- Canada

- /

- Oil and Gas

- /

- TSX:RGSI

Evaluating Rockpoint Gas Storage (TSX:RGSI): Is the Stock Undervalued After Recent Trading Consolidation?

Reviewed by Kshitija Bhandaru

Rockpoint Gas Storage (TSX:RGSI) is trading flat today, with no major headlines or earnings updates moving the stock so far. Investors may be watching for new developments or shifts in sector sentiment that could impact the shares.

See our latest analysis for Rockpoint Gas Storage.

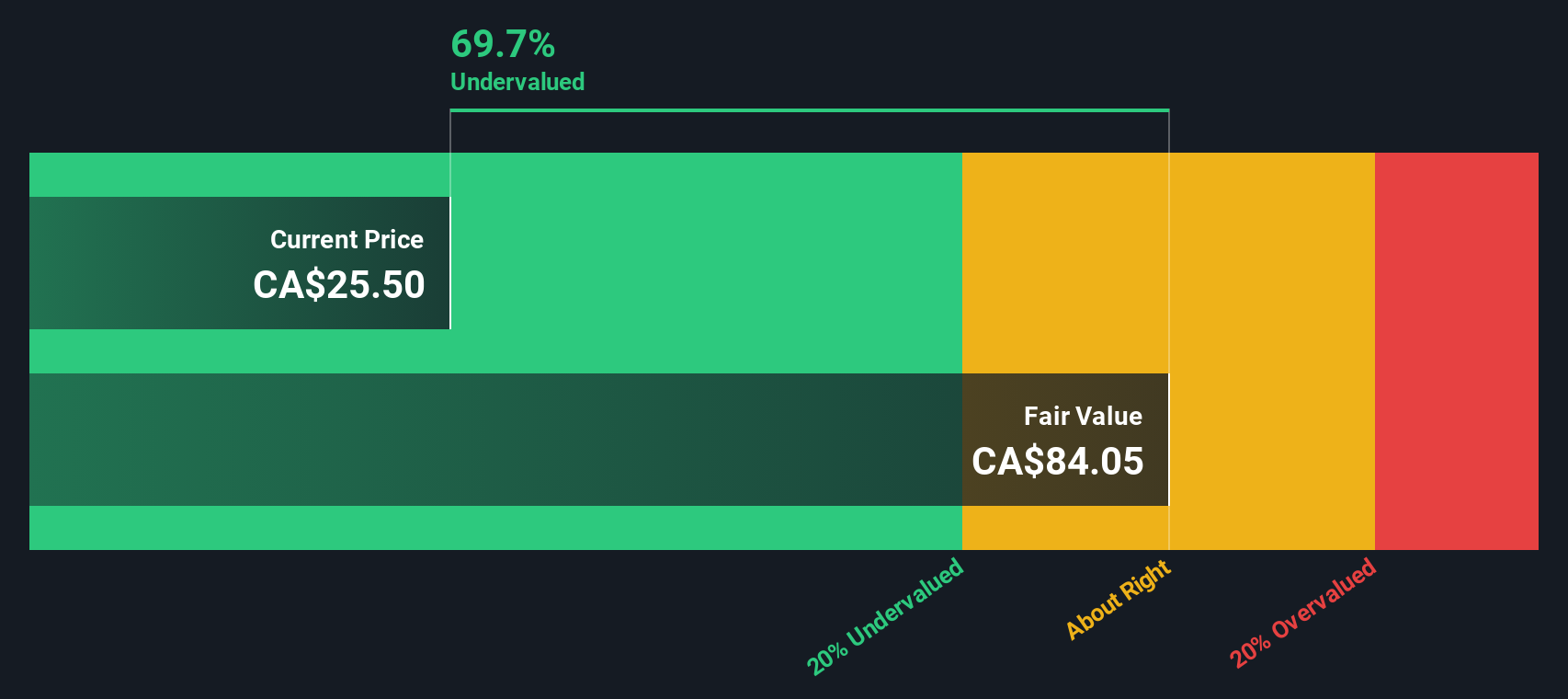

With Rockpoint Gas Storage holding steady at $25.5 per share, its recent trading patterns reflect a period of consolidation after earlier volatility. Momentum appears subdued for now, as investors weigh long-term energy demand against prevailing market caution on valuations.

If you're looking to broaden your horizons beyond the usual names, it could be the perfect time to discover fast growing stocks with high insider ownership.

But with Rockpoint Gas Storage trading near steady levels and sporting a value score of 4, investors may wonder if the stock is now undervalued and positioned for potential upside, or if the market has already taken its growth potential into account.

Price-to-Earnings of 4.6x: Is it justified?

Rockpoint Gas Storage’s shares are trading at a price-to-earnings (P/E) ratio of 4.6, a figure that is dramatically lower than industry and peer averages. With the last close at CA$25.5 per share, this low multiple signals that the market may be underestimating the company’s current earnings potential or future growth.

The price-to-earnings ratio shows how much investors are willing to pay today for one dollar of earnings. In sectors like oil and gas, where earnings can swing with commodity cycles, a low P/E can highlight perception of risk, skepticism about sustainability of profit margins, or overlooked growth opportunities.

Rockpoint Gas Storage’s P/E is not only well below the Canadian oil and gas industry average of 11.9x, but it is also far beneath its direct peer group’s average of 20.3x. By comparison, this sharp discount suggests the market may be missing key catalysts or is cautious due to the company’s earnings history and recent volatility.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 4.6x (UNDERVALUED)

However, stagnant revenue and net income growth, along with limited recent stock returns, could mean that valuation concerns linger for cautious investors.

Find out about the key risks to this Rockpoint Gas Storage narrative.

Another View: Discounted Cash Flow (DCF) Perspective

Looking at Rockpoint Gas Storage through the SWS DCF model provides a different perspective. Using this approach, the shares appear to be trading around 70% below their estimated fair value of CA$84.05. This indicates potential undervaluation beyond what the low price-to-earnings ratio alone suggests.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rockpoint Gas Storage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rockpoint Gas Storage Narrative

If you want to dig deeper or see things from your own angle, take a few minutes to create a custom narrative and shape your outlook. Do it your way

A great starting point for your Rockpoint Gas Storage research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by searching for fresh opportunities. Don’t miss the chance to spot stocks you might have overlooked with powerful screeners designed for your goals.

- Tap into some of the market’s most promising up-and-comers by reviewing these 3585 penny stocks with strong financials and see which companies are making waves with critical financial strength.

- Target attractive yields and steady returns by checking out these 19 dividend stocks with yields > 3%, which highlights stocks paying dividends above 3% for consistent income potential.

- Uncover real value hiding in plain sight with these 892 undervalued stocks based on cash flows, focusing on businesses trading below their fair value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RGSI

Rockpoint Gas Storage

Owns and operates natural gas storage infrastructure facilities in North America.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives