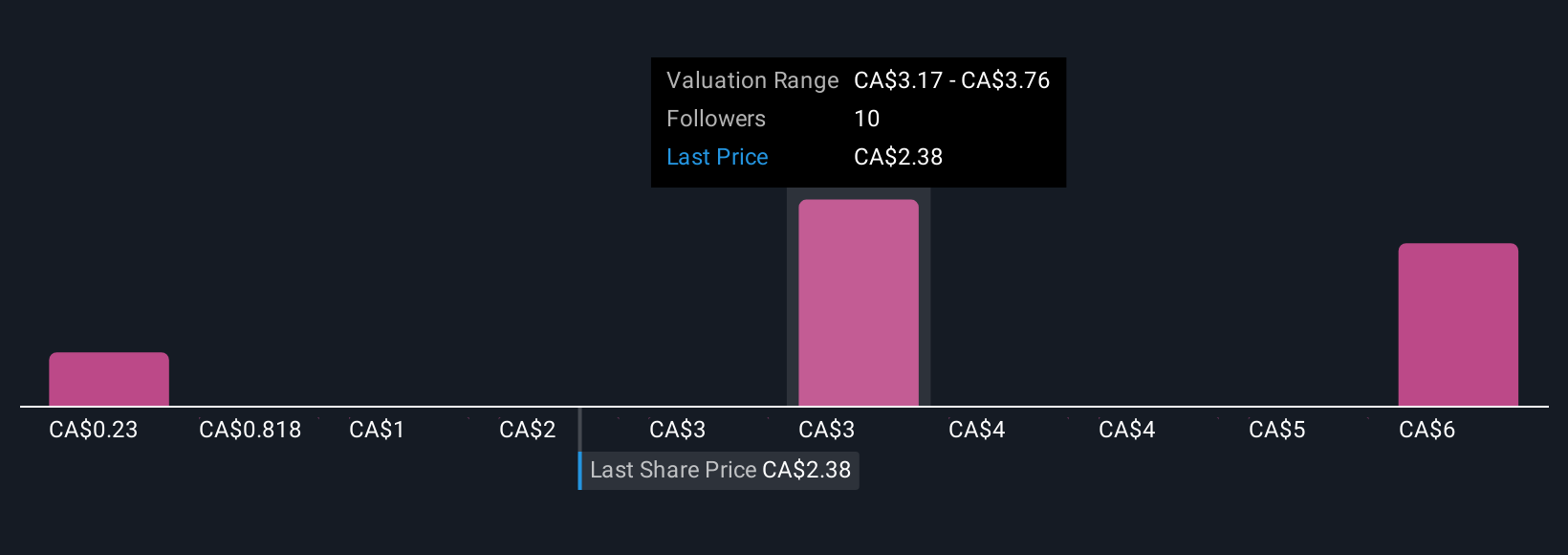

Six individual fair value estimates compiled by the Simply Wall St Community range from as low as CA$0.23 to more than CA$8.32 per share, showing just how much opinions can diverge. While this disagreement suggests considerable uncertainty about the company's underlying worth, it’s the ongoing challenge of rising net losses that remains central to the overall outlook. Take a closer look at these diverse viewpoints to better understand where expectations align or diverge for Ur-Energy.

Explore 6 other fair value estimates on Ur-Energy - why the stock might be worth less than half the current price!

Build Your Own Ur-Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ur-Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ur-Energy's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives