The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Parex Resources (TSE:PXT), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Parex Resources

How Fast Is Parex Resources Growing Its Earnings Per Share?

Over the last three years, Parex Resources has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Parex Resources' EPS skyrocketed from US$3.85 to US$4.95, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 28%.

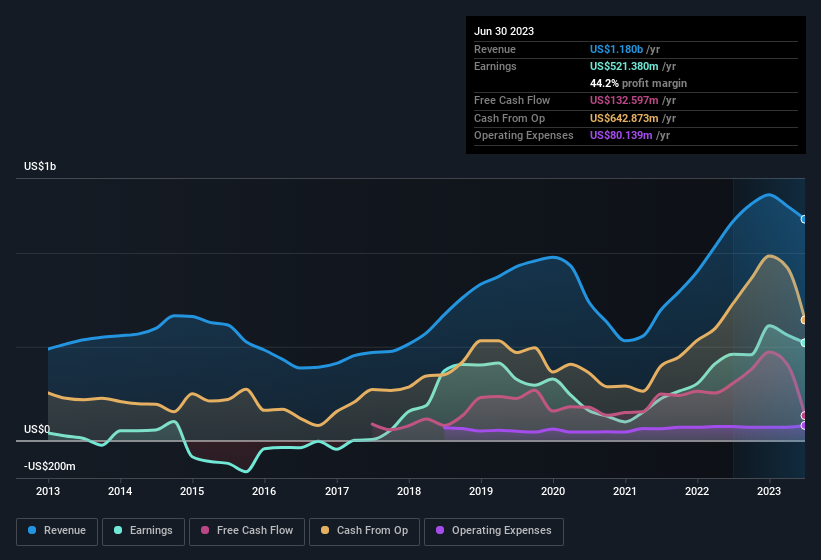

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Parex Resources' EBIT margins are down, it's not all bad news as revenues are at least stable. Shareholders will be hopeful that the company can buck this trend.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Parex Resources.

Are Parex Resources Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Parex Resources shares worth a considerable sum. Indeed, they hold US$52m worth of its stock. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 2.0%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Parex Resources Deserve A Spot On Your Watchlist?

For growth investors, Parex Resources' raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Parex Resources (at least 1 which is a bit concerning) , and understanding these should be part of your investment process.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PXT

Parex Resources

Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives