- Canada

- /

- Oil and Gas

- /

- TSX:TOU

January 2025's Noteworthy Stocks Estimated To Be Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, including declining U.S. consumer confidence and fluctuating stock indices, investors are increasingly focused on identifying opportunities that may be undervalued amidst this volatility. In such an environment, stocks estimated to be below their fair value can present compelling opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lundin Gold (TSX:LUG) | CA$31.92 | CA$63.81 | 50% |

| Tourmaline Oil (TSX:TOU) | CA$67.37 | CA$134.34 | 49.9% |

| Bank BTPN Syariah (IDX:BTPS) | IDR935.00 | IDR1869.73 | 50% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7284.35 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.25 | US$84.44 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.76 | €5.50 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.80 | SEK123.12 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.87 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

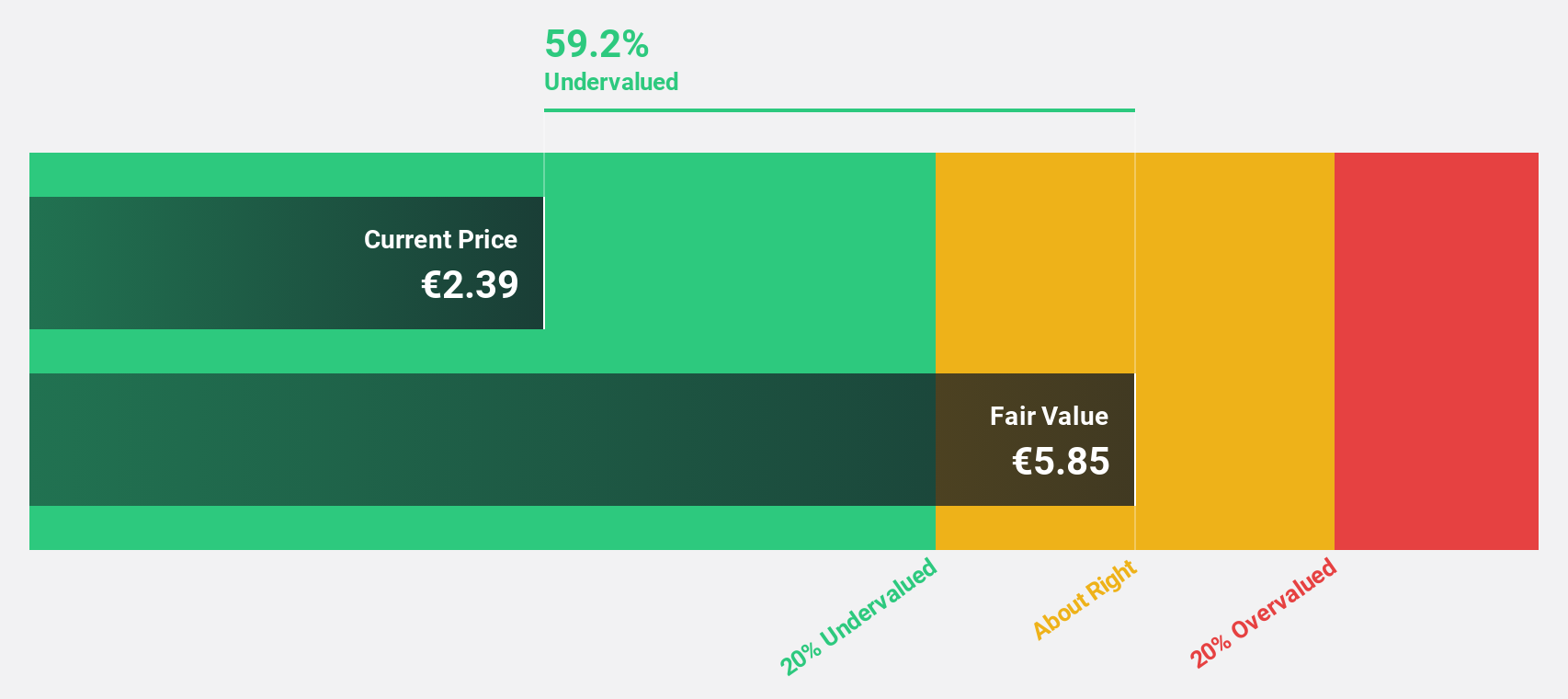

Saipem (BIT:SPM)

Overview: Saipem SpA is a global provider of energy and infrastructure solutions with a market cap of €5.21 billion.

Operations: The company generates revenue from various segments, including Energy Carriers (€5.87 billion), Offshore Drilling (€1.40 billion), and Asset Based Services (€10.86 billion).

Estimated Discount To Fair Value: 43.1%

Saipem is trading at €2.66, significantly below its estimated fair value of €4.68, suggesting it may be undervalued based on cash flows. Despite forecasted revenue growth lagging the Italian market at 1.7% per year, earnings are expected to grow substantially at 25.2% annually over the next three years, outpacing the market's 6.9%. Saipem became profitable this year and has a high projected return on equity of 22.1% in three years.

- Our comprehensive growth report raises the possibility that Saipem is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Saipem.

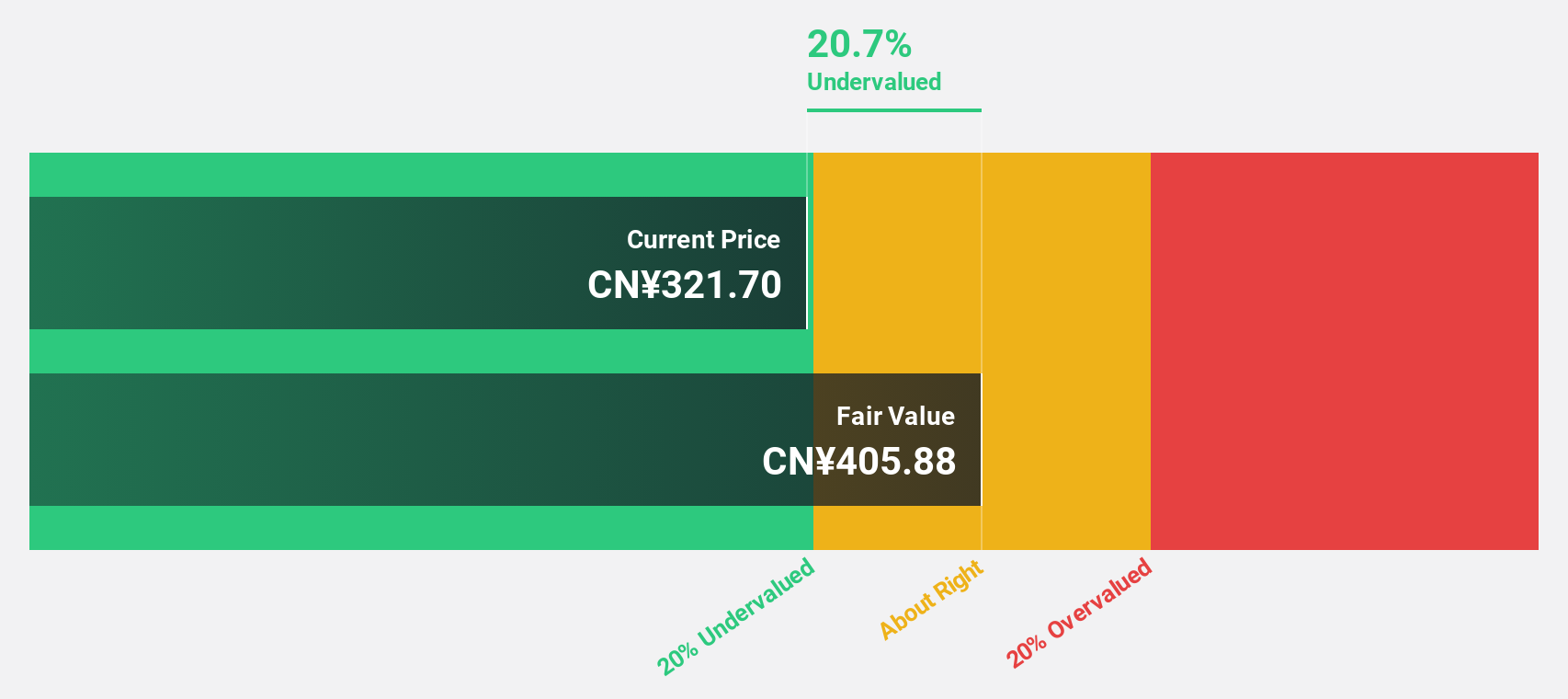

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. manufactures beverages in China and has a market cap of CN¥128.67 billion.

Operations: The company generates revenue of CN¥15.18 billion from the production, sales, and wholesale of beverages and pre-packaged foods in China.

Estimated Discount To Fair Value: 23.9%

Eastroc Beverage is trading at CN¥247.44, below its fair value estimate of CN¥325.2, highlighting potential undervaluation based on cash flows. Recent earnings for the nine months ended September 2024 show significant growth, with sales reaching CN¥12.56 billion and net income at CN¥2.71 billion, both up from the previous year. Revenue is expected to grow 22.4% annually, outpacing the Chinese market's 13.6%, though earnings growth may lag slightly behind market expectations.

- In light of our recent growth report, it seems possible that Eastroc Beverage(Group)'s financial performance will exceed current levels.

- Get an in-depth perspective on Eastroc Beverage(Group)'s balance sheet by reading our health report here.

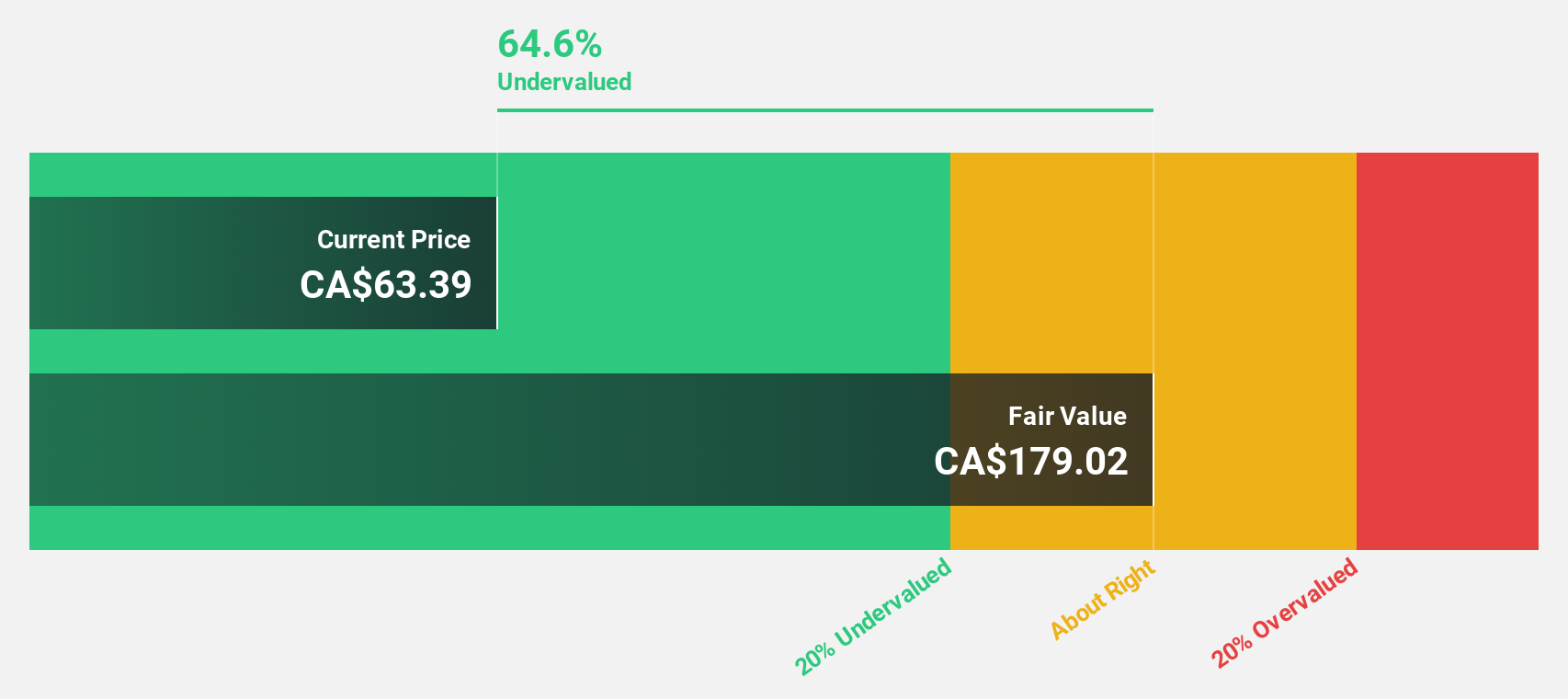

Tourmaline Oil (TSX:TOU)

Overview: Tourmaline Oil Corp. is engaged in the exploration and development of oil and natural gas properties within the Western Canadian Sedimentary Basin, with a market cap of approximately CA$24.84 billion.

Operations: The company generates revenue primarily from its petroleum and natural gas properties, amounting to CA$4.48 billion.

Estimated Discount To Fair Value: 49.9%

Tourmaline Oil, trading at CA$67.37, is significantly undervalued with a fair value estimate of CA$134.34 based on discounted cash flow analysis. Despite a dividend yield of 5.79% not being well-covered by free cash flows, the company demonstrates robust growth prospects with earnings expected to rise 25.66% annually over the next three years, outpacing the Canadian market's growth rate. However, recent insider selling and past shareholder dilution may warrant caution for potential investors.

- Upon reviewing our latest growth report, Tourmaline Oil's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Tourmaline Oil's balance sheet health report.

Turning Ideas Into Actions

- Access the full spectrum of 897 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

High growth potential with adequate balance sheet.