- Canada

- /

- Oil and Gas

- /

- TSX:TVE

Tamarack Valley Energy (TSX:TVE) Reports Strong Q3 Earnings Growth; Declares New Dividend

Reviewed by Simply Wall St

Tamarack Valley Energy (TSX:TVE) has reported an impressive 144.1% earnings growth for the past year, significantly boosting its net profit margin to 15.2%. Despite facing a low return on equity and a notable one-off loss of CA$83.2 million, the company remains optimistic with insider buying and a projected target price over 20% higher than its current share price. Readers can expect a detailed analysis of Tamarack's strategic initiatives and potential growth opportunities amidst market challenges.

Dive into the specifics of Tamarack Valley Energy here with our thorough analysis report.

Unique Capabilities Enhancing Tamarack Valley Energy's Market Position

With a remarkable 144.1% earnings growth over the past year, Tamarack Valley Energy Ltd. showcases its financial health and operational efficiency. The company's net profit margin has improved significantly to 15.2% from 6.3% the previous year, reflecting strong profitability. The experienced management team, with an average tenure of four years, has been instrumental in driving these results, leveraging their expertise to navigate market challenges effectively. Additionally, substantial insider buying in the past three months signals strong internal confidence in the company's strategic direction. However, Tamarack's current trading at a Price-To-Earnings Ratio of 11x, above the industry average, suggests a premium valuation that may reflect its strong market position.

To dive deeper into how Tamarack Valley Energy's valuation metrics are shaping its market position, check out our detailed analysis of Tamarack Valley Energy's Valuation.Critical Issues Affecting the Performance of Tamarack Valley Energy and Areas for Growth

Tamarack faces certain challenges, including a low return on equity of 9.7%, which falls short of the 20% threshold. The recent financial results were also impacted by a significant one-off loss of CA$83.2 million. Furthermore, the company's dividend yield of 3.39% remains below the market's top-tier payers, raising questions about its attractiveness to income-focused investors. These financial challenges highlight areas where Tamarack needs to focus on improving efficiency and profitability to align with industry standards.

Learn about Tamarack Valley Energy's dividend strategy and how it impacts shareholder returns and financial stability.Emerging Markets Or Trends for Tamarack Valley Energy

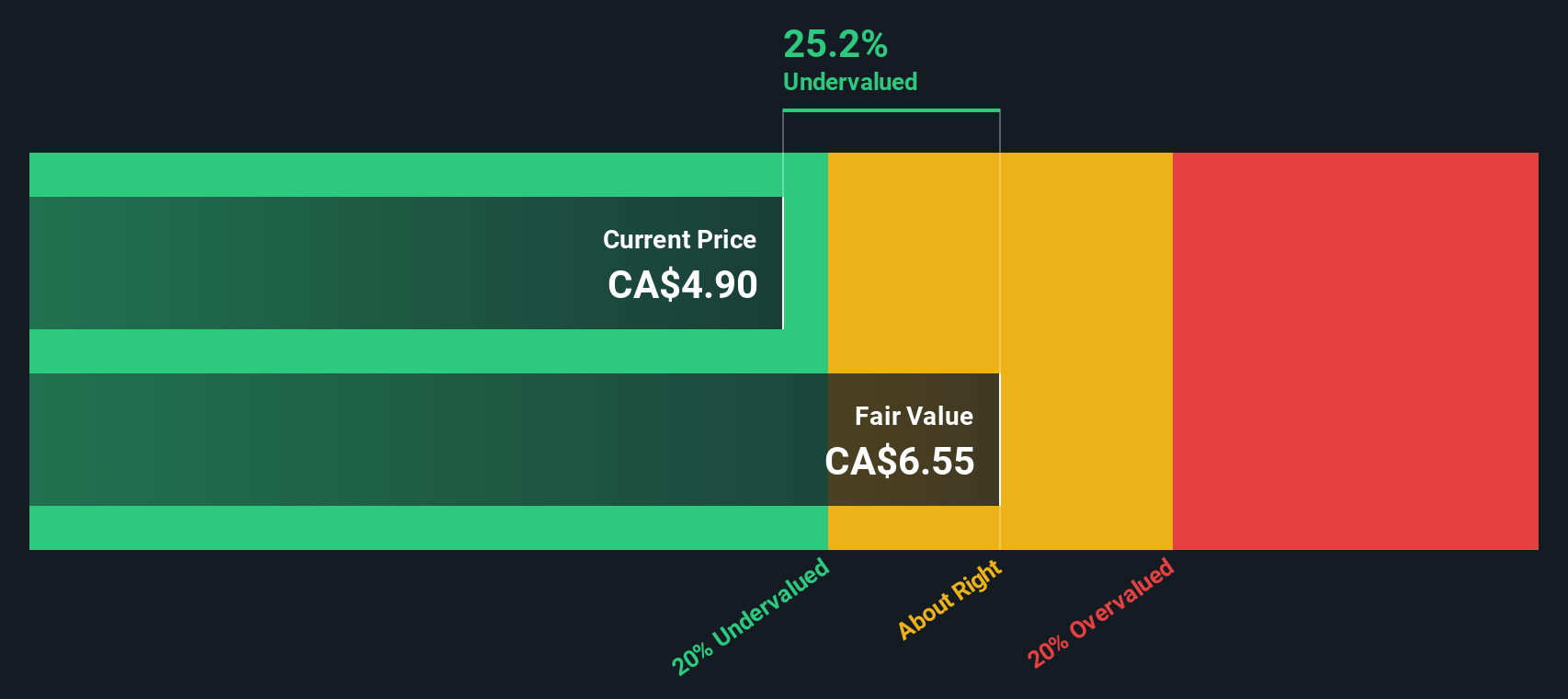

Looking ahead, Tamarack has several opportunities to capitalize on. Analysts predict a target price over 20% higher than the current share price, indicating potential for growth. Trading below its estimated fair value of CA$4.98, the company is well-positioned for price appreciation. Additionally, despite forecasts of a 3% revenue decline over the next three years, there is potential for revenue and profit recovery, driven by strategic investments and market expansion efforts.

To gain deeper insights into Tamarack Valley Energy's historical performance, explore our detailed analysis of past performance.Competitive Pressures and Market Risks Facing Tamarack Valley Energy

However, Tamarack must navigate external threats, including economic headwinds and intense market competition. The company is sensitive to fluctuations in oil prices, which could impact revenue. Moreover, regulatory challenges pose potential hurdles, necessitating strategic planning to ensure compliance and cost management. These factors underscore the need for Tamarack to remain agile and innovative to sustain its competitive edge and market position.

See what the latest analyst reports say about Tamarack Valley Energy's future prospects and potential market movements.Conclusion

Tamarack Valley Energy's impressive earnings growth and improved net profit margin highlight its financial health and operational efficiency, driven by a capable management team. This performance has instilled confidence, as evidenced by recent insider buying, suggesting a positive outlook for the company's strategic direction. However, trading at a Price-To-Earnings Ratio of 11x, higher than both industry and peer averages, indicates that the market recognizes Tamarack's strong position but may also see it as relatively expensive. The company faces challenges such as a low return on equity and a significant one-off loss, which it must address to enhance profitability and attract income-focused investors. Looking forward, Tamarack has opportunities for growth, with analysts predicting a higher target price and potential for recovery through strategic investments, though it must remain vigilant against external threats like oil price fluctuations and regulatory challenges to maintain its competitive edge.

Key Takeaways

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Tamarack Valley Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TVE

Tamarack Valley Energy

Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

Proven track record and fair value.

Market Insights

Community Narratives