- Canada

- /

- Diversified Financial

- /

- TSX:FN

October 2024's Top Canadian Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex landscape marked by shifting expectations around interest rates and economic productivity, influenced by global trends such as the U.S. Federal Reserve's evolving rate policies and technological advancements. As these factors create both challenges and opportunities, investors are increasingly focused on identifying small-cap stocks that demonstrate resilience and potential for growth amidst these dynamic conditions. In this environment, a good stock often exhibits strong fundamentals, adaptability to changing economic landscapes, and insider confidence through strategic actions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.9x | 0.9x | 20.97% | ★★★★★★ |

| AutoCanada | NA | 0.1x | 40.20% | ★★★★★★ |

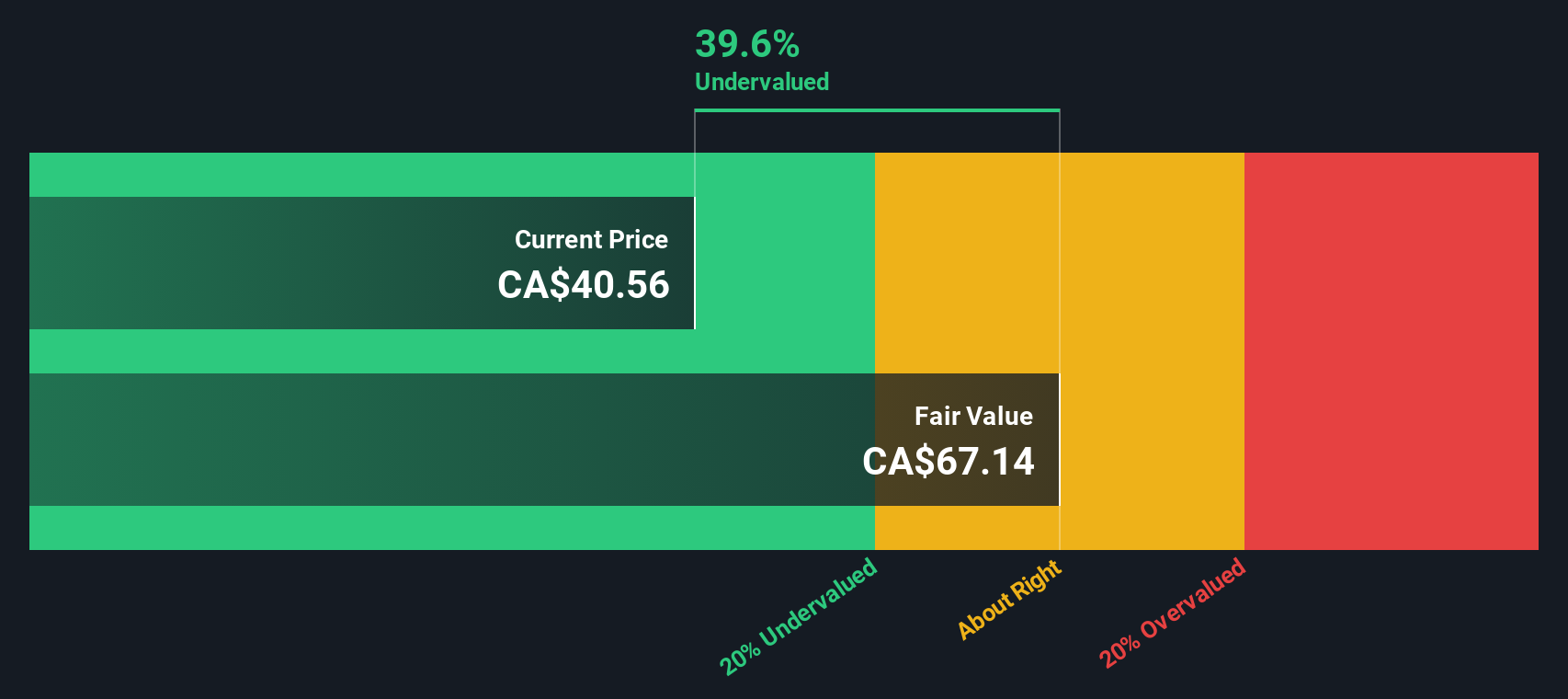

| First National Financial | 13.8x | 3.9x | 42.81% | ★★★★☆☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 19.60% | ★★★★☆☆ |

| Rogers Sugar | 15.3x | 0.6x | 48.45% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.9x | 3.4x | 45.48% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -44.56% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 19.71% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.1x | -202.37% | ★★★★☆☆ |

| StorageVault Canada | NA | 5.2x | -638.86% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First National Financial is a Canadian company specializing in the origination, underwriting, and servicing of residential and commercial mortgages with a market cap of approximately CA$2.31 billion.

Operations: First National Financial generates revenue primarily through its operations, with a notable gross profit margin reaching up to 86.04% as of September 2024. The company's cost of goods sold (COGS) and operating expenses are significant components affecting profitability, with general and administrative expenses consistently being a major part of the operating costs over various periods.

PE: 13.8x

First National Financial, a smaller player in the Canadian market, has demonstrated insider confidence with Stephen J. Smith acquiring 128,614 shares valued at approximately C$4.86 million. Despite recent declines in net income for Q3 2024 to C$36.41 million from C$83.63 million last year, the company has increased its annualized dividend rate to C$2.50 per share and announced a special dividend of C$0.50 per share for December 2024, signaling commitment to shareholder returns amidst challenging times.

- Dive into the specifics of First National Financial here with our thorough valuation report.

Learn about First National Financial's historical performance.

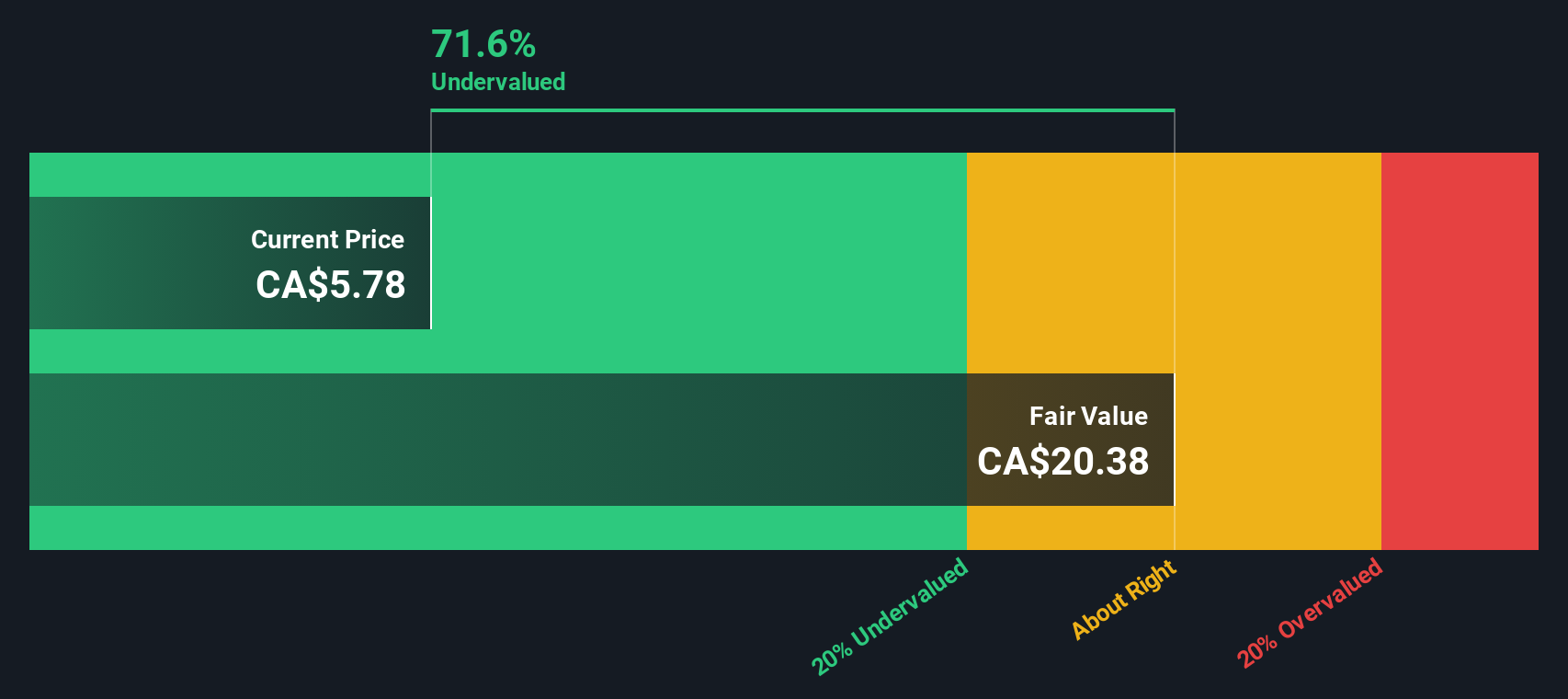

Headwater Exploration (TSX:HWX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Headwater Exploration is engaged in the exploration, development, and production of petroleum and natural gas, with a market cap of CA$1.74 billion.

Operations: Headwater Exploration generates revenue primarily from the exploration, development, and production of petroleum and natural gas. The company's gross profit margin has shown variability over time, with a recent figure of 76.21%. Operating expenses include significant costs such as depreciation and amortization, which amounted to CA$123.69 million in the latest period.

PE: 8.6x

Headwater Exploration, a Canadian energy player, stands out in the small-cap landscape with insider confidence evident from recent share purchases. Despite a forecasted earnings decline averaging 10.9% annually over the next three years, insiders have shown faith in its potential by buying shares this year. However, reliance on external borrowing for funding adds risk to its financial structure. Recent conference presentations in Calgary and Toronto highlight their proactive engagement with investors and industry peers.

- Delve into the full analysis valuation report here for a deeper understanding of Headwater Exploration.

Understand Headwater Exploration's track record by examining our Past report.

Trican Well Service (TSX:TCW)

Simply Wall St Value Rating: ★★★★★★

Overview: Trican Well Service is a Canadian company that provides oilfield services focusing on hydraulic fracturing, cementing, and other pressure pumping services, with a market capitalization of approximately CA$1.28 billion.

Operations: Trican Well Service generates revenue primarily through its operations, with a notable gross profit margin trend showing an increase from -25.69% in 2016 to 28.22% by mid-2023. The company's cost structure is heavily influenced by cost of goods sold (COGS), which consistently forms a significant portion of total expenses, impacting overall profitability. Operating expenses remain substantial but show some variability over the periods analyzed, influencing net income outcomes alongside non-operating expenses and depreciation & amortization costs.

PE: 7.9x

Trican Well Service, a player in Canada's energy sector, has caught attention with its strategic moves. The company's recent buyback program is set to reclaim 9.90% of its shares by October 2025, having already repurchased over 10% for C$94.7 million as of early October 2024. Insider confidence is evident with CFO Scott Matson purchasing 27,000 shares for C$130k recently, reflecting belief in potential growth despite reliance on riskier external funding sources and an expected earnings growth rate of 8.85%.

- Take a closer look at Trican Well Service's potential here in our valuation report.

Explore historical data to track Trican Well Service's performance over time in our Past section.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 21 Undervalued TSX Small Caps With Insider Buying now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FN

First National Financial

First National Financial Corporation, together with its subsidiaries, originates, underwrites, and services commercial and residential mortgages in Canada.

Established dividend payer and good value.