- Canada

- /

- Energy Services

- /

- TSX:PSD

Pulse Seismic (TSX:PSD): Assessing Valuation After Q3 Results and Dividend Announcement

Reviewed by Simply Wall St

Pulse Seismic (TSX:PSD) just released its third quarter 2025 results, highlighting a net loss for the quarter but a much stronger net income for the first nine months of the year compared to last year. The company also announced a regular quarterly dividend set for November, which is a key update for investors watching the stock.

See our latest analysis for Pulse Seismic.

Despite some choppy trading in recent weeks, Pulse Seismic’s total shareholder return over the past year stands at a robust 48.5%, and the five-year total return is a remarkable 539%. The share price did pull back 15% in the last month alone as investors digested third quarter results and the updated dividend. However, longer-term holders have enjoyed substantial gains, with momentum generally still above where it started the year.

If you’re ready to look beyond the latest earnings cycle, now’s a great time to broaden your search and explore fast growing stocks with high insider ownership.

With shares down sharply in recent weeks but long-term returns still impressive, the question now is whether Pulse Seismic is trading below its true worth or if the market has already factored in its future growth potential.

Price-to-Earnings of 6.9x: Is it justified?

Pulse Seismic is currently trading at a price-to-earnings (P/E) ratio of just 6.9x, which is substantially lower than both its peers in the sector and the broader market. With a last close price of CA$3.02, the shares are effectively priced at a deep discount based on recent earnings.

The price-to-earnings multiple measures how much investors are paying for each dollar of the company's earnings. It is a quick gauge of whether a stock looks cheap or expensive in relation to profits, and is especially important for companies with established earnings like Pulse Seismic in the Energy Services industry.

Such a low P/E ratio suggests investors may be undervaluing Pulse Seismic's current earnings power. If the company continues to demonstrate solid profitability and growth momentum, there may be room for the market to re-rate the stock higher in the future.

Compared to the North American Energy Services industry average of 16x, Pulse Seismic's P/E is less than half that benchmark. This marks the company as one of the best-value names in its peer group and signals strong relative undervaluation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.9x (UNDERVALUED)

However, sustained share price volatility or a downturn in the energy sector could quickly put pressure on Pulse Seismic’s attractive valuation.

Find out about the key risks to this Pulse Seismic narrative.

Another Perspective: Discounted Cash Flow Tells a Different Story

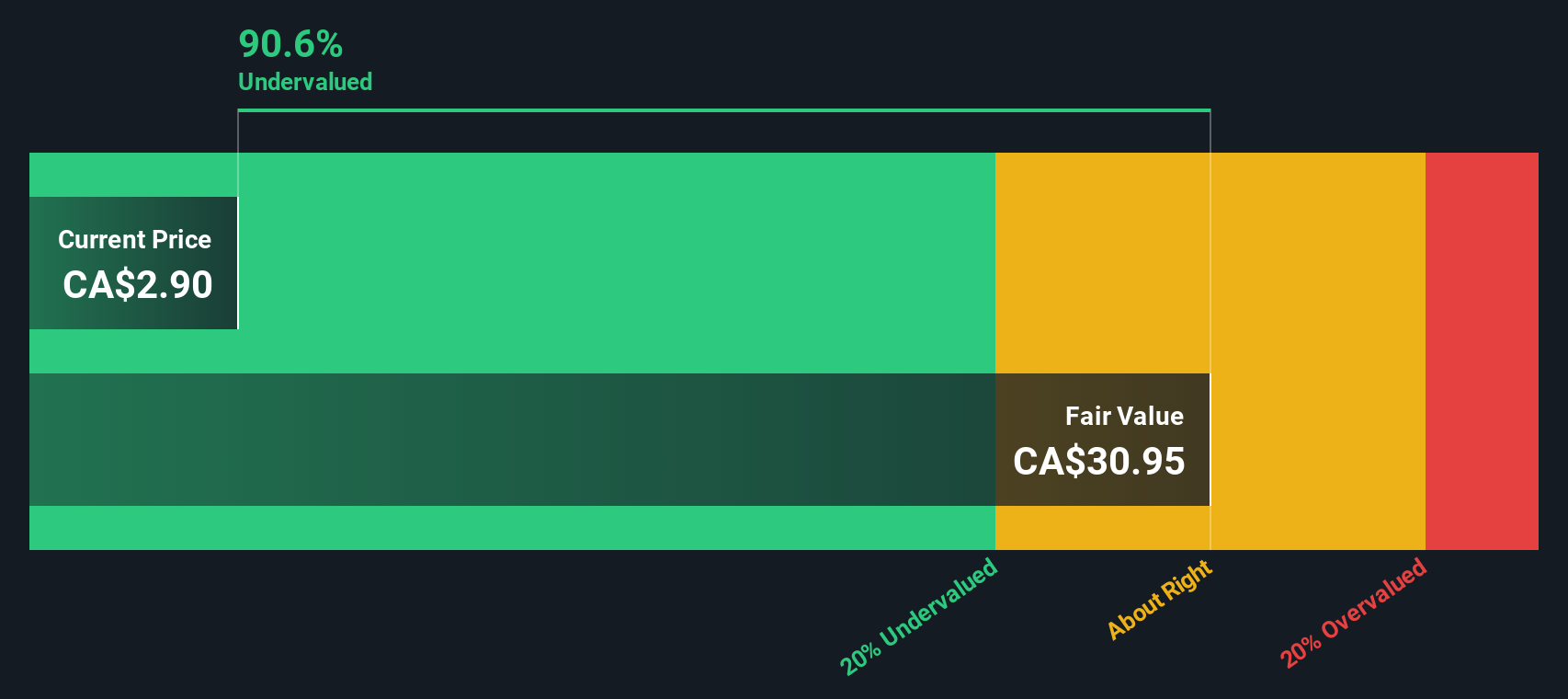

While the recent price-to-earnings ratio signals attractive value, the SWS DCF model paints an even starker picture. It suggests Pulse Seismic trades at more than 90% below its estimated fair value. This method focuses on long-term cash flow potential rather than simple earnings. Could the market really be overlooking that much upside, or is there a reason for such a wide gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pulse Seismic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pulse Seismic Narrative

If you want to dive into the numbers yourself or follow a different angle, you can build and share your own insights in just a few minutes. Do it your way.

A great starting point for your Pulse Seismic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game by uncovering new growth stories, income opportunities, and emerging trends. The possibilities are too good to miss. Make your next move count by checking out these unique themes:

- Unlock the potential of small-cap innovation by checking out these 3583 penny stocks with strong financials poised for rapid growth and market-shaking breakthroughs.

- Enhance your portfolio with steady cash flow by selecting income opportunities from these 21 dividend stocks with yields > 3% that deliver reliable yields over 3%.

- Tap into the world of machine learning and automation with these 26 AI penny stocks, finding companies at the forefront of artificial intelligence transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)